The USD is losing ground to the CAD after Canada released high-impact economic data earlier in the trading session. Consumer Price Index Median YoY came out better than expected with 5%; analysts were expecting 4.7%. Furthermore, Canada’s Inflation Rate slowed to 7.6% from the previous 8.1% last month; this is mainly attributed to lowered Oil prices in the month.

Given the recent results of economic indicators, we would expect the Interest Rate to continue hiking; a hawkish stance could be expected from the Bank of Canada for the next Interest Rate decision in September, where they are likely to continue tightening the monetary policy in an effort to restore price stability.

Canada will release more economic indicators that will impact the exchange rate with the USD this week; on Friday, they will release Retails Sales YoY and MoM, which is a good gauge of economic activity in the country.

The US will also make important data releases this week; on Wednesday, they will announce Retails Sales YoY and MoM, followed by the FOMC Minutes, which will give us a better idea of where the Fed stands in regards to monetary policy.

A stronger US labor market has been supporting the country's economy over these last few weeks. This Thursday, the country will be reporting Jobless Claims. If the results are not favorable, we will likely see a weaker USD in the short term.

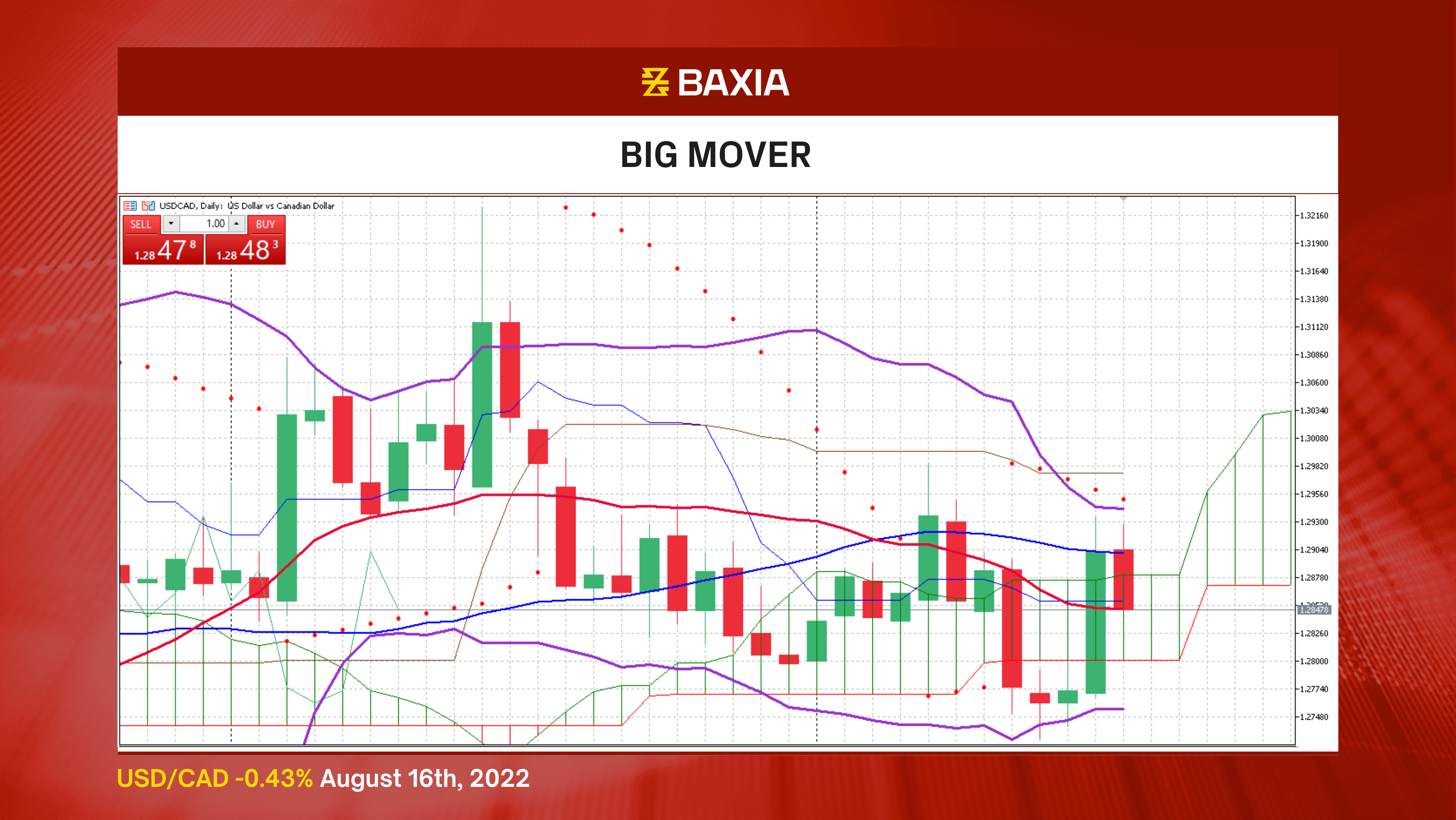

The Bollinger bands are narrow and steady, meaning we would see lower volatility in the short term and a possible consolidation phase as the bands stabilize. Our parabolic SAR indicator suggests that the price will continue to fall in the upcoming sessions.

The relative strength index is very neutral at 49%; the price could move in either direction at this point; however, the pair is trading below the short and long-term moving averages, suggesting that the general trend is downwards.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.