In the intricate dance of the financial markets, XAUUSD has been a focal point of attention, displaying noteworthy price movements and technical patterns. Let's delve into the recent cues shaping the landscape and explore potential implications, especially in light of the upcoming Non-Farm Payrolls (NFP) and unemployment rate data from the US.

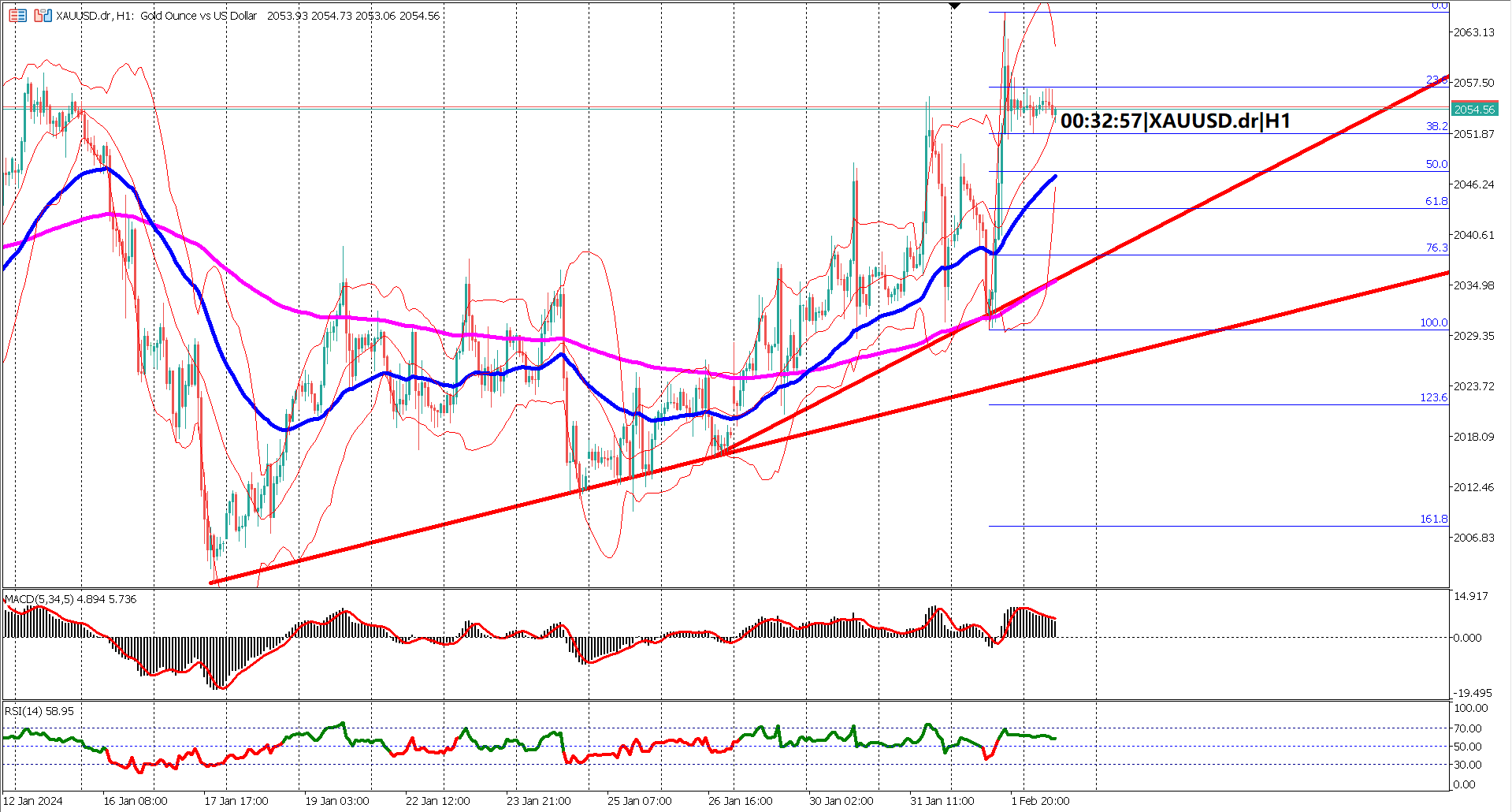

XAUUSD witnessed a robust rally, surging by 1.75% from $2029 to $2065. This upward momentum reflects a prevailing bullish sentiment in the market.

Post the New York trading session, XAUUSD has entered a phase of sideways trading. This pattern is characteristic of markets anticipating significant news releases, with participants adopting a cautious stance.

The retracement of 38.2% in the wake of the recent bullish rally is considered shallow. Such retracements are common, especially before high-impact news releases, showcasing the market's inherent cautiousness.

Today's focus is on the US NFP and unemployment rate announcements. Forecasts indicate a lower NFP number of 187K compared to the previous 216K, coupled with an expected uptick in the unemployment rate to 3.8% from 3.7%. These projections suggest a potential weakening of the USD against Gold.

On the 1-hour timeframe, XAUUSD has formed two ascending trendlines, moving parabolically. The steepness of these trendlines indicates strong momentum, supported by EMA 50 diverging from EMA 200.

As the market consolidates ahead of the NFP release, the Bollinger Bands exhibit a contraction, indicating reduced volatility. Such behavior is typical when market participants await significant economic data.

Both RSI and MACD offer bullish signals. MACD's signal line and histogram remain above the 0 line, signaling positive momentum. RSI consistently maintains a value above 40% in the last 24 hours, reflecting ongoing bullish strength.

With economists foreseeing a potential weakening of the USD based on NFP and unemployment rate forecasts, traders may witness an extension of XAUUSD's upward trajectory until the bullish momentum subsides. Traders are advised to stay attuned to the unfolding economic data, incorporating it into their strategy amid the dynamic market environment.

As we approach the NFP release, the intricate interplay of technical and fundamental factors will likely shape XAUUSD's journey in the coming sessions. Stay vigilant, and may your trades be guided by a thorough understanding of these market dynamics.

Robust Rally: XAUUSD experienced a strong rally, surging by 1.75% from $2029 to $2065, indicating robust bullish momentum.

Sideways Trading: The market has entered a phase of sideways trading, a common behavior observed ahead of significant news releases, fostering a cautious market sentiment.

Shallow Retracement: The retracement of 38.2% following the bullish rally is relatively shallow, aligning with the typical market behavior before high-impact news releases.

NFP Anticipation: Traders are closely monitoring the anticipated US NFP and unemployment rate data, with forecasts suggesting a potential weakening of the USD against Gold.

Technical Strength: On the 1-hour timeframe, XAUUSD exhibits strong technical strength, with two ascending trendlines and EMA 50 diverging from EMA 200, signaling robust momentum.

Bollinger Band Contraction: The Bollinger Bands show a contraction, indicative of reduced volatility as the market consolidates before the NFP release.

Oscillator Signals: Both RSI and MACD provide bullish signals, with MACD's signal line and histogram above the 0 line, affirming positive momentum.

Strategy Consideration: Traders are advised to stay vigilant, incorporating the unfolding economic data into their strategy amid the dynamic market environment. The potential weakening of the USD could extend XAUUSD's bullish trajectory until the momentum subsides.

Forecast 2.7% vs Previous 2.9%

Forecast 5.25% vs Previous 5.25%

Forecast 213K vs Previous 214K

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.