The pound sterling regains some of the lost ground against the US dollar; volatility is expected to be higher in the next trading session as there are high-impact economic indicators scheduled to be released on Friday.

The Bank of England released an Interest Rate Decision earlier in the trading session, resulting in a 50 basis points hike, which experts anticipated due to the high Inflation Rate reading (9.4%) from the UK in July.

We have seen interest rate hikes across almost every strong economy in an effort to restore price stability. Inflation readings for the UK are scheduled to be released on August 17th. Only then would we be able to see if the rate hikes are cooling inflationary pressures.

The US released data on economic indicators this session as well: the Balance of trade data came out with a better than anticipated result; the trade deficit was -79.6B of the -80.1B expected. Initial Jobless Claims data was slightly worse than expected with a 260K reading, just 1K above the consensus, adding some value to the GBP.

The US will release Non-Farm Payrolls tomorrow; if the data released is worse than expected, we could see the USD lose much more ground to the GBP and other major currencies. A contraction in the labor market is expected, but we are yet to find out how bad the situation is.

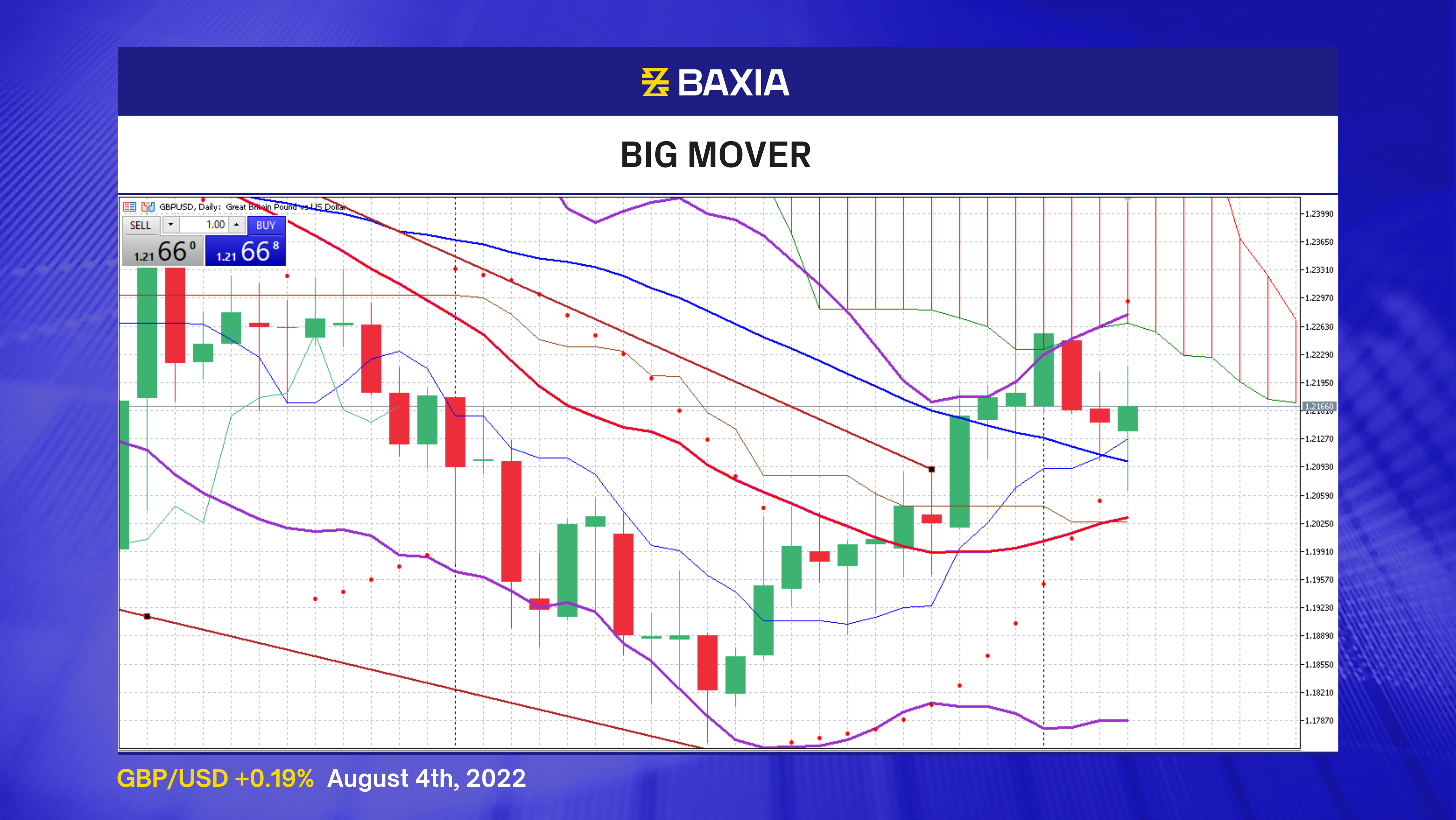

The currency pair found strong resistance on the 50% Fibonacci Retracement at $1.22133; the general trend continues to be upward as the price trades above the short and long-term moving averages. The upper Bollinger band is opening, suggesting that the price will likely move upwards in the short term.

The relative strength indicator is at 53%, allowing the pair to move freely before entering an overbought or oversold status. The falling wedge broke out just seven sessions ago, and there is strong potential for a rally aiming to reach the 1.2483 level.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.