EURUSD experienced a volatile trading session on Thursday, initially climbing to its highest level since March 21 above 1.0870 before erasing its gains and closing flat. In the early European session on Friday, the pair continued to fluctuate within a narrow range below 1.0850 as investors awaited the release of US labor market data.

The US Dollar (USD) staged a rebound in the American session on Thursday, bolstered by hawkish comments from Federal Reserve (Fed) officials and a negative shift in risk sentiment. This resurgence in the USD contributed to EURUSD's reversal from its daily highs.

Market focus now turns to the upcoming release of Nonfarm Payrolls (NFP) data in the US for March, with forecasts anticipating a rise of 212,000 jobs and an unchanged Unemployment Rate at 3.9%. A strong NFP reading of 212,000 or higher could potentially dampen expectations of a rate cut in June, providing further support to the USD. Conversely, a disappointing print below 212,000 may revive optimism for a policy pivot in June, exerting downward pressure on the USD.

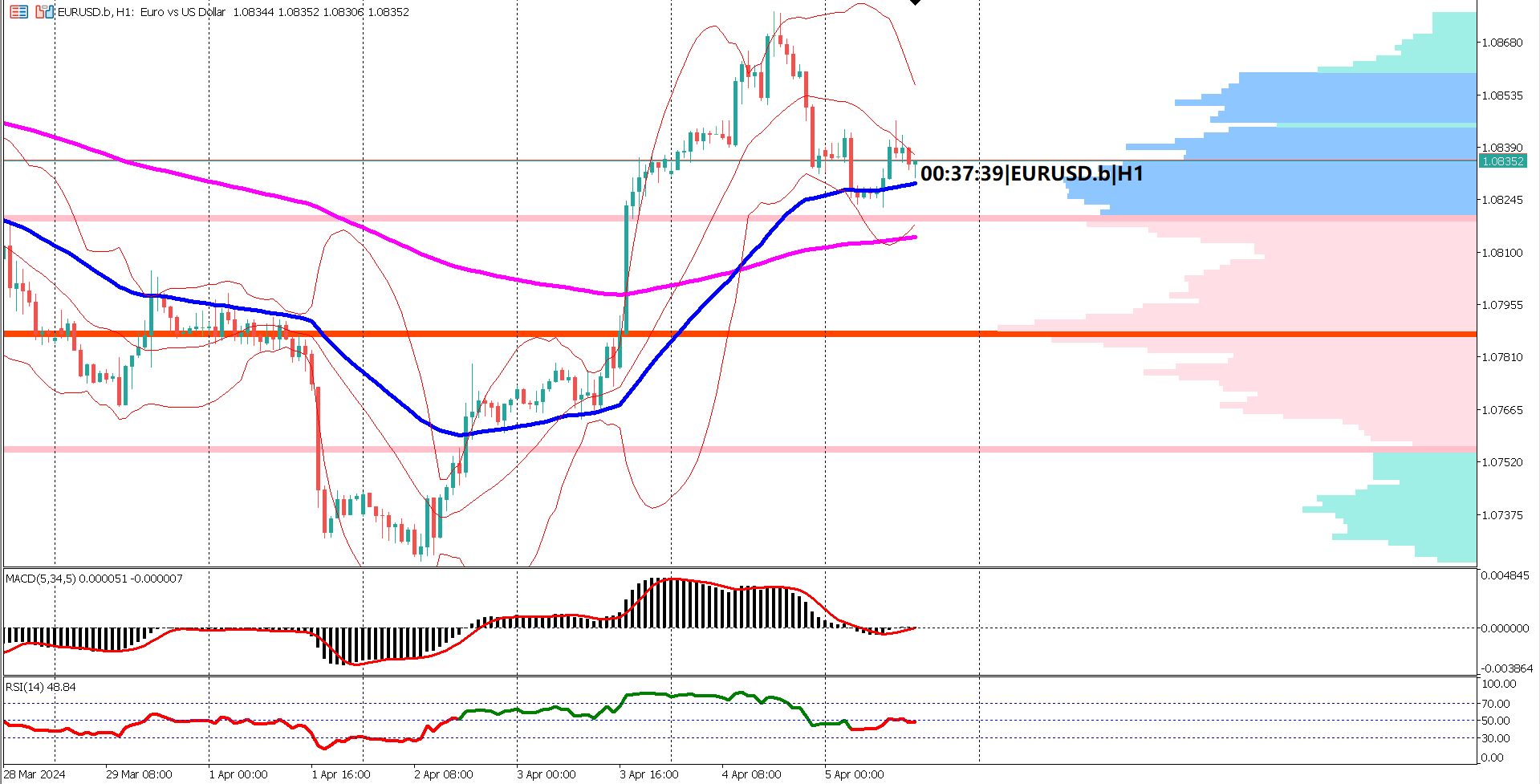

On the 1-hour timeframe, major indicators like the Exponential Moving Averages (EMA) 50 and 200 reflect bullish sentiment, with the recent formation of a golden cross. Additionally, prices have remained above the lower band of the Bollinger band, indicating ongoing bullish momentum. However, the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) suggest bearish sentiment, albeit not significantly alarming. The MACD signal line hovers slightly below the zero level, while the RSI remains comfortably within the 50% range, signaling sideways movement in the market.

As EURUSD navigates through these technical indicators and awaits the NFP release, traders remain cautious, prepared for potential market volatility and shifts in sentiment.

Forecast 0.3% vs Previous 0.1%

Forecast 212K vs Previous 275K

Forecast 3.9% vs Previous 3.9%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.