The pound sterling is on a two-day losing streak after the US Initial Jobless Claims came out slightly better than expected in yesterday's trading session; this indicates that the US labor market continues to be solid. Furthermore, the US released more high-impact economic indicators today that boosted the USD. Michigan Consumer Sentiment reading came out 2.6 higher than the 52.5 expert consensus, strengthening the Dollar across almost all major currency pairs.

The UK had several economic indicator releases; the GDP MoM came out better than expected but still is in the contraction area with a -0.6% of the -1.3% expected by analysts. The same happened with the Growth Rate QoQ; data came out at a -0.1 of the -0.2 consensus, better than expected results but within the economic decline area. Furthermore, the growth rate YoY had a slightly better reading with a 2.9 of the 2.8 expert consensus.

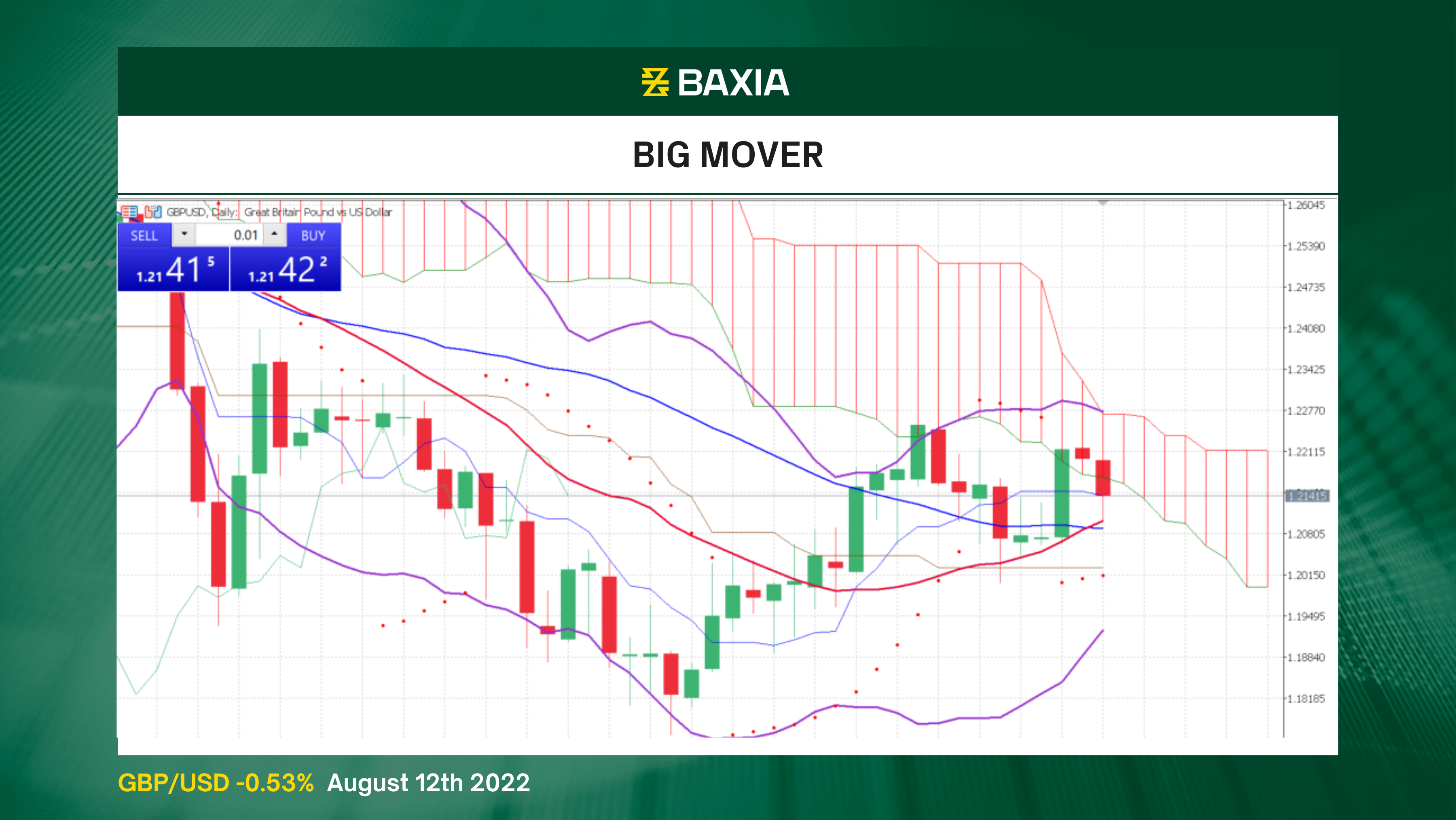

The Bollinger bands are shrinking and slightly moving upwards, volatility could be lower in the upcoming sessions, and the uptrend should continue in the short term. In that event, the price could find resistance at 1.22711.

The short and long-term moving averages crossed in yesterday's trading sessions, suggesting that the currency pair is now on a general uptrend; despite the recent retracement, the price continues trading above the trend lines.

The price entered the Ichimoku cloud, which could be seen as a period of uncertainty by market participants. Our parabolic SAR indicator suggests that the price will likely move upwards in the short term.

The relative strength index dropped to 51% during the recent pullback, allowing the pair to move in either direction before entering an oversold or overbought status. The current market sentiment is 72% long.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.