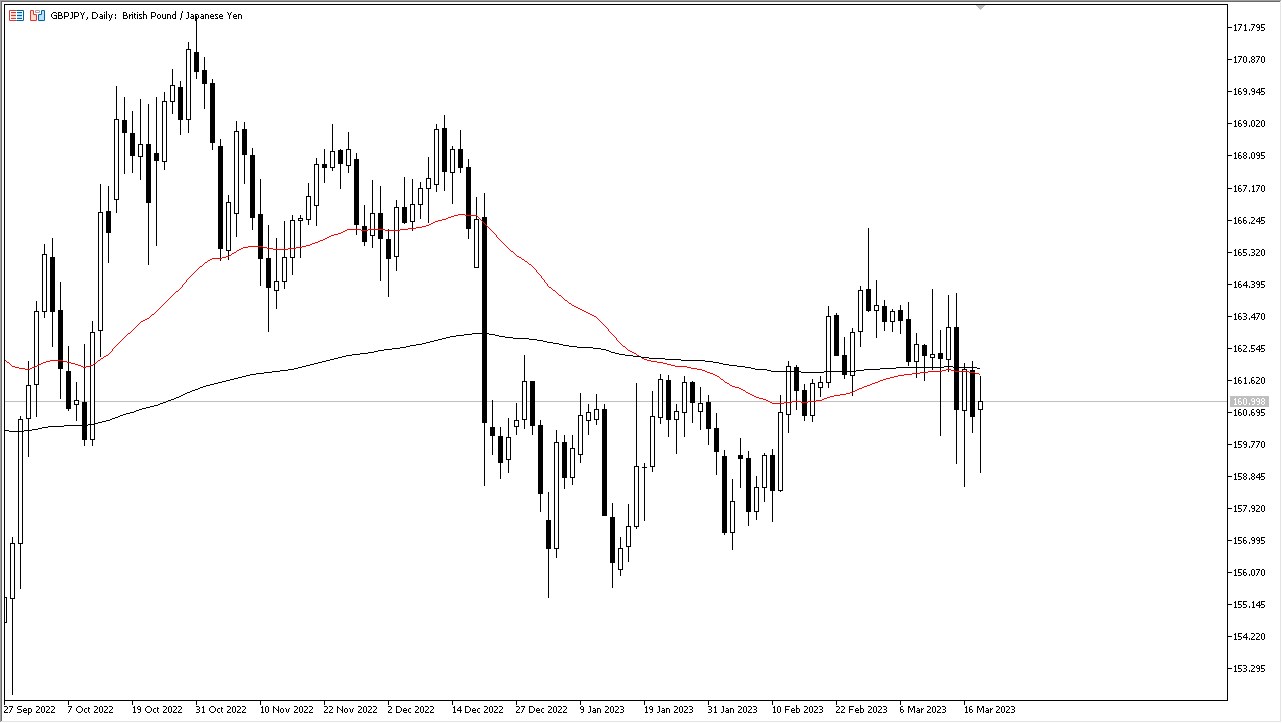

The British pound initially rallied against the Japanese yen on Monday to reach the 50-Day EMA, but then pulled back towards the ¥159.10 level, indicating a lot of volatility and noise in the market. This currency pair is highly sensitive to risk appetite, which is currently all over the place due to the recent Swiss bank bailout and other global concerns.

As a trader, it's important to look at this market through the prism of risk appetite, as there will likely be a lot of headaches to deal with in the short term. If the market pulls back, it could go down to the ¥157.50 level, an area that previously had strong support. If it breaks down below that, it could go down to the ¥155 level. On the other hand, if it breaks above the moving averages, it could test the ¥162.50 level and potentially reach the ¥165 level above, which was a significant resistance level.

Overall, this market is difficult to predict and could change rapidly due to the fluidity of global markets. As things stand, it appears to be a range-bound market between the ¥160 and ¥165 levels. As a trader, it's important to keep your position size reasonable and use a range-bound system to be successful in this market environment. Things could rapidly change after the Wednesday Federal Reserve meeting, as traders get an eye on what central banks may think about the global situation, but in the meantime, it is probably better for traders to be cautious, and perhaps more importantly, nimble. Remember that risk appetite is a major driver of what happens in this pair, as the Japanese yen faces yield curve control, and therefore if rates around the world start to drop again, that relieve some of the pressure that the Japanese Yen has been facing. On the other hand, if rates start to rise again, that could send this pair higher.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.