The Aussie strengthens against the USD amid the upcoming Reserve Bank Of Australia Interest Rate Decision. The USD lost ground to most major Forex pairs during the session after high-impact economic indicators suggested that the US economy might be slowing down. US manufacturing data showed weak figures, the US Bond Yields dropped, and the Stock market closed with gains. There is still a negative correlation between the US Stock market and the USD exchange rate.

The US ISM Manufacturing PMI for September came out at 50.9, a worse than expected result by 1.3; the consensus was 52.2. This result shows slower growth in the industry; the figure is still above the 50 level, which indicates industry expansion. The US Federal Reserve could ease the hike on the upcoming interest rate decision as we finally see signs of a slowdown in economic growth.

Australia will release important economic indicators later in the day; the Ai Group Manufacturing Index for September is expected to come out at 48.5; the previous figure was 49.3. If the actual result comes out below 50, the market will see it as an indicator of industry contraction, which will be negative for the AUDUSD exchange rate.

AU will also release Buiding Permits MoM and Home Loans MoM; the consensus for these indicators is 5% and -3.5%, respectively, which is better than the previous month's figures, and a better than expected result will be positive for the Aussie.

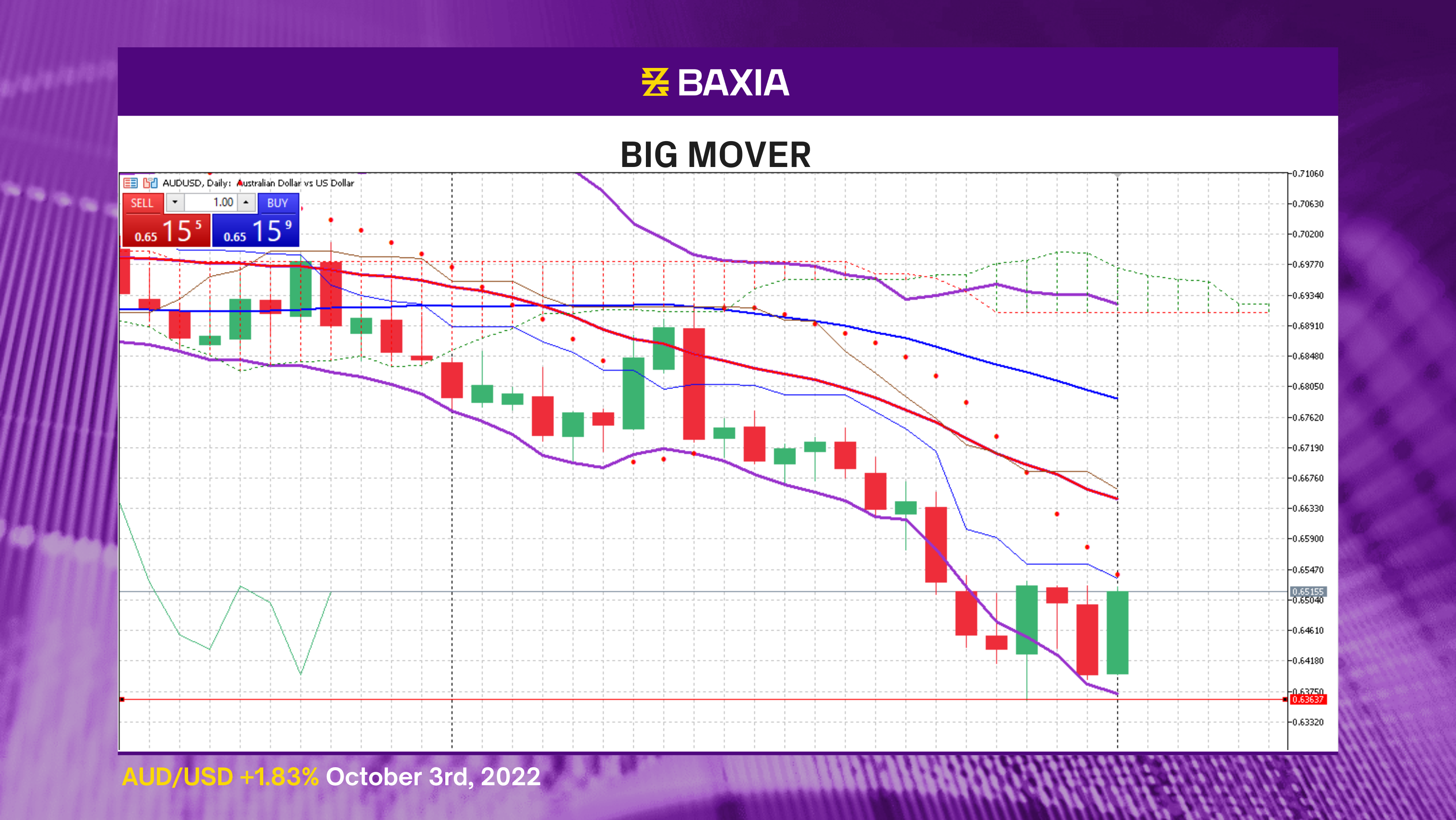

The pair continues on a downtrend as the short and long-term moving averages are still above the current price, and the gap between the trend lines continues expanding, suggesting that the downtrend is likely to continue in short to medium term.

The price is down 8.44% since mid-August; the pair found strong support at $0.6363 last week and is finally pulling back; the USD will be volatile in the upcoming sessions with the release of more high-impact economic indicators.

The Bollinger bands are wide and continue moving down, suggesting high volatility and strengthening the short signals for AUDUSD. The relative strength index is at 39%, allowing the pair to climb a bit more before the downtrend resumes.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.