NZDUSD demonstrated strength on Monday, initiating with a gap-up move. However, the optimism stemming from the gap is at risk of being eroded due to the release of underwhelming CPI economic data.

Statistics New Zealand's report unveiled that inflation in New Zealand, as measured by the Consumer Price Index (CPI), registered a 1.8% increase in the three months up to September. This figure fell slightly below market expectations, which had anticipated a rate of 2%. The annual comparison revealed a 5.6% increase, a drop from the prior 6% reading and falling short of the projected 5.9%.

Unsurprisingly, the New Zealand Dollar (NZD) faced a decline in response to this news, with NZD/USD dropping toward the 0.5900 level. Immediate market reactions to the data release often drive such fluctuations.

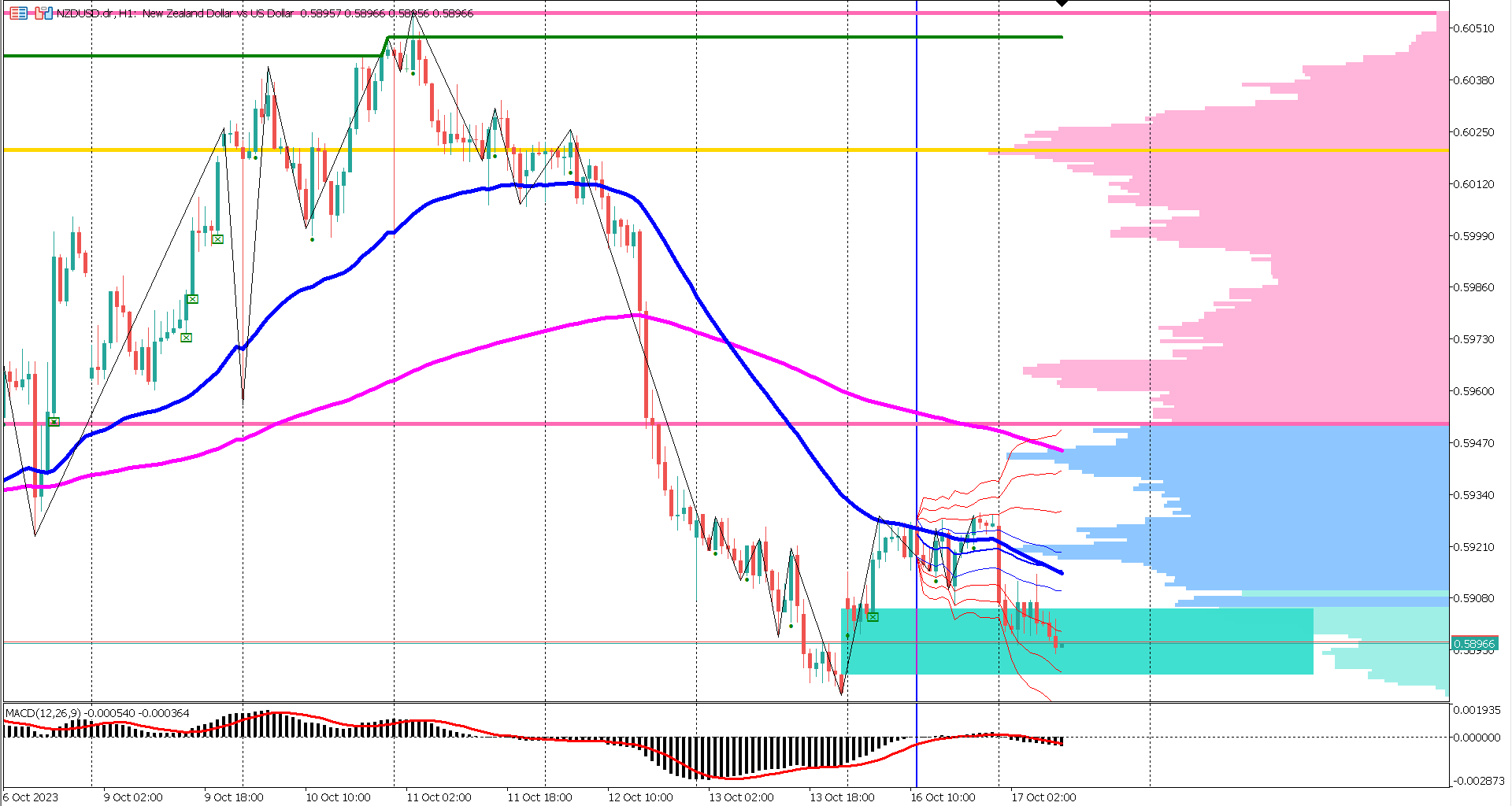

In terms of technical analysis, when observing the classic EMA indicators, specifically the 50 and 200 period EMAs, NZDUSD's performance trends bearish. This sentiment was further reinforced by the occurrence of a death cross late last week, marking a bearish shift in market dynamics.

Additionally, NZDUSD currently hovers below the value area, shaded in pink, of the volume profile. This suggests that the market views NZDUSD as undervalued.

The MACD histogram and signal line both linger beneath the 0-level, signifying a bearish sentiment among market participants.

Furthermore, the anchored VWAP indicator, based on data from Monday's high, points to a bearish outlook. This is primarily due to the price residing near the second lower band of the anchored VWAP. A potential shift to a bullish scenario could occur if NZDUSD manages to climb above the first upper band of the anchored VWAP, positioned at 0.5923.

Actual 5.6% vs Forecast 5.9%

Actual 1.8% vs Forecast 1.1%

Forecast 0.2% vs Previous 0.6%

Forecast 0.3% vs Previous 0.6%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.