Crude Oil prices wiped the last 2 days of gains as traders awaited the U.S. Federal Reserve's interest rate decision, grappling with uncertainty about peak rates and their impact on energy demand. Economists are forecasting fewer barrels of crude oil inventories, -2.200M vs previously at 3.954M. The price of WTI could fall further if the result is higher than the forecast (higher supply of crude oil) and the FED remains the hawkish stance.

Crude Oil prices wiped the last 2 days of gains as traders awaited the U.S. Federal Reserve's interest rate decision, grappling with uncertainty about peak rates and their impact on energy demand. Economists are forecasting fewer barrels of crude oil inventories, -2.200M vs previously at 3.954M. The price of WTI could fall further if the result is higher than the forecast (higher supply of crude oil) and the FED remains the hawkish stance.

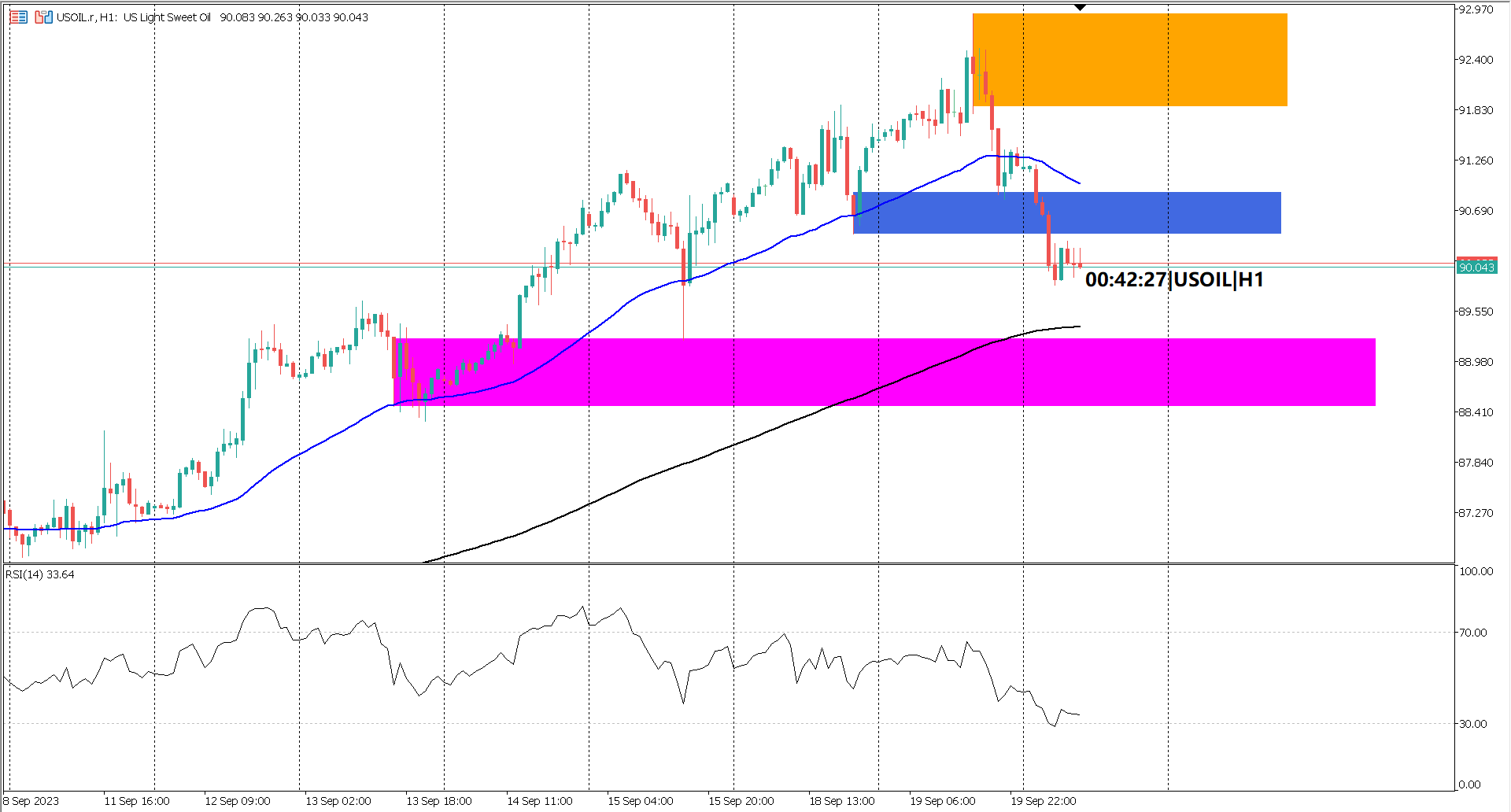

The current sentiment surrounding WTI can be characterized as neutral, given the presence of mixed signals encompassing both bullish and bearish indicators.

Firstly, the RSI (Relative Strength Index) has dipped into oversold territory, suggesting a bearish outlook. Additionally, the price has breached a critical support zone within the range of 90.423 to 90.89 (as indicated by the blue rectangle), further underscoring the bearish sentiment. Notably, this previously pivotal support zone has now assumed the role of a resistance zone, following the principle of SBR (Support Becomes Resistance).

It's also worth noting that the EMA 50 (Exponential Moving Average) remains positioned above the EMA 200, a situation often associated with bullish sentiment.

Key resistance levels to monitor include the ranges of 90.423 to 90.89 (blue rectangle) and 91.86 to 92.91 (orange rectangle). Conversely, the next significant support zone can be identified at 88.47 to 89.24.

Forecast: 5.50%

Previous: 5.50%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.