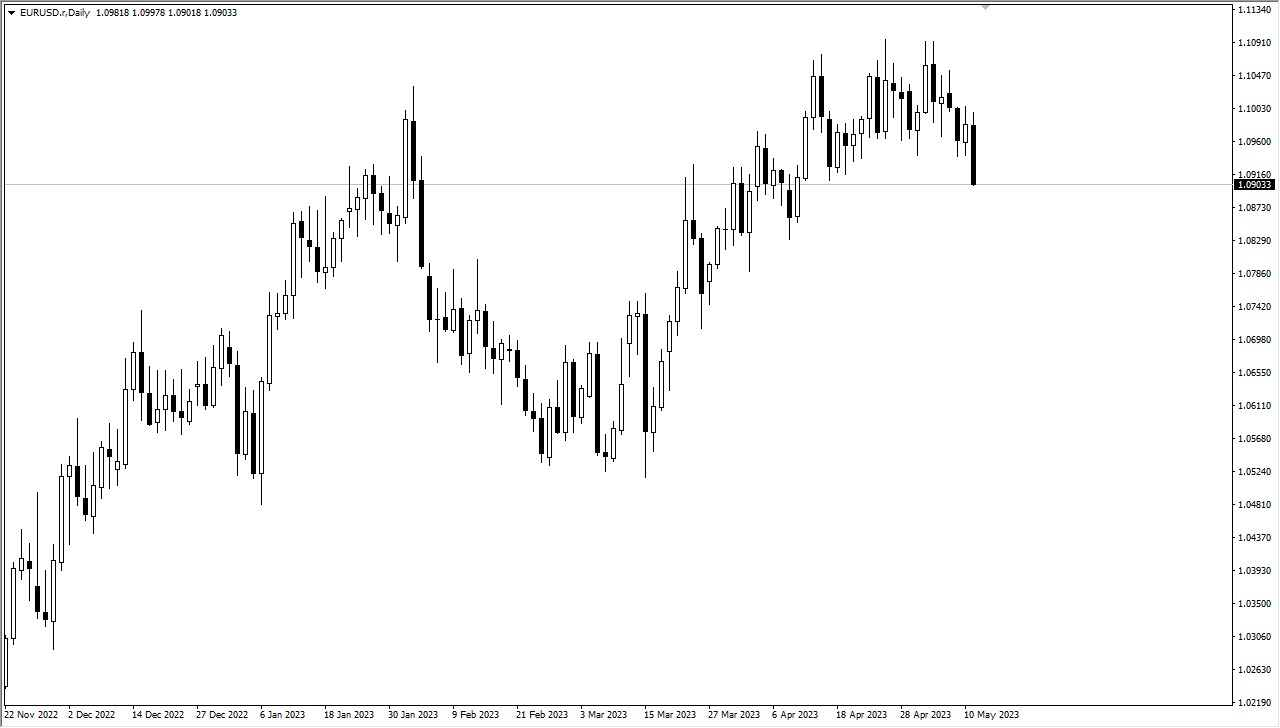

The Euro experienced a bit of a decline during Thursday's trading session, continuing the trend of volatile and erratic behavior. Positioned just below is the 50-Day Exponential Moving Average (EMA) at around the 1.09 level, which has historically been a zone of significant market commotion. It previously served as notable resistance, and thus, we can expect some influence from "market memory." A breakdown below this level would open the door to a rapid move toward the 1.08 level.

Conversely, if the market bounces from its current position, the 1.10 level is likely to be viewed as a point of "fair value" and will attract considerable attention. In this type of environment, it is expected to function as a price magnet. However, it is important to note that the market will continue to exhibit a high degree of noise, suggesting that short-term trading is currently the more viable approach. Paying close attention to the shorter time frames while utilizing these larger numbers as support and resistance is recommended.

If the market maintains its current behavior, which seems likely, given the absence of compelling factors suggesting otherwise, it will require some patience to witness significant moves. In terms of long-term trading, this currency pair may not be the most favorable option due to the market's uncertain direction as both central banks maintain a tight monetary policy stance and are expected to do so for the foreseeable future. Volatility in Forex pairs has decreased, and the EUR/USD pair could serve as a reliable gauge for overall movement in the Forex markets. Consequently, it is prudent to temper expectations, as it appears that the market is settling into a range, at least temporarily. Nevertheless, it is essential to maintain a reasonable position size, as any sudden surge in one direction or the other is likely to trigger significant market shifts as participants scramble to adjust their positions.

The 1.08 level under current pricing should be a major support level, and possibly a target for bears. On the other hand, we have seen several pullbacks recently, all of which have been bought.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit