Gold price (XAUUSD) continues its downward trajectory for the second consecutive day on Friday, as the precious metal corrects further from its all-time high. The decline comes amidst hawkish remarks made by Federal Reserve (Fed) officials, bolstering the US Dollar (USD) and exerting pressure on gold. This sentiment is reinforced by some follow-through USD buying, adding to the downward pressure ahead of the crucial US Nonfarm Payrolls (NFP) data release.

Investors eagerly anticipate the NFP report for fresh insights into the Fed's rate-cut path, which could drive USD demand and dictate the next move for gold. Meanwhile, persistent geopolitical tensions, including the Russia-Ukraine conflict and risks of escalation in the Middle East, serve as a buffer for the safe-haven appeal of gold, potentially limiting any substantial corrective slide from its all-time peak.

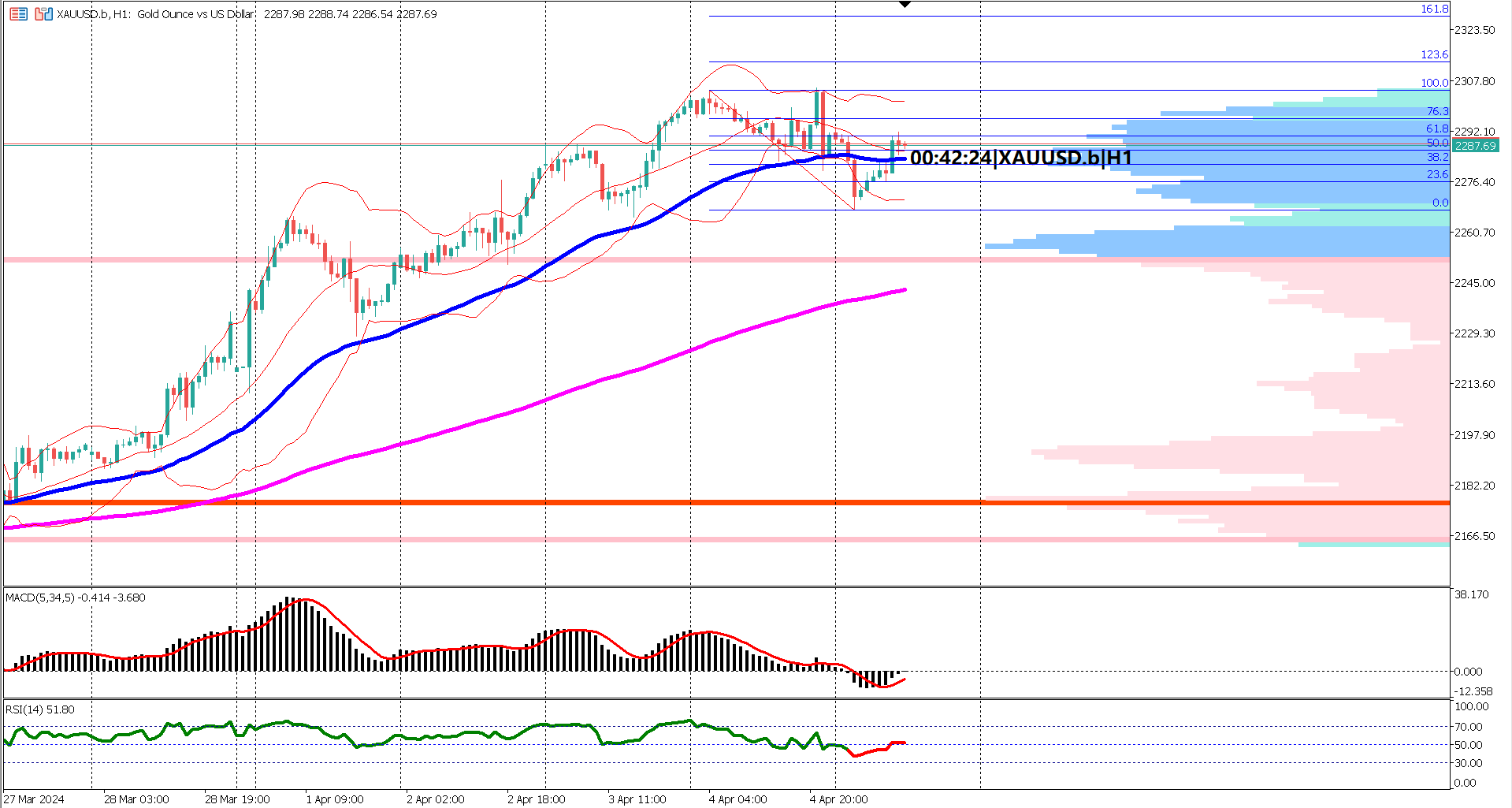

In today's economic landscape, key releases including Average Hourly Earnings, Nonfarm Payrolls, and Unemployment Rate are poised to influence market sentiment and direction. Technically, on the 1-hour chart, the market exhibits sideways movement as it awaits these critical economic data points. The Exponential Moving Averages (EMA) 50 and 200 maintain a relatively bullish stance, with caution warranted as price breaks below the lower band of the Bollinger Band, indicating a potential retracement towards the EMA 200.

Key support rests at the EMA 200, with a potential rebound anticipated to resume the bullish trajectory, targeting levels between $2300 to $2330, representing the 1.618 Fibonacci extension. However, oscillator indicators, including the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI), suggest a bearish short-term trend for gold. Overall, the short-term trend remains bearish, with a potential rebound anticipated upon reaching the EMA 200 support level. Investors are advised to closely monitor key technical levels and economic data releases for further insights into gold's price movements.

In summary, gold price (XAUUSD) drifts lower for the second straight day amidst hawkish Fed remarks, USD strength, and anticipation of key US NFP data. Geopolitical tensions offer support but corrective slide from all-time high persists. Technical analysis suggests caution as market awaits pivotal economic releases and eyes key support levels for potential rebound. Overall, short-term trend remains bearish with potential for recovery upon reaching EMA 200 support.

Forecast 0.3% vs Previous 0.1%

Forecast 212K vs Previous 275K

Forecast 3.9% vs Previous 3.9%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.