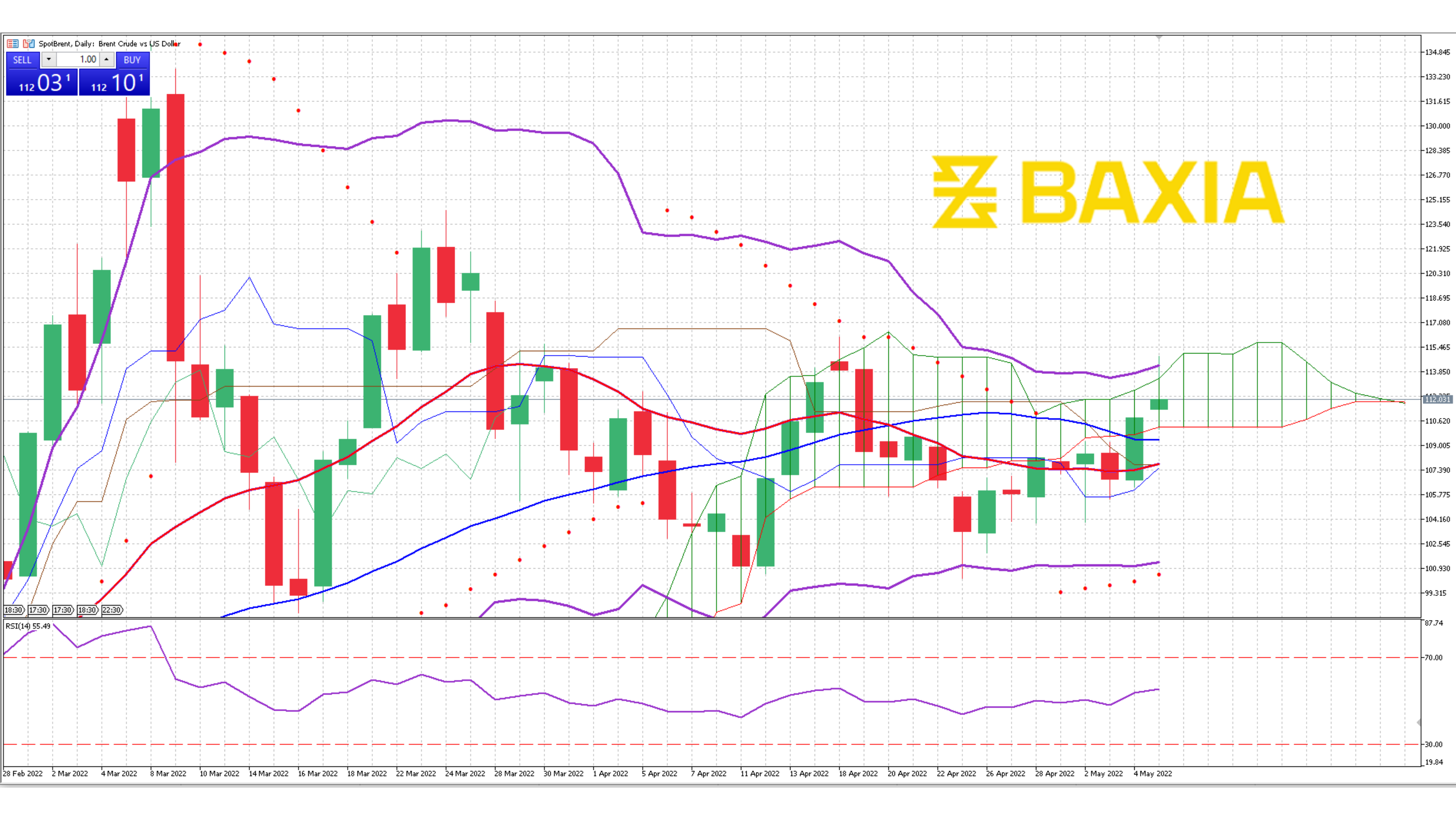

The energy commodity reached the $113.95 price mark but fell back close to $110 shortly after, the resistance at the 38.2% Fibonacci retracement proved to be strong. The pair is currently trading above the short and long-term moving averages, indicating that the price could start an uptrend soon.

The Bollinger bands are not very wide but we could still see some highly volatile moves in the short term, the pair reached the upper band suggesting that the price could be is consider relatively high, which is one of the reasons it is findig a resistance close to the band.

The relative strength index is at 55% which will allow the pair to move in either direction in the short term. Our parabolic SAR indicator suggests that the price is likely to move upwards in the upcoming sessions, we would have to wait and see if the price can break the resistance, the upper band will have to expand to allow this.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.