EURUSD -0.96%

The Euro could reach parity with the US dollar once again after Gazprom announced that they would reduce the supply of gas exports to Germany, jeopardizing the energy security of Europe. Nordstream 1 pipeline is being used at only 20% of the total capacity.

Politicians in Europe believe Russia could cut off gas supply during the wintertime as retaliation for continued sanctions on Putin's government, making the commodity prices soar and potentially causing a recession in Germany.

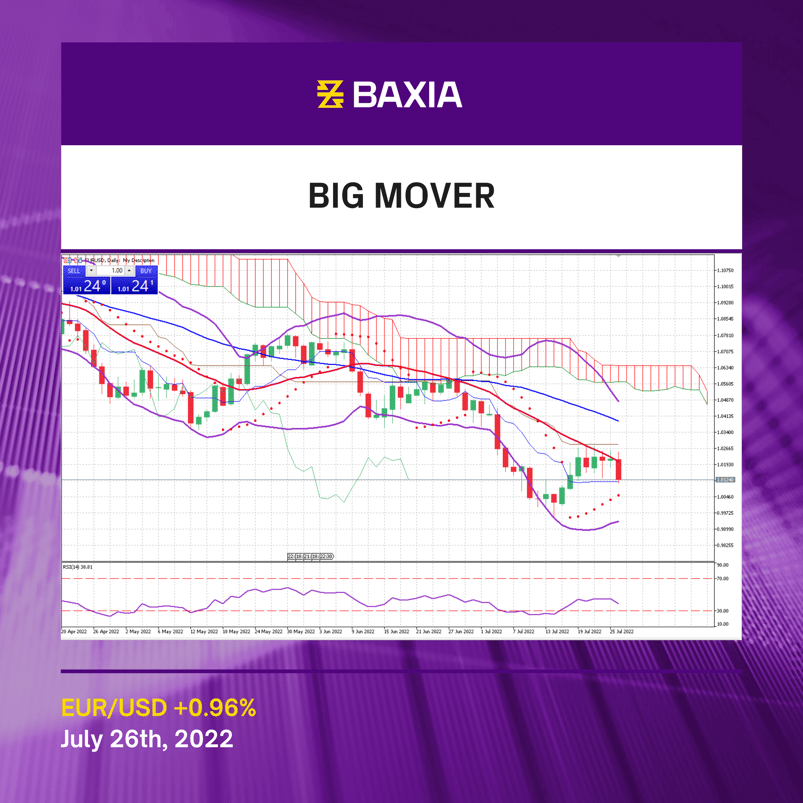

The Euro started to consolidate around 1.021 during the last five trading sessions, but following the recent news, the market sentiment changed.

US Dollar volatility should be higher this week as the US Fed is programmed to make an Interest Rate decision tomorrow. Experts agree that the US rate hike is likely to be 75 bps, while other analysts believe that a higher rate hike might occur due to inflationary pressures. A reading higher than 2.5% will make a case for a stronger US Dollar, which, combined with a potential energetic crisis in Europe, could be very favorable for the buck.

EURUSD continues on a general downward trend; after today's losses, the price trades below the short and long-term moving averages, suggesting that the price will continue moving down in the short term.

The support level from our 23.6% Fibonacci retracement at 1.01086 could be hard to break based only on technical analysis. Still, the fundamental aspects surrounding the pair will bring high volatility and momentum to potentially complete a breakout.

The relative strength index is at 39%, which could limit the downwards move; however, we have seen EURUSD stay oversold for a few sessions in recent weeks.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.