The US Dollar lost 1.29% to the Swiss Franc in the last two trading sessions. The USD rally is reversing after Switzerland released Unemployment Rate for August; the result met the expert consensus at 2%, a very healthy figure for the Swiss economy, which puts an end to the 4.69% rally the USD built over the previous 18 sessions.

The US also released high-impact economic indicators earlier in the session; Jobless claims for the week came out at 222K out of the 240K analyst's prediction; this figure shows that the labor market in the US continues to be strong despite the Fed's effort to slow down economic activity to reach a comfortable inflation rate.

Next week the US will announce Inflation rate, which is expected to drop from 8.5% to 8.1%; this will give the market participants a clear picture of where the Fed stands for the next interest rate decision at the end of September, where a 75 basis points hike is expected.

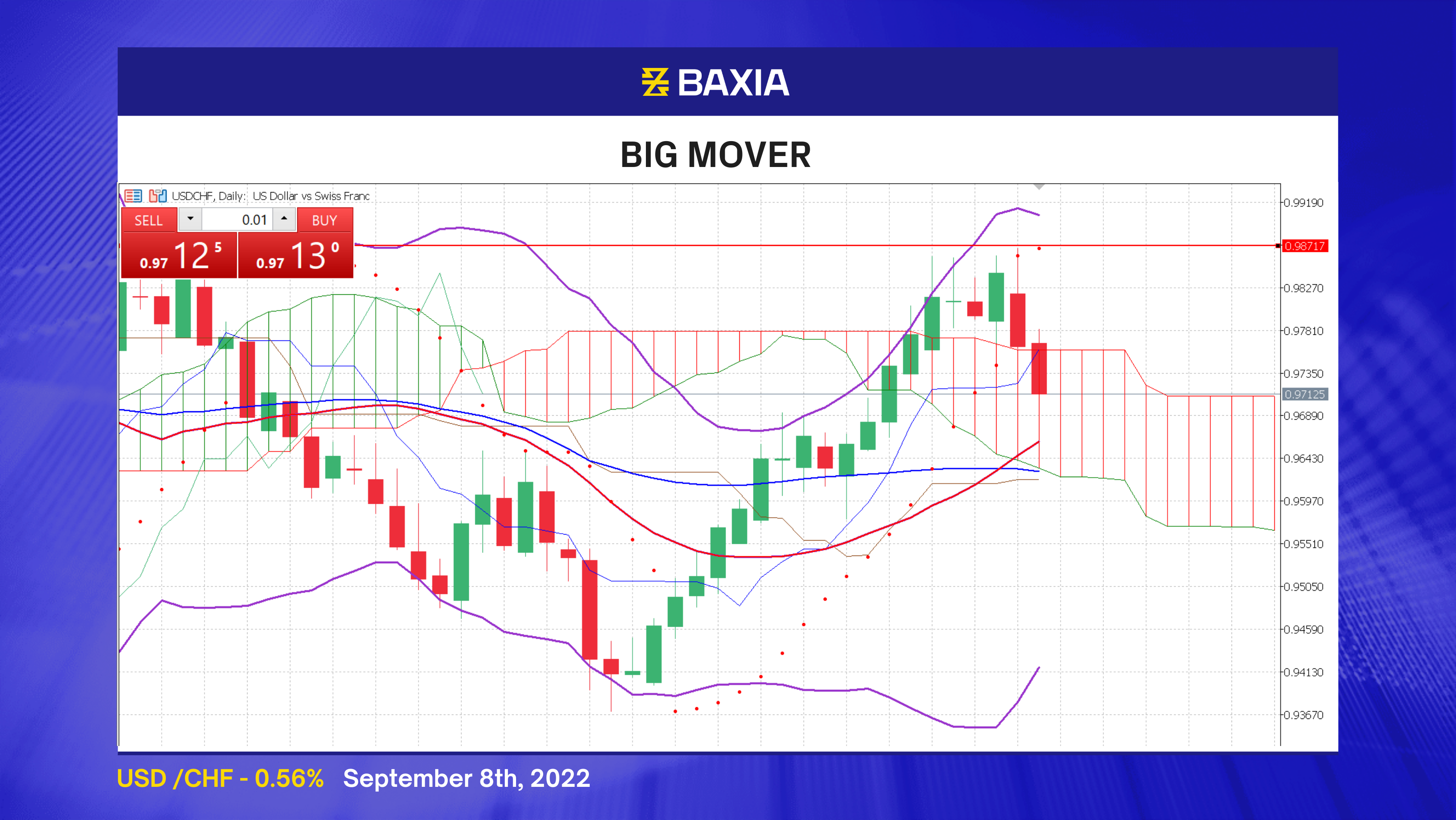

The Bollinger bands are wide but are starting to shrink, suggesting that the price could enter a consolidation period in the medium term. Volatility will continue to be high until the bands are narrower. The price is trading inside the Ichimoku cloud, suggesting there is market uncertainty.

The price could move in either direction, but the general trend continues to be upward as the short and long-term moving averages are still under the current price; the trend lines crossed recently, strengthening the long signals. The pullback could find support in our 61.8% Fibonacci retracement at 0.96891

The price started to move downwards after the relative strength index reached the overbought status before breaking the resistance at 0.98859. The market sentiment changed, and the RSI is currently at 53%, a very neutral area that will allow the USD to resume the uptrend in the short term.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.