Natural Gas is up more than 14% in the last three trading sessions. The energy commodity price reached a two-week high after the day's production output declined for the third day in a row. Alongside this, demand is expected to be much higher than anticipated for next week.

Power plants continue to burn more fuel to provide electricity; given the recent heat waves across the US, more energy is consumed by users to keep their households at a comfortable temperature.

More energy is being consumed by users, given the recent heat waves in the US, to keep their households at comfortable temperature levels. Power plants continue to burn more fuel to provide this electricity.

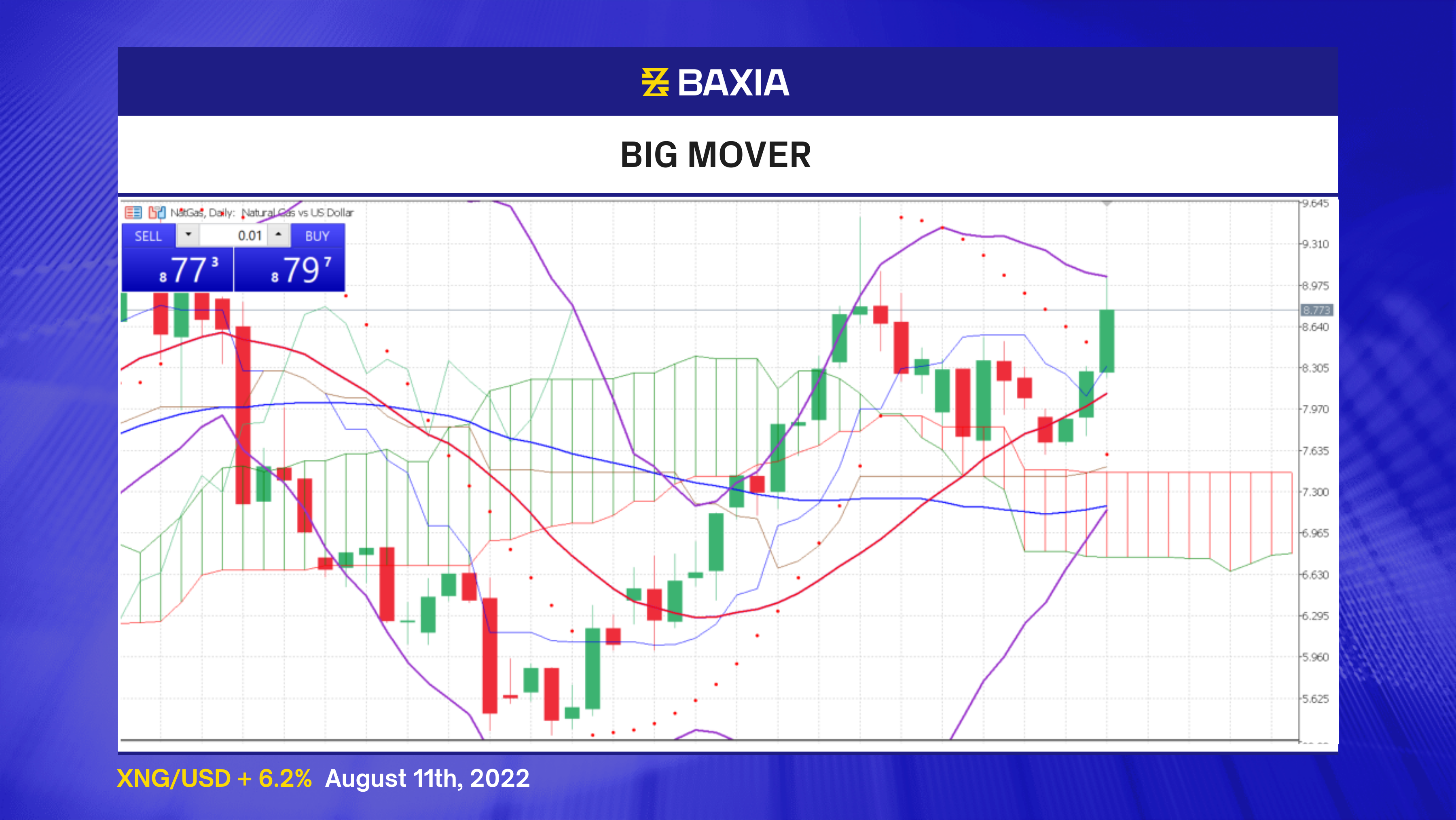

Natural Gas is trading above the short and long-term moving averages, the trend continues to be upwards, but the price could face resistance close to the upper Bollinger band.

The relative strength index is at 63%; once the RSI gets closer to 70%, the market will see it as being overbought, and the sentiment might change; as a result, the pair could find a temporary pullback in the short term, then XNG might gather enough strength to resume an uptrend.

The Bollinger bands are shrinking but moving upwards, suggesting that the price is likely to continue rising in the short term; the pair could find resistance at $9.085, the previous high from June 27th; if that level is broken, we would expect the price to continue climbing and potentially reach the $9.52 levels.

Our parabolic SAR indicator suggests that the price will likely continue rising; fundamental factors will hold a heavy weight in determining where the price moves next.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.