The USD lost strength during the week's final session after the release of fundamental economic indicators from the US suggested that the labor market could start to decline in short to medium term.

The US released Non-Farm Payrolls earlier in the session. While the result came out better than expected with 315K of the 300K expert consensus, and the USD lost value. Furthermore an economic deceleration is likely to begin towards the end of this month once the Fed hikes the interest rate.

The US also released the Unemployment rate; the figure came out slightly higher than expected at 3.7%, analysts anticipated 3.5%. The US dollar could bounce back in the upcoming sessions with the release of more economic indicators.

Australia will release S&P Global Services PMI during the new trading session; experts' consensus is 49.6, which indicates an economic contraction in the sector. A lower figure will likely drive the AUDUSD exchange rate down. In contrast, a better-than-expected number will strengthen the Aussie dollar.

AU is also scheduled to release Retail Sales during the following session; expert consensus is at 1.3%, showing an increase in Australia's economic activity. If the figure comes out higher, the AUD could make some good gains over the USD.

On Monday, the Reserve Bank of Australia will release an interest rate decision; a 50 basis point hike is expected by analysts, although some experts believe that it could hike up to 75 basis points to cool off inflationary pressures.

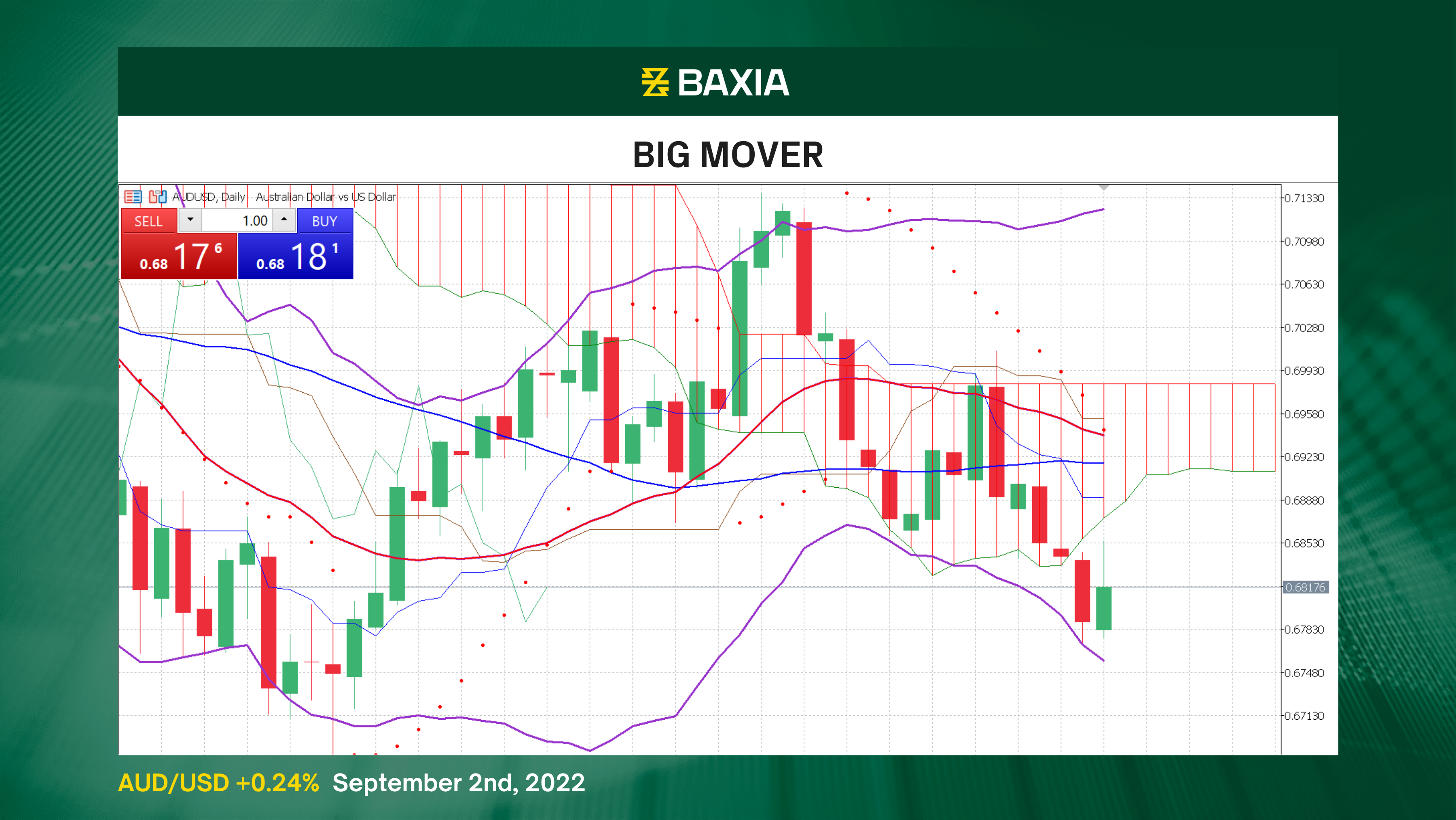

The general trend continues to be downwards as the short and long-term moving averages are above the current price, and the trend lines are close to crossing, strengthening the short signals.

The Bollinger bands are wide and continue to open; high volatility is expected in the short term. The pair is trading closer to the lower band, suggesting that the price is relatively low. The support in our 78.6% Fibonacci retracement at $0.67789 is strong, and the pullback could continue in the short term.

The relative strength index is at 40%, allowing the pair to climb freely before entering an overbought status. Our parabolic SAR indicator suggests that the price will continue to decrease in the upcoming sessions.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.