Switzerland released high-impact news earlier in the session; Retail Sales MoM exceeded the consensus of -0.3% with a result of 0.1%, suggesting that the Swiss economy is still active. Retail Sales YoY also came out positive at 1.2%, exceeding the consensus at -1.8%.

Next Tuesday, Switzerland will release Consumer Confidence and Manufacturing PMI data, experts anticipate a contraction, but we have been surprised by positive data releases that have strengthened the CHF in recent weeks.

The US will also have its share of the high-impact news releases next week; on Monday, the S&P Global Manufacturing PMI and ISM Manufacturing PMI will be announced, and a slight decline is expected by expert analysts, which would slightly hurt the USD.

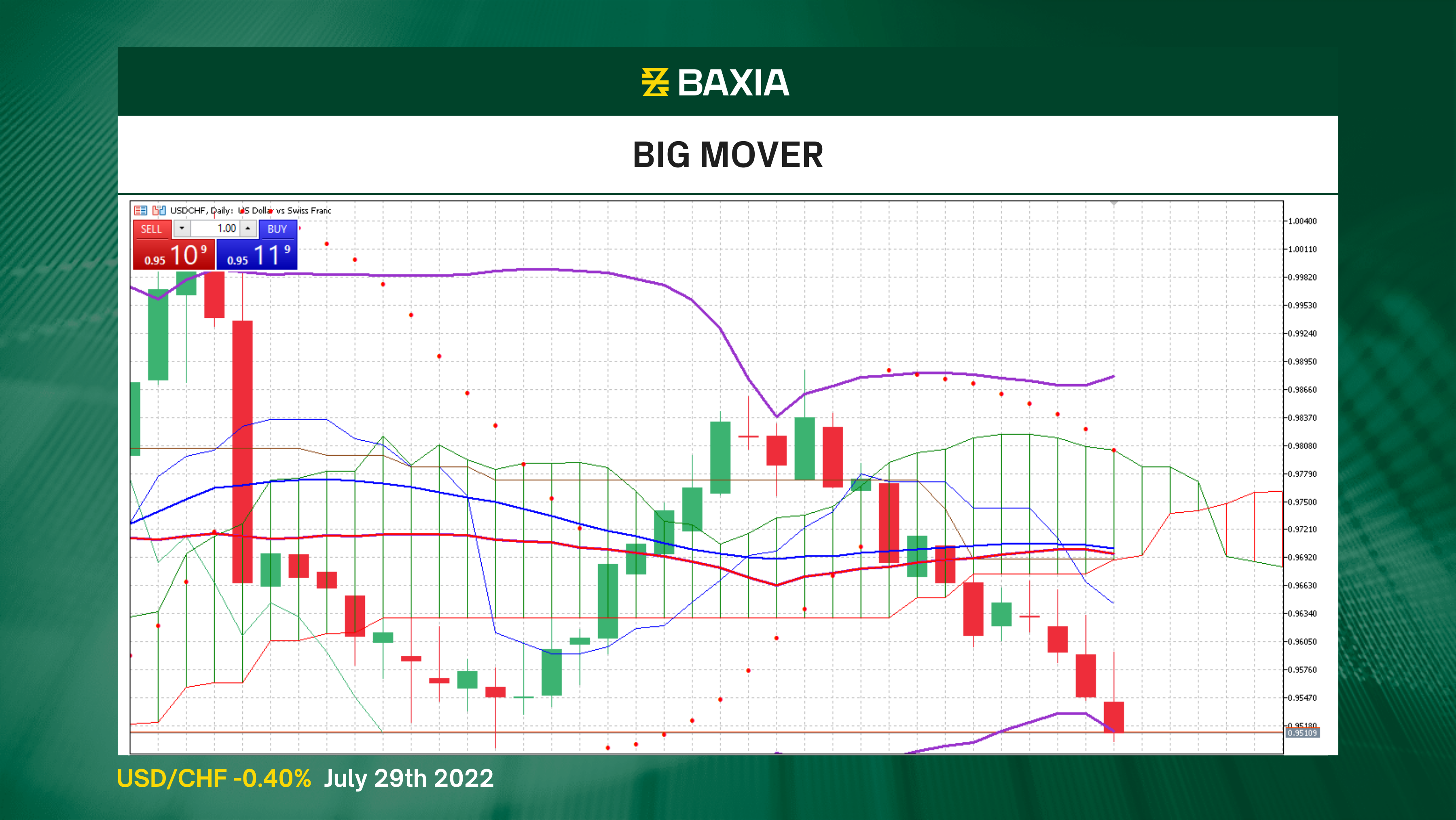

The US dollar continues losing ground against the Swiss Franc and is now on a four-day losing streak. The general trend continues to be downwards as the price broke below the short and long-term moving averages at the end of last week.

The price could find strong support close to the lower Bollinger band at 0.95178, but as the bands continue expanding, the support will move lower, giving the pair a chance to continue falling in the short term.

The relative strength index is at 36%, which will not give the pair enough room to fall significantly more, it is close to the oversold status, and that could impact the market sentiment in the upcoming trading sessions.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.