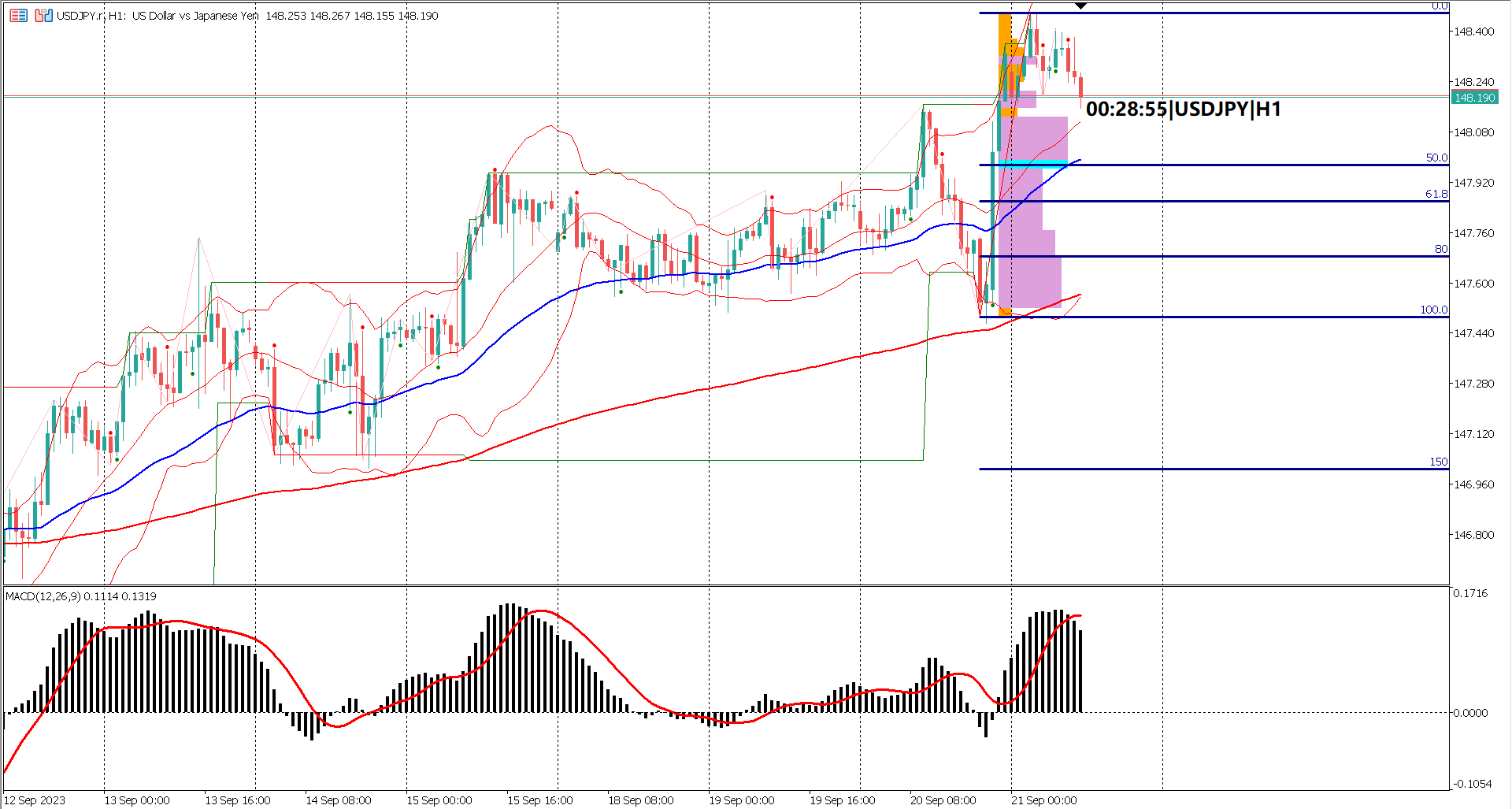

USDJPY began Thursday's session with a significantly higher high than Wednesday's. During the London trading session, it initiated a bullish correction, potentially aiming for the 50% retracement level, EMA 50, or Bollinger's mid band.

All indicators currently display a bullish bias:

Additionally, the volume profile indicator highlights a high-volume zone, specifically at 147.961-147.988 (depicted in a light blue rectangle). This point of control can serve as a support zone, where traders might anticipate bullish responses upon price contact. Furthermore, it coincides with the Fibonacci 50% retracement level, a significant area closely monitored by traders.

USDJPY exhibited a bullish trend with technical indicators supporting further upward movement. Traders are likely to focus on potential support levels like the 50% retracement, EMA 50, and Bollinger's mid band. The volume profile indicator also highlights a crucial support zone at the Fibonacci 50% retracement level, enhancing its significance as a potential bullish reaction point.

Forecast: 225K

Previous: 220K

Forecast: -1.0

Previous: 12.0

Forecast: 4.10M

Previous: 4.07M

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.