US Recession fears strengthened after GDP Growth Rate came out negative for the second consecutive quarter last week. The US dollar continues weakening against most major currencies.

The US released S&P Global Manufacturing PMI earlier today with slightly worse than expected results; data came out at 52.2, just 0.1 below the analyst's consensus. The result is still within the expansion area above 50 but lower than the previous month. US Factory slowdown suggests that their economy could struggle in short to medium term.

The US will release Non-Farm Payrolls on Friday, which is expected to decline from 372K to 255K, likely weakening the USD a bit more.

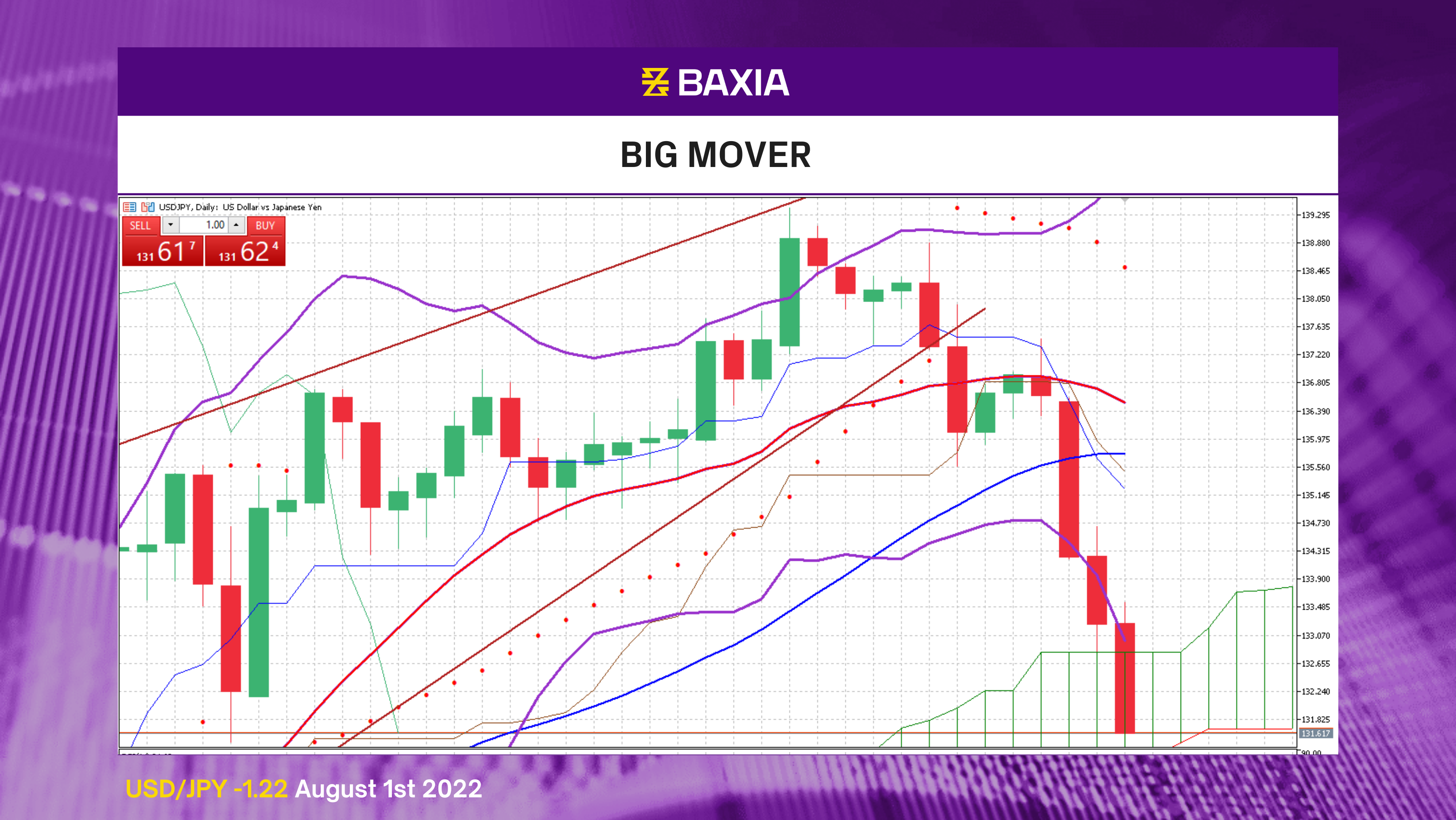

Based on technical analysis, the pair will likely continue moving downwards and potentially test the support on our 61.8% Fibonacci retracement at $131.338 in the short term.

The general trend is downwards as the price broke the 50% Fibonacci retracement and trades below the short and long-term moving averages; the MA's are close to crossing, which would strengthen the sell signals; our parabolic SAR indicator suggests that the downtrend will continue.

The relative strength index is at 32%, which could limit the downwards move as it is very close to entering an oversold status; once that happens, many investors might react and cause a temporary pullback.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.