The US released the S&P Global Services PMI earlier in the trading session with 47.3, a slightly better than expected figure; however, the result sits at a contraction level, so it did not help the USD. On the other hand, US ISM Non-Manufacturing PMI had a better than expected result with 56.7, higher than the previous month's and a level indicating growth.

The European Area had a number of recent negative economic releases; retail sales dropped 3.7% on a YoY basis as well as 1.2% MoM. As a result, the EURUSD pair has lowered more than 1.2% in the last two trading sessions.

This Friday, the US is to release the Unemployment rate and Non-Farm Payrolls data for the month. This data gauges the country's labor market strength and has a strong influence over the USD value. A negative indicator reading could make a big impact on the Dollar, and currently, the expert consensus is data will report a 151K drop from last month's 230K.

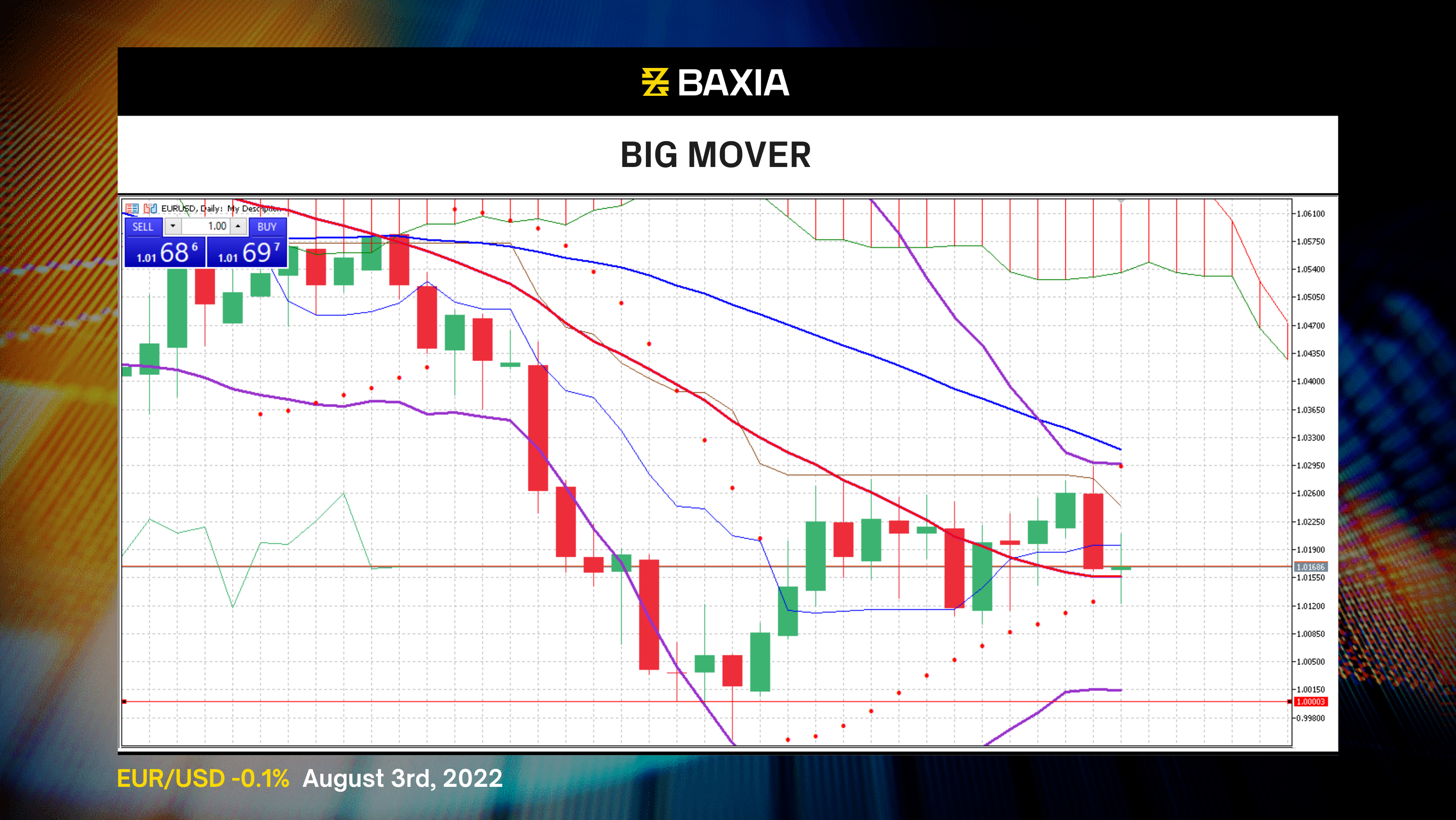

Consequently, the EURUSD pair could resume a downtrend in the short term after a brief pullback; a lot will depend on the results of the economic indicators on Friday. The price is trading close to the short-term moving average, and the general trend continues to be downwards.

The relative strength index is at 43%, allowing the pair to move downwards significantly before it enters an oversold status and the market sentiment changes. Our parabolic SAR indicator suggests that the price will continue to move downwards in the upcoming sessions.

The Bollinger bands are wide but steady; there is a chance that the pair could enter a consolidation phase if the support from our 23.6% Fibonacci retracement at 1.01086 is not broken.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.