Amidst anticipation surrounding the US Core PCE data, USDJPY experiences volatility, showcasing several significant doji candlesticks. The March core Personal Consumption Expenditures Price Index (PCE) release, closely monitored by the US Federal Reserve (Fed), has stirred market sentiment. Recent US Core PCE YoY figures surpassed expectations, reaching 2.8% compared to the forecasted 2.6%. This outcome hints at potential strength in the USD value against the Yen.

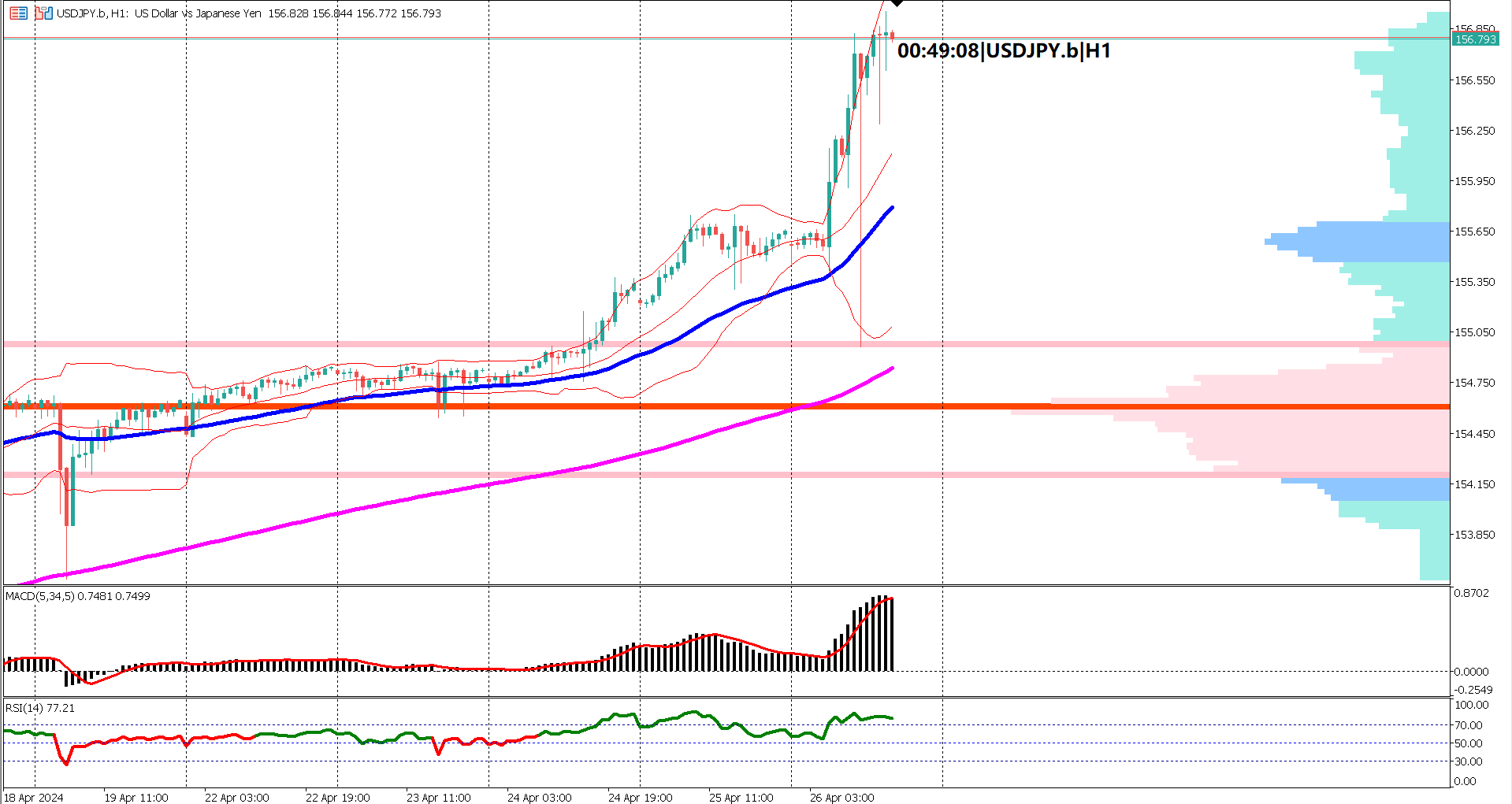

Analyzing the hourly timeframe, the market's reaction is marked by a doji candlestick, indicating a state of indecision among traders. Zooming out, the overarching sentiment remains bullish, with the EMA 50 positioned above the EMA 200. Supporting this outlook, oscillator indicators like the MACD signal line hovering above the 0 line reinforce the bullish sentiment. However, caution is advised as the RSI signals overbought conditions, signaling limited upside potential. Consequently, short-term sentiment suggests a corrective phase or bullish pullback may be imminent.

In summary, USDJPY's prevailing trend indicates a bullish bias, although the overbought RSI warrants caution, hinting at a possible pullback. Traders should closely monitor market developments for potential shifts in sentiment and price action.

Forecast 2.5% vs Previous 3.4%

Forecast 2.6% vs Previous 2.8%

Forecast 0.3% vs Previous 0.3%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.