The EURUSD pair reached its lowest level in 22 years after the US Fed hiked the interest rate to 3.25%, a 75 basis point hike that analysts anticipated. The Euro recovered some of the lost ground after Fed Chair Powell's Speech, where he talked about an economic slowdown in the US economy and a growth rate below trend.

We are seeing a resilient labor market where tighter monetary policy has not been taking much effect; however, Powell mentioned that labor markets have been very strong in a robust economy and that we are seeing the effects of rate hikes on sectors of the economy that are more rate sensitive like the Housing market. He also mentioned that the rate hikes are not seeing much effect in other sectors as people have money from when they were not spending during the pandemic.

We will start to see a slower level of growth which will give rise to an increase in unemployment; the projections increased by 1% from June figures, and the expected unemployment rate for this year is now at 4.4%.

The Fed's restrictive monetary policy continues; the message is that the FOMC is strongly committed to bringing inflation down to 2% and that the rate hikes will continue until there is clear evidence that inflation is moving down to 2%.

Powell said, "Americans need to be prepared for economic pain in the short term" and that "there is no painless way to get inflation down; the interest rates can be painful at the beginning, but they set the stage to achieve maximum employment and price stability, supply and demand need to align, and the way to do that is by slowing down the economy."

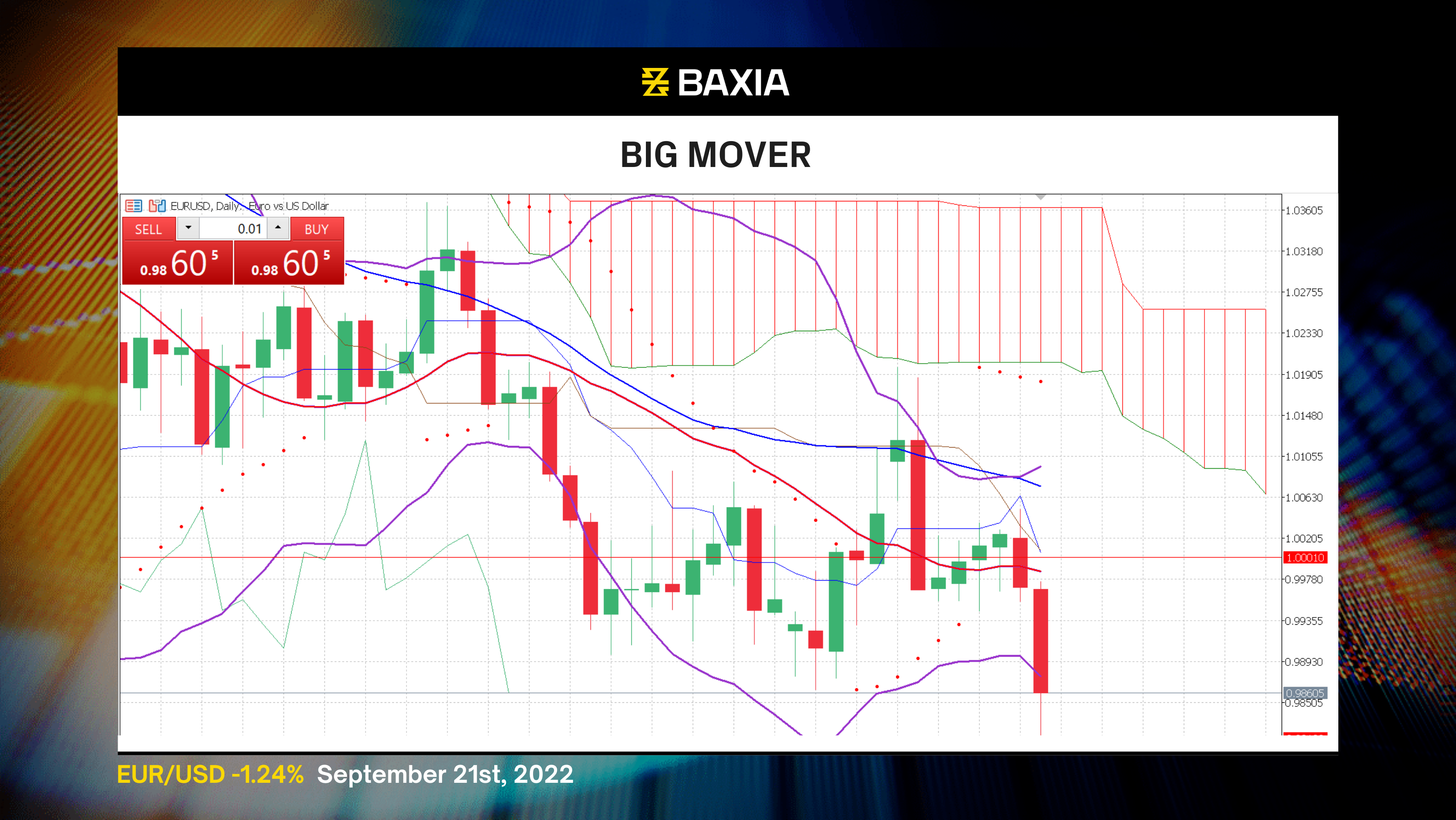

The Bollinger bands are opening up after they shrank aggressively during last week's consolidation phase; this will bring high volatility to the pair. The price is currently trading below the lower band, suggesting that the price is relatively low.

The general trend continues to be downwards as the price trades below the short and long-term moving averages; the pair found support at $0.98127, the lowest level we have seen for EURUSD in over 22 years.

The relative strength index is at 36%, which is very close to entering an oversold status; at that point, we could see a market sentiment change that could boost the EUR up temporarily. We have seen the pair stay oversold in the past, so we wouldn't be surprised if the price continues sinking before we see a pullback.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.