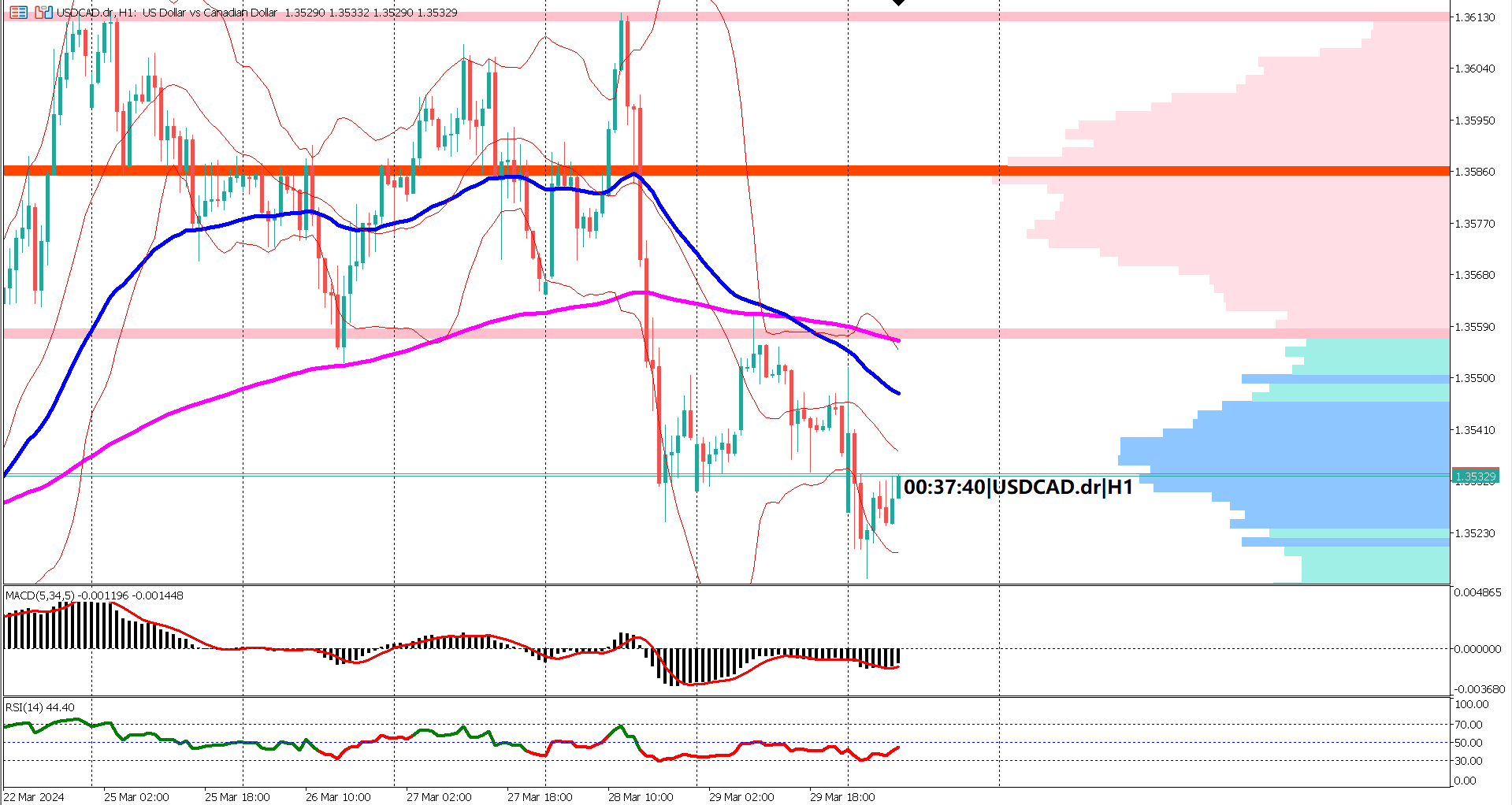

Amidst a flurry of economic data releases, the USDCAD pair finds itself under persistent selling pressure, dropping to over a one-week low on Monday. The currency pair's decline extends from the 1.3610-1.3615 supply zone, representing the year-to-date peak. Despite the downward trend, the descent halts just shy of the psychological support level at 1.3500, prompting a modest recovery from the session's low.

Today's economic calendar features key releases for the US, including the S&P Global Manufacturing Index and the ISM Manufacturing Purchasing Managers' Index (PMI). Forecasts for these indicators stand at 52.5 and 48.5, respectively, maintaining a level of consistency with previous readings.

Last week's trading session concluded with a notable development as the USDCAD pair exhibited a death cross on the Exponential Moving Averages (EMAs) 50 and 200. This technical pattern typically signals a further downward trajectory. Additionally, prices breached below the value area of the volume profile, underlining a prevailing bearish sentiment in the market.

Both the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) corroborate the bearish outlook. The MACD's signal line remains below the zero line, while the RSI comfortably resides below the 40% range. These oscillators further underscore the prevailing negative sentiment surrounding the USD/CAD pair.

In light of these developments, traders remain cautious as they monitor the unfolding economic data and technical indicators for potential shifts in market sentiment and direction.

Forecast 52.5 vs Previous 52.5

Forecast 48.5 vs Previous 47.8

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.