The GBPUSD pairing finds itself at a pivotal juncture, buffeted by the gusts of economic data and charting a course amidst unfolding dynamics. The stage was set yesterday with the revelation of US GDP figures, which fell below expectations at 4.9% versus the forecasted 5.2%. Today's spotlight remains on the US, as the market eagerly awaits the release of Core Durable Goods Orders, with economists anticipating a positive trajectory at 0.2% compared to the previous 0.0%. Simultaneously, the Core PCE Price Index is forecasted to exhibit a slowdown at 3.4%, a marginal dip from the prior 3.5%.

GBPUSD Price Action

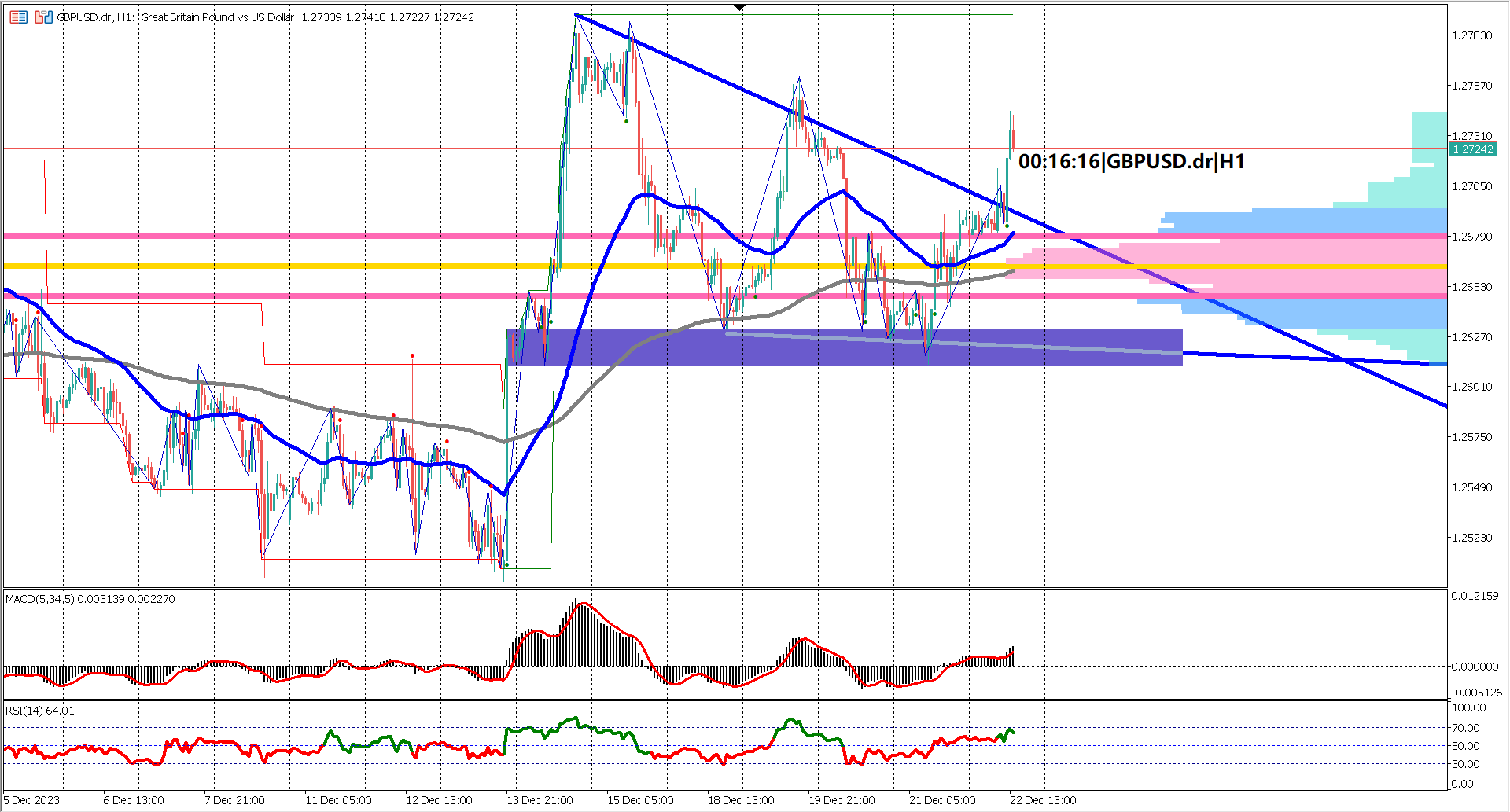

The technical tapestry for GBPUSD reveals the emergence of a falling wedge chart pattern, following a robust bullish impulsive move that stretched from the low of December 13, 2023, at $1.2500 to the high of December 14, 2023, at 1.27657. This pattern is visually represented by two descending blue trendlines. A noteworthy development unfolded during the European trading session, as the price boldly breached the upper echelons of these descending blue trendlines—a pivotal breakout that signals a nascent bullish trend.

The formation of the falling wedge prompted the convergence of EMA 50 and EMA 200, underscoring a brief period of consolidation. However, a glance beyond the wedge breakout reveals a divergence between these moving averages, with EMA 50 reasserting its dominance above EMA 200. This divergence signifies an uptick in bullish momentum, hinting at the strengthening resolve of the bulls.

The oscillator indicators resonate with this bullish narrative. The MACD, with its signal line and histogram soaring above the 0 line, paints a compelling picture of bullish momentum. Simultaneously, the RSI has breached the 60% threshold, further substantiating the prevailing bullish sentiment.

In summation, GBPUSD stands on the cusp of an upward trajectory, the falling wedge acting as a catalyst for a potential surge. As the market eagerly awaits the US economic releases, the pound seems poised to extend its gains, breaking recent highs. However, the caveat lies in the economic crosswinds, and traders would be wise to monitor the unfolding data releases for a nuanced understanding of the terrain ahead.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.