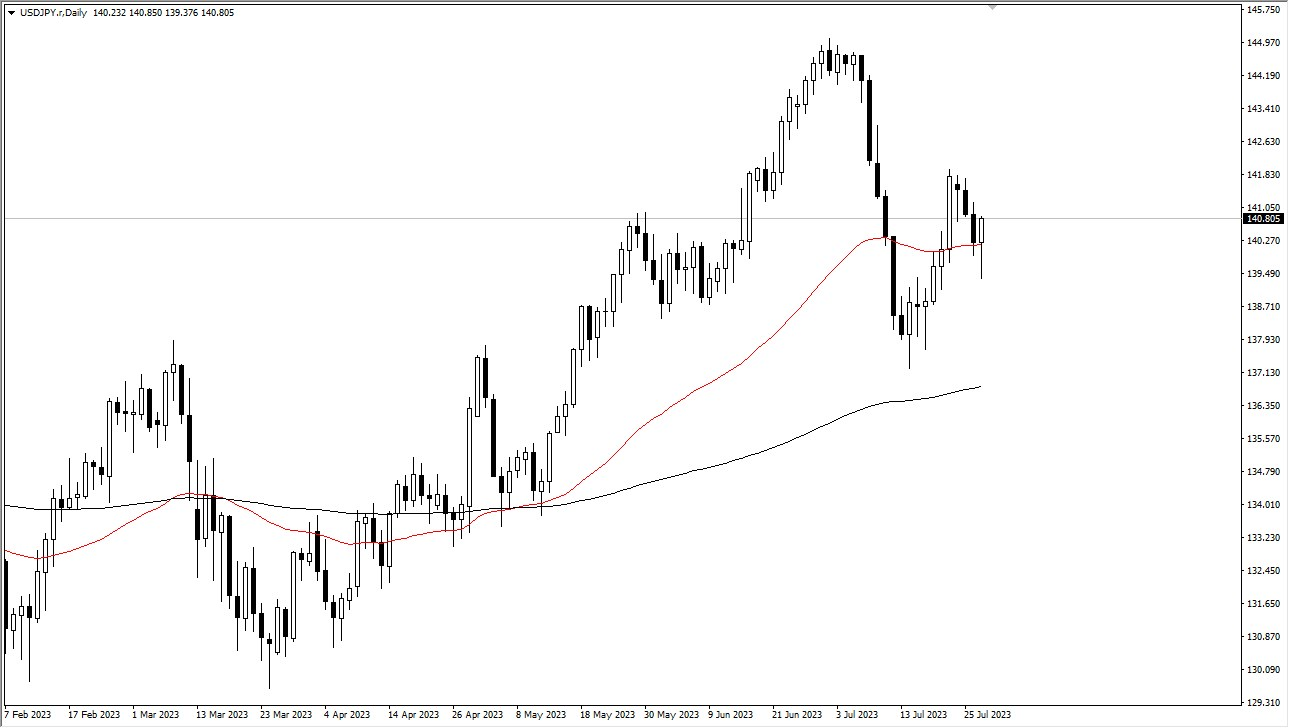

The US dollar initially experienced a decline against the Japanese yen but managed to reverse its course on Thursday, demonstrating signs of vitality in the forex markets. The 50-Day Exponential Moving Average provided some support, pushing the currency back above the ¥140 level after encountering early session weakness. While breaking above the top of the candlestick would technically signal a buying opportunity, traders should remain cautious due to the impending interest rate decision by the Bank of Japan, which could introduce further volatility. Despite short-term fluctuations, the overall sentiment indicates a bullish stance for the US dollar against the Japanese yen, unless any surprising actions from the Bank of Japan alter market dynamics significantly.

Looking ahead, there are two potential scenarios for the US dollar against the Japanese yen. If the market can successfully break above the top of the candlestick for the day, it would present a buying signal for traders. However, it is essential to consider the Bank of Japan's upcoming interest rate decision, as it could introduce additional market volatility.

On the other hand, if the US dollar reverses its gains and breaks down below the bottom of the candlestick, a possibility may arise for it to explore the ¥138 level. This level holds particular significance due to its psychological impact, being a large, round number. Furthermore, it is also the top of an ascending triangle, likely to hold significant "market memory." The presence of the 200-Day EMA grinding toward that area amplifies the attention drawn to this region. A breakdown below this level could signal a shift in momentum.

Despite the short-term uncertainties, the longer-term outlook for the US dollar against the Japanese yen remains optimistic, with a bullish bias. The interest rate differential is expected to be a major driver of this market's direction in the future, favoring the US dollar's upward momentum.

Given the favorable outlook, it is reasonable to expect the US dollar to continue its ascent and potentially target the ¥142.50 level. This area holds significant importance historically and has played a pivotal role in market movements. A successful breach of this level would likely pave the way for further gains, with the ¥145 level being the next potential target for the currency pair.

In light of the overall upward momentum and the influence of the interest rate differential, adopting a "buy on the dip" strategy appears prudent for approaching this market. As with any trading strategy, caution is essential, especially considering the anticipated volatility surrounding the Bank of Japan's interest rate decision. Traders should be mindful of their position sizing to manage risk effectively.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit