Amidst anticipation for key economic releases, XAUUSD's market action remained relatively stable. Today's focus lies on US NFP and unemployment rates for both the US and Canada. Analysts predict a rise in Canada's unemployment rate, a decline in US NFP compared to previous figures, and no change in the US unemployment rate. The market showed a bullish tilt, with XAUUSD experiencing a brief dip lasting 5 hours during the Asian session before rebounding to establish new highs.

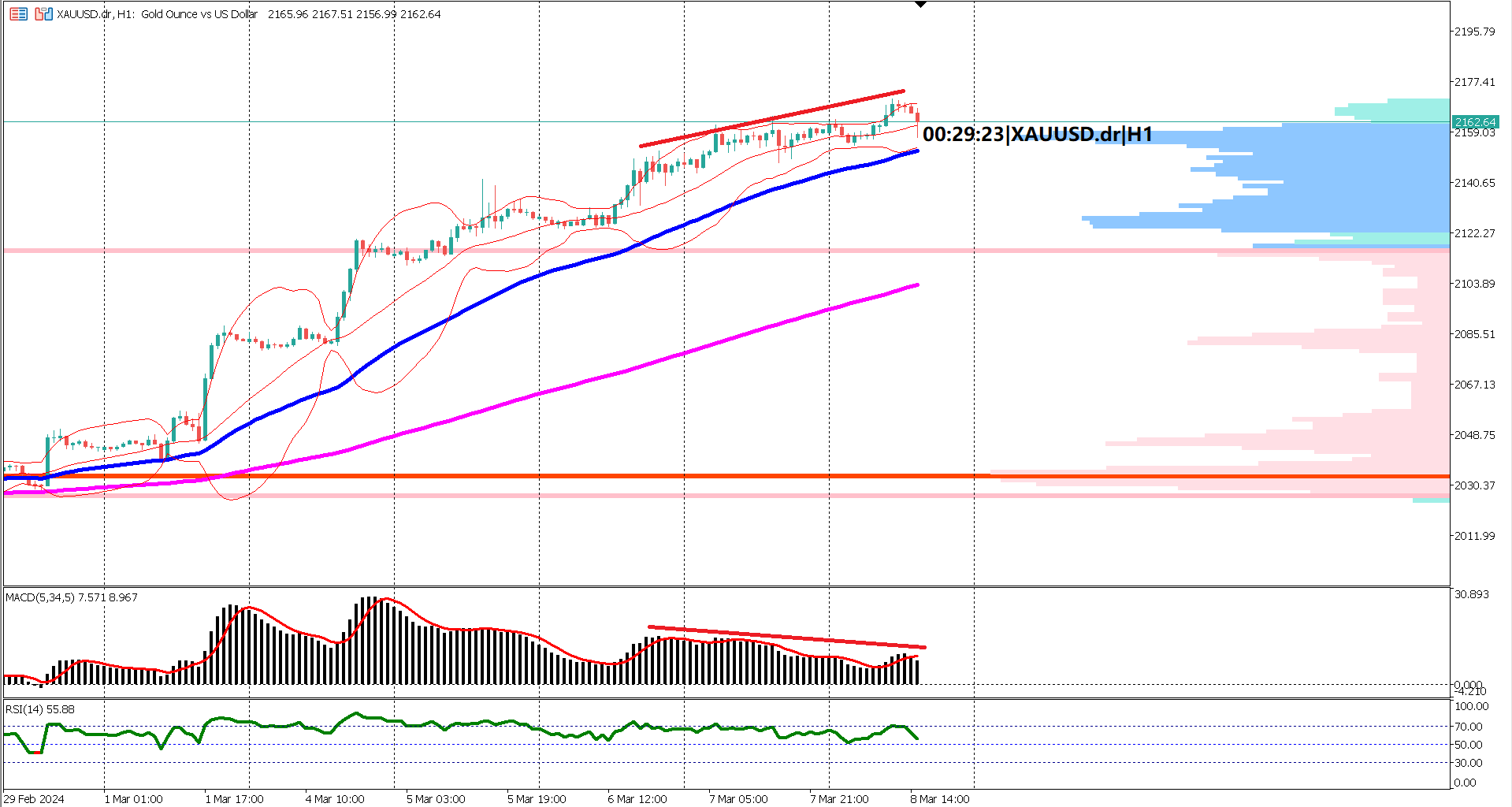

Technical indicators reflect a robust bullish sentiment, with both the EMA 50 and EMA 200 signaling upward momentum. The expanding gap between the two EMAs further reinforces the bullish outlook. In addition, XAUUSD has consistently breached above the upper Bollinger band over the past 6 trading sessions, indicating strong bullish momentum and limited downside potential.

Moreover, XAUUSD is trading comfortably above the volume profile's value area, suggesting strong support around $20205. The wide value area spanning approximately 900 pips underscores the market's bullish bias.

However, caution is warranted as oscillator indicators hint at a potential weakening of bullish momentum. While the MACD remains bullish, the histogram and signal line display a pattern of lower highs despite higher price highs, signaling a divergence that could indicate waning bullish strength.

In summary, XAUUSD continues to exhibit bullish tendencies, supported by technical indicators and market dynamics. Traders should closely monitor economic releases for potential shifts in sentiment, particularly in response to US NFP and unemployment data.

Forecast 198K vs Previous 353K

Forecast 3.7% vs Previous 3.7%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.