After Canada released the Consumer Price Index, the US dollar resumed the rally against the loonie; initial data came out at 4.8% for August, short of the expert consensus at 5.1%, suggesting that Canadian economic activity is settling. The lower CPI is mainly attributed to lower cost in fuel prices.

The Bank of Canada has been hiking the interest rates aggressively and is now starting to impact the country's inflation rate, which was announced earlier this session. The result came out lower than expected at 7%, while analysts anticipated a 7.3%. The BoC is expected to continue hiking the interest rate in order to restore price stability; expert consensus indicates that the next hike could be 50 basis points.

Tomorrow morning, the US Federal Reserve will announce an Interest Rate Decision; experts believe the hike will be 75 basis points, while others believe that the Fed will be more aggressive on this hike and raise interest rates by 100 bps, which will affect the exchange rate of USDCAD.

Central Banks around the world are taking aggressive measures to control inflation; however, economic activity does not seem to slow down at the rate they anticipated, pushing them to take further action.

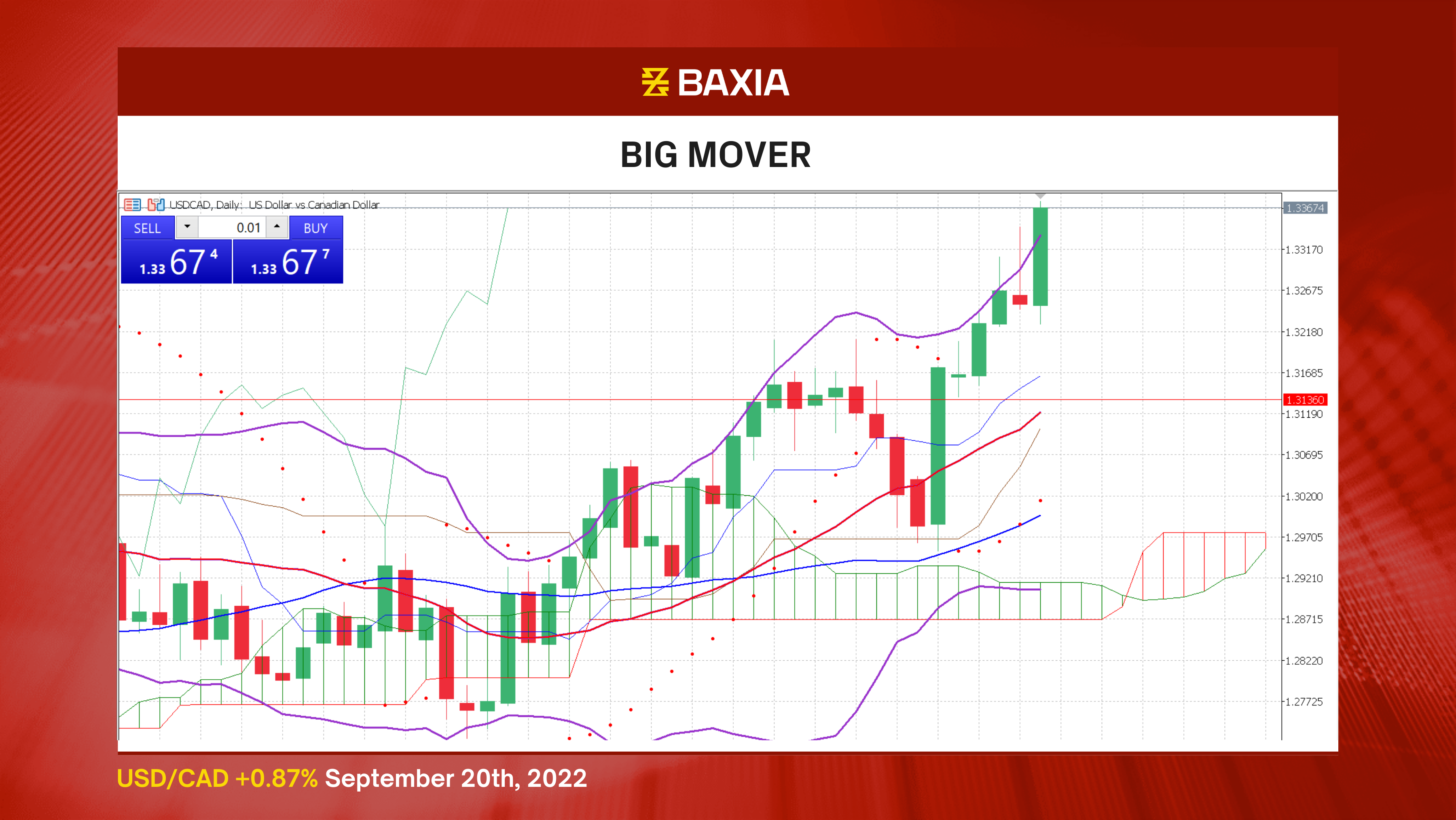

The general trend continues to be upward as the price is trading above the short and long-term moving averages. USDCAD reached its highest level in almost two years. The support level at $1.33923 could be strong and retrace the USD in the short term.

The Bollinger bands are wide and continue to open up, suggesting that there will be high volatility in the upcoming sessions. The bands are also moving upward, indicating that the price is likely to continue the upwards trend.

The relative strength index is at 69%, which is very close to the overbought status. The price could see a temporary pullback in the upcoming sessions; however, this could strengthen the USD in the medium term. Our parabolic SAR indicator suggests that the price will continue moving up in the short term.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.