The Canadian dollar recovered some ground against the US dollar after the Bank of Canada released an Interest Rate Decision; they hiked the rate to 3.25%, a 75 basis points increase from the previous figure of 2.5% in July.

Experts anticipated this rate hike as an effort from the Canadian Central Bank to control inflationary pressures, which was 7.6% in July. We are starting to see Inflation give in; however, this is mainly attributed to the lower price of energy commodities. Most Central Banks are expected to continue hiking rates until Inflation is under control, which is likely to cause a global slowdown in economic activity in the medium term.

The US is scheduled to release high-impact economic indicators during the next trading session, which will likely impact the exchange rate of USDCAD. Initial Jobless Claims are expected to come out at 240K, a 7K increase from the previous figure.

A result higher than 240K will weaken the USD as it relies heavily on its labor market to maintain solid economic activity. We have seen very good labor market numbers in the past that we were not expecting; we wouldn't be surprised if these numbers continue to improve. On the other hand, a figure lower than 240K will strengthen the USD across most Major Forex pairs.

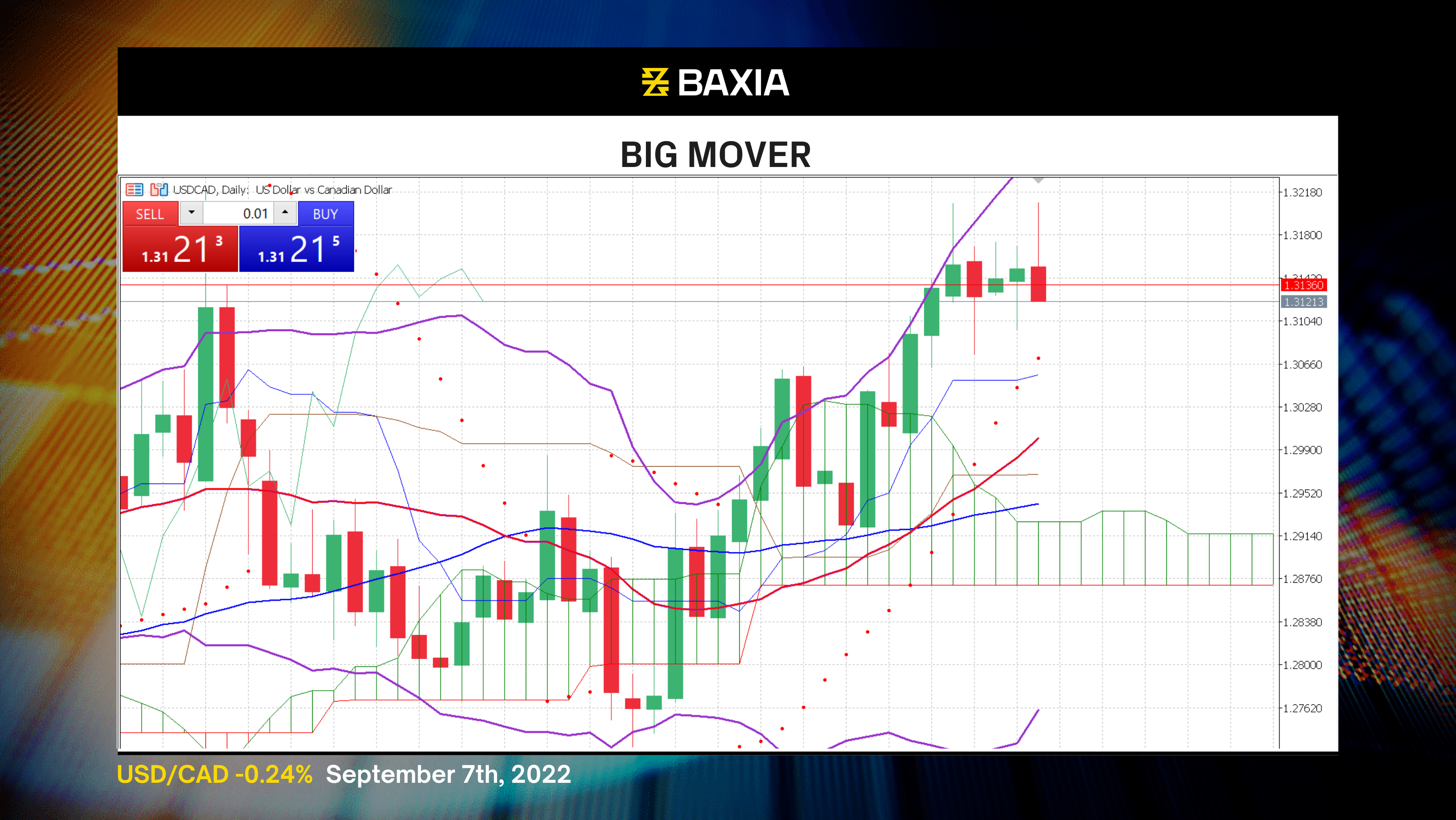

The Bollinger bands are wide and continue expanding upwards; volatility will continue to be high in the upcoming trading sessions. The pair found strong resistance at 1.32086 during the session and then pulled back to a low of 1.31290, a 79 pip range during the day. The support level in our 78.6% Fibonacci retracement at 1.31176 is likely to be tested in the short term.

The relative strength index is at 61%, limiting a potential climb; however, a pullback will allow the USD to gather strength and resume the uptrend in the upcoming trading sessions. The general trend continues to be upward as the short and long-term moving averages are below the current price.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.