Today, the focus of traders is squarely on the impending US GDP news release, a pivotal economic indicator that has the potential to shape the trajectory of USDCAD. Gross Domestic Product (GDP), serving as a comprehensive measure of economic health, is anticipated to reflect a growth rate of 3.3% for the fourth quarter of 2023. This figure, forecasted by economists, carries significant weight as it provides insights into the inflation-adjusted value of all goods and services produced within the economy. Moreover, it serves as a primary indicator of overall economic activity, guiding market sentiments and influencing currency movements. Notably, in the context of USDCAD, a higher-than-expected GDP reading is generally perceived as favorable for the USD, potentially strengthening its position against the CAD.

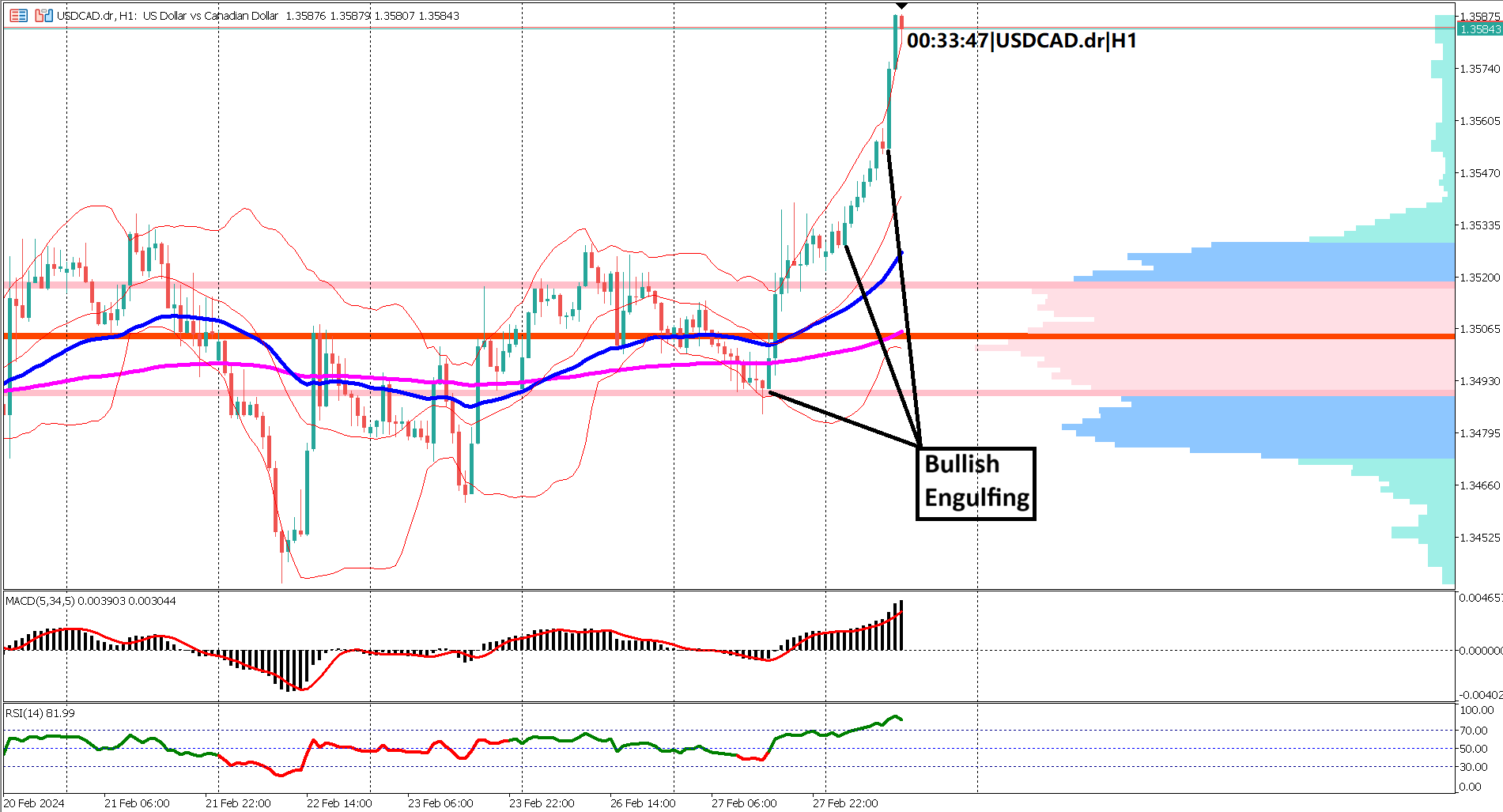

In recent trading sessions, USDCAD has exhibited a notable surge in bullish momentum, characterized by the emergence of multiple bullish engulfing candlestick patterns. These bullish signals, with three such patterns identified, underscore the prevailing optimism within the market. This bullish sentiment has persisted into today's trading session, with USDCAD prices witnessing a substantial rally of over 100 pips from yesterday's lows. Such a robust uptrend indicates a strong bias towards bullish movements, with investors displaying confidence in the currency pair's upward trajectory.

Adding to the bullish outlook, both the Exponential Moving Average (EMA) 50 and EMA 200 have demonstrated expansion and alignment. This convergence of the two EMAs suggests a sustained and strengthening bullish trend, with the widening gap between them indicative of growing momentum. Market participants keenly observe this alignment, considering it a significant factor in gauging the overall market sentiment and potential price movements.

Furthermore, market dynamics have been accentuated by USDCAD's consistent trading on the upper Bollinger band, a technical indicator widely utilized to gauge volatility and potential trend reversals. The expansion observed in both the upper and lower bands underscores the heightened market volatility and strength evident throughout the Asian-European trading sessions. This trend, coupled with strong bullish momentum, suggests a favorable environment for further upside potential in USDCAD.

Despite the prevailing bullish sentiment, caution is warranted as oscillator indicators approach overbought levels. While the Relative Strength Index (RSI) has reached overbought territory, signaling a potential correction in the recent rally, the Moving Average Convergence Divergence (MACD) indicator remains bullish, with its signal line and histogram above the zero line. This suggests that despite short-term fluctuations, the overall bullish momentum remains intact.

In summary, USDCAD traders remain cautiously optimistic ahead of the US GDP release. While the bullish momentum prevails, particularly evidenced by the emergence of bullish engulfing candlestick patterns and the alignment of EMAs, the market awaits the GDP data with anticipation. Depending on the outcome of the GDP release, further upside potential or potential bearish reversals may be expected in USDCAD. As such, traders are advised to remain vigilant and adapt their strategies accordingly to navigate the dynamic market conditions.

1. US GDP release anticipated to impact USDCAD dynamics, with a forecasted growth rate of 3.3%.

2. Recent bullish momentum evident through multiple bullish engulfing patterns.

3. Convergence and expansion of EMAs signal sustained bullish trend strength.

4. Consistent trading on upper Bollinger band reflects heightened market volatility and strength.

5. Oscillator indicators approaching overbought levels, urging caution amidst bullish sentiment.

Forecast 3.3% vs Previous 3.3%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.