In today's trading session, XAUUSD commenced with a downward gap, following a remarkable five-day bullish streak witnessed in the previous week. Notably, last week's Tuesday saw a golden cross of the EMA 50 and EMA 200 for XAUUSD, a widely recognized bullish indicator. The current week is set to be eventful, with significant focus on the release of CPI data from Canada, New Zealand, and the UK.

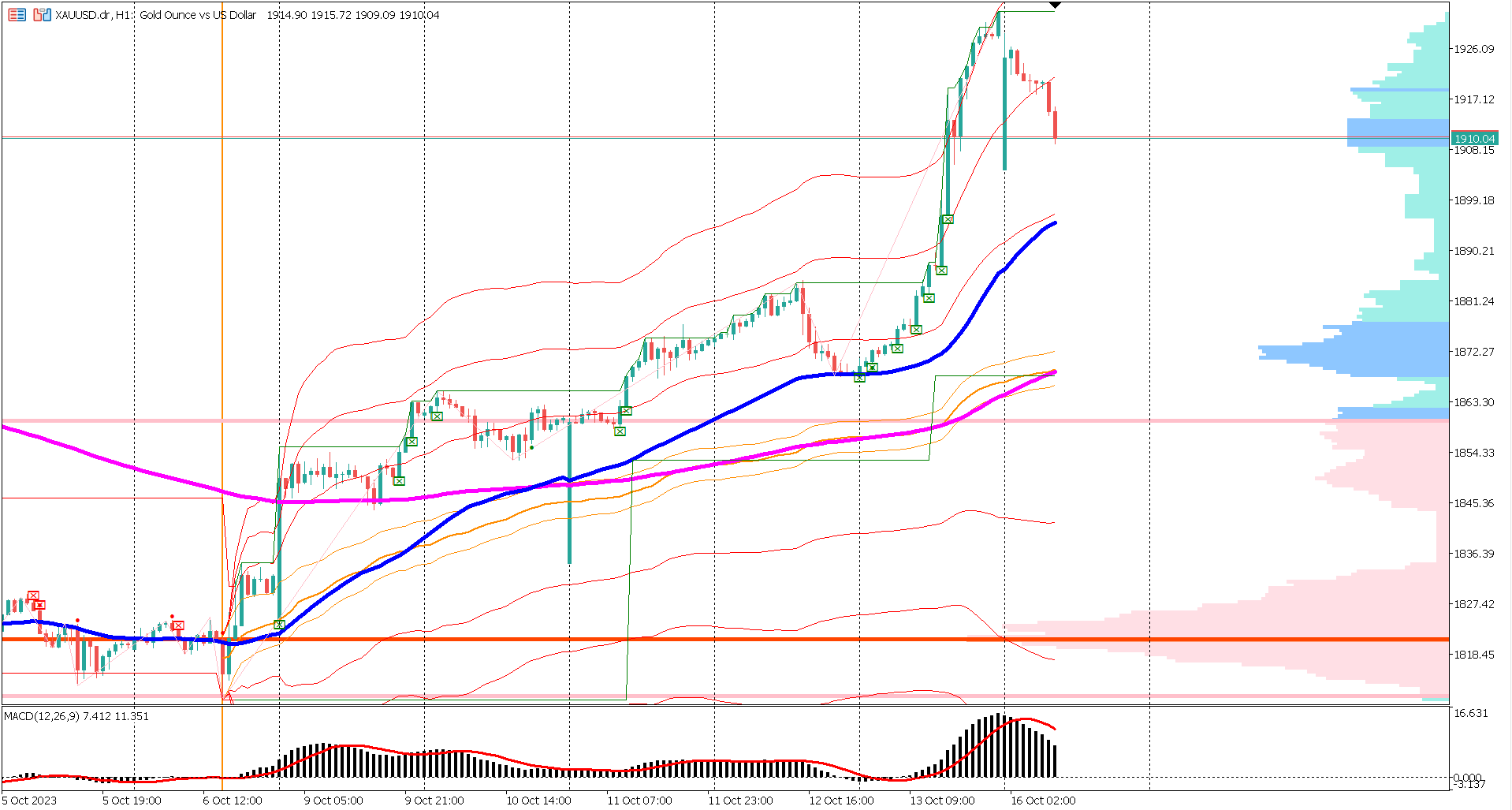

From a technical perspective, XAUUSD remains in a bullish stance, marked by the EMA 50 consistently positioned above the EMA 200. Typically, EMA 50 and EMA 200 signals persist for just one trading day or extend to over ten trading days. Presently, the ongoing EMA bullish signal has spanned four trading days. The range between EMA 50 and EMA 200 serves as a dynamic key support level, spanning from 1868 to 1895. A breach below this dynamic support level would elevate the possibility of a bearish signal, commonly referred to as a death cross.

An examination of the Anchored VWAP indicator, anchored from the recent swing low at 1818, indicates a bullish trend. Notably, it has encountered resistance at the third upper band of the VWAP. The key support level for this Anchored VWAP is situated at the VWAP midline, ranging from 1866 to 1869.

The MACD indicator reveals a bullish correction trend. Both the signal and histogram are positioned above the 0 level, indicative of a prevailing bullish trend. However, the crossing of the histogram beneath the signal line during a bullish trend suggests a forthcoming bullish correction.

Previous 6.5B

Forecast 2.6% vs Previous 0.2%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.