The EURUSD reclaims parity during the trading session after the Euro Area Inflation Rate came out higher than expected; analysts anticipated a 9% rate, but the actual figure was 9,1%, helping the EURUSD go above $1 as it shows solid economic activity in the EU.

Consumer Price Index in the Euro Area came out slightly short of the analyst's expectations with 117.78; the consensus was at 117.80.

Our Economic Calendar indicates that tomorrow the EU will release S&P Global Manufacturing PMI, which gauges economic trends in the manufacturing sector. Analysts anticipate a 49.7; a figure below 50 indicates a contraction in the manufacturing activity, which would affect the exchange rate of the EURUSD pair.

Later in the session, the US will release Jobless Claims; they are expected to come out higher than the previous; however, we have been surprised by the strong labor market in the US during the last few weeks. A better-than-expected figure will likely strengthen the USD.

The US will also release S&P Global Manufacturing PMI tomorrow; experts' consensus is at 51.3, a lower figure than the previous 52.2, but still within the expansion zone above 50.

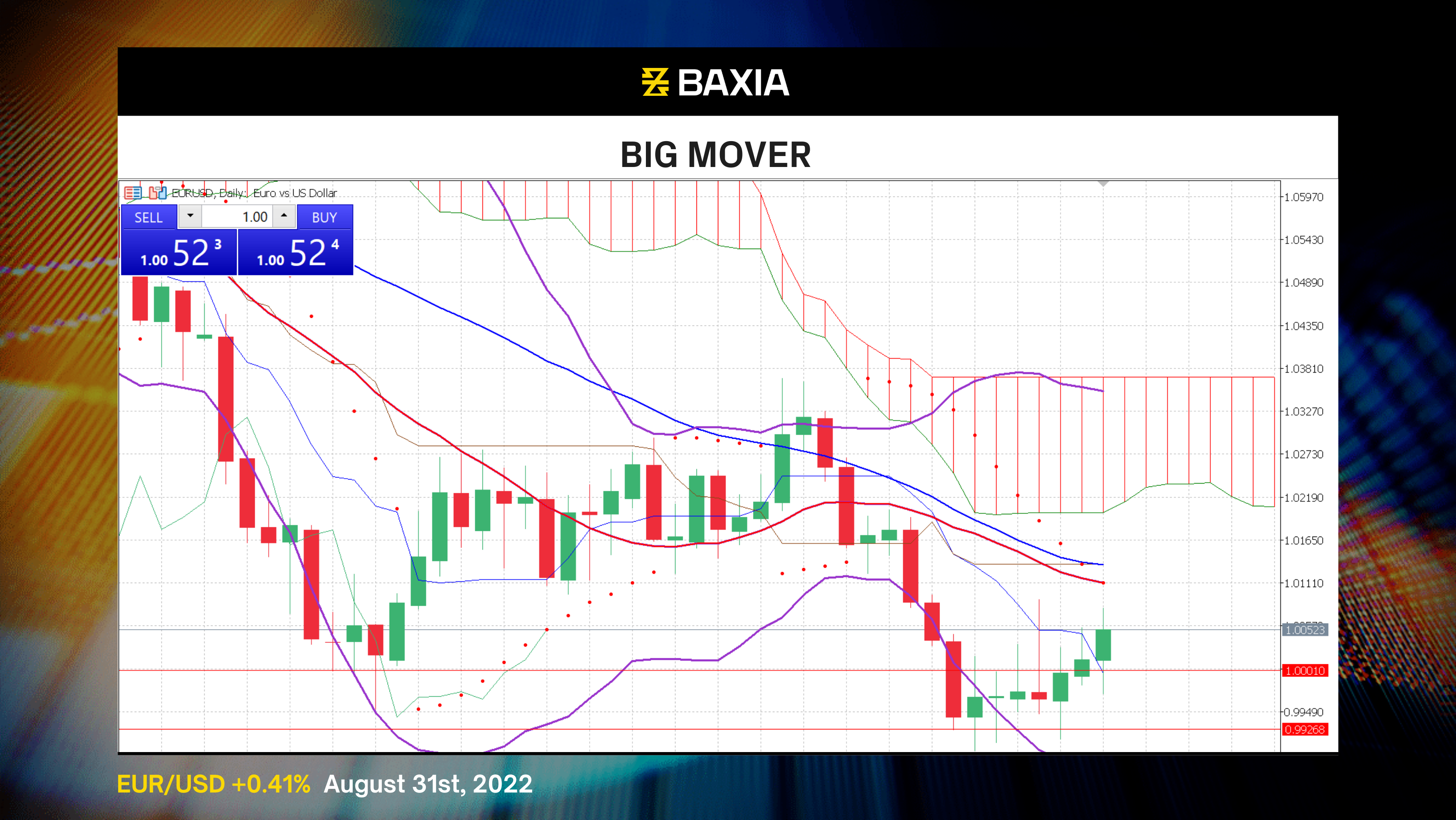

The price found strong resistance in our 38.2% Fibonacci retracement at 1.00794; if the pair manages to complete a breakout, we would likely see the price climb to 1.01346, which is our 50% Fibonacci retracement. On the other hand, our first support level is at $1.0011; if that level is broken, we would likely see the price reach $0.99006 in short to medium term.

The Bollinger bands are wide and continue opening; volatility should be high in the short term. The pair will likely resume the downtrend in the upcoming sessions as the bands move downwards. The price is trading below the short and long-term moving averages, strengthening the short signals.

The relative strength index is currently at 45%, allowing the pair to move in either direction before entering an oversold or overbought status. Our parabolic SAR indicator suggests that the price will decrease in the short term.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.