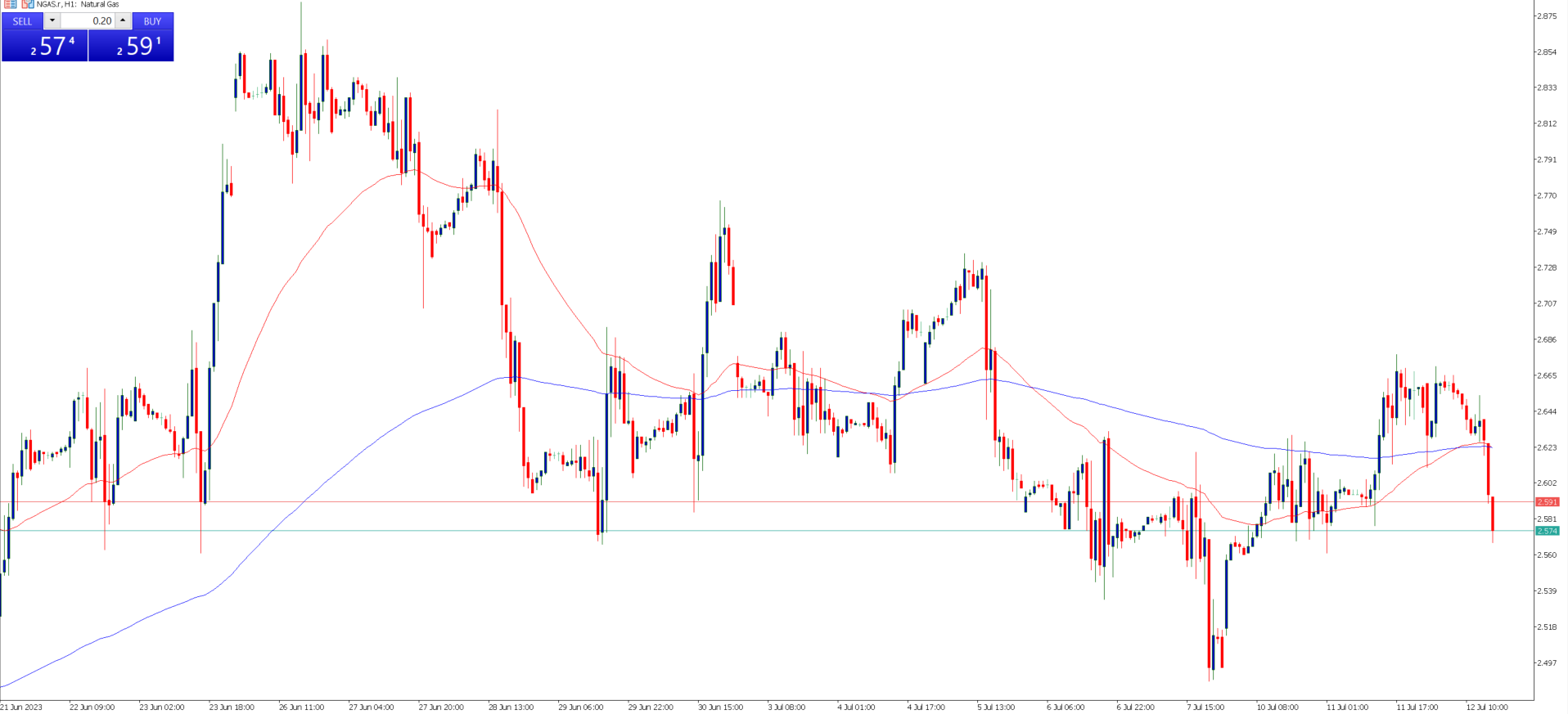

In recent trading sessions, the natural gas market has displayed a modest rally, with the 50-Day Exponential Moving Average serving as a potential support level. As we examine the dynamics of the natural gas market, it becomes evident that there are various factors contributing to the upward momentum. One key factor is the anticipation of increased demand for liquefied natural gas due to the scarcity of Russian gas in the European Union during the upcoming winter season.

The potential shortfall in Russian gas supply has prompted market participants to turn their attention towards alternative sources, particularly LNG exports from the United States. The natural gas contract is closely tied to the distribution from Henry, Louisiana, and any developments in this area greatly impact market sentiment. Consequently, the $3.00 level stands as a significant resistance point. If this level is breached, it may open the door for a breakout and further upward movement.

While the short-term breakout remains uncertain, there is evidence of position building in the market. The ETF market, known for its accumulation of significant volume, indicates that larger traders are increasingly placing bets on a potential rise in natural gas prices later this year. However, it is crucial to note that the market is still range-bound, and cautious optimism should prevail.

Resilient Natural Gas Market looks at $3.00 level

In the event of a successful breach above the $3.00 level, the market will likely set its sights on the 200-Day EMA, which currently resides around the $3.60 mark. Conversely, in case of a pullback from current levels, substantial support is expected to materialize, providing an opportunity for buyers to re-enter the market. Historically, the $2.00 level has proven to be a crucial support zone on multiple occasions, representing a psychologically significant figure that attracts considerable attention.

Given the prevailing market conditions, adopting a prudent approach to trading natural gas appears advisable. Opportunistic buying during price dips, while remaining watchful for a potential breakout in the future, represents a sensible strategy. Investors and traders should closely monitor the market's response around key levels and exercise caution in their decision-making.

The natural gas market has shown resilience and a modest rally in recent trading sessions. The anticipation of increased demand for LNG due to the scarcity of Russian gas in the European Union this winter has been a driving factor. While the market remains range-bound, with the $3.00 level serving as a significant barrier, there are indications of position building and growing market optimism. Traders should exercise caution, closely observe support and resistance levels, and consider buying on dips while waiting for a potential breakout. The natural gas market holds promise, but a measured and strategic approach is prudent in navigating its current dynamics.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit