Today's US trading session is poised for pivotal economic releases, notably the US GDP forecasted at 5.2%, reflecting a robust economy compared to the previous 2.1%. Concurrently, Initial Jobless Claims are anticipated to rise to 214k, signaling potential shifts in market sentiment.

Analysts project a stronger performance in the US economy, potentially bolstering the USD. As economic indicators influence currency strength, traders are keenly observing these releases for their impact on USDJPY dynamics.

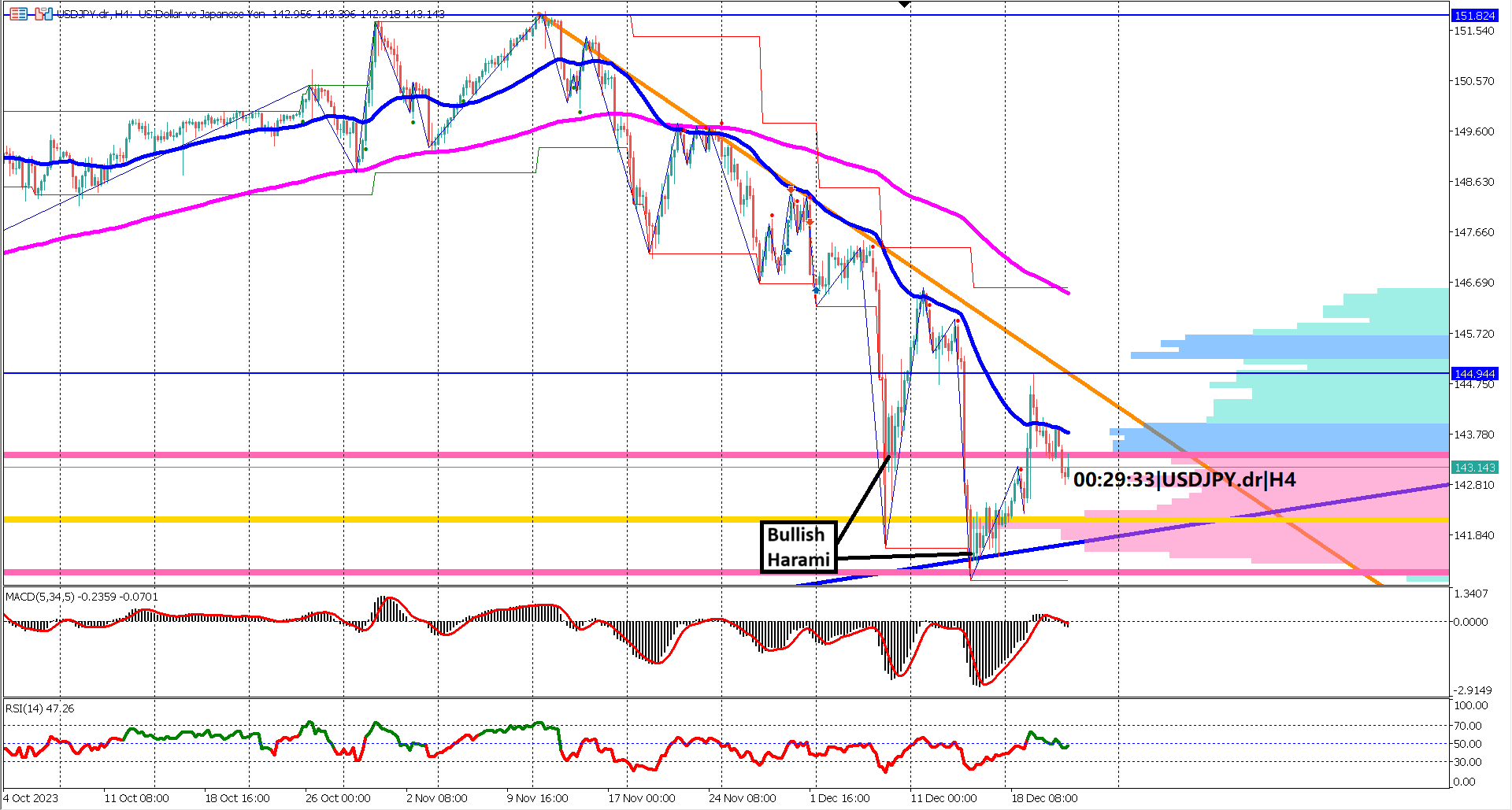

Technical Analysis - USDJPY H4 Chart:

USDJPY has been ensnared beneath a descending trendline for the past 5 to 6 weeks, indicating a persistent bearish trend. Notably, the pair found support at the ascending trendline, confirmed by a bullish harami candlestick pattern, signifying potential resilience. EMA 50 positioned under EMA 200 signals a bearish trend. Both lines are expanding, underscoring the robust bearish momentum.

Looking at oscillator indicators, they are giving mixed signals. MACD histogram and signal line below the 0 line suggest a bearish stance. RSI broke above the 60% level, maintaining a position above 40%, offering a mixed signal.

The pair's stability hinges on the critical support at 140.961 and the ascending trendline. Economic data below forecasts may jeopardize these levels. A positive economic outcome could propel USDJPY to break above EMA 200, paving the way for a potential golden cross.

As traders brace for economic revelations, USDJPY stands at a crossroads. A robust US economy may trigger bullish movements, challenging the current bearish trajectory. Conversely, weaker-than-expected data may intensify bearish pressures, putting key support levels at risk. Stay attuned to the evolving landscape for informed decision-making.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.