The Pound Sterling (GBP) stands at a fascinating juncture against the US Dollar (USD), poised for a potential breakout but held in check by the looming UK inflation report and broader hawkish headwinds. While a narrow rising channel and bullish technical indicators suggest upside potential, Wednesday's Consumer Price Index (CPI) data could throw a wrench in the gears.

Economists are forecasting a dip in UK inflation to 3.8% YoY, down from 3.9% previously. A lower-than-expected reading could bolster the GBP by easing pressure on the Bank of England (BoE) to raise rates aggressively. Conversely, a higher-than-expected number could reignite hawkish bets.

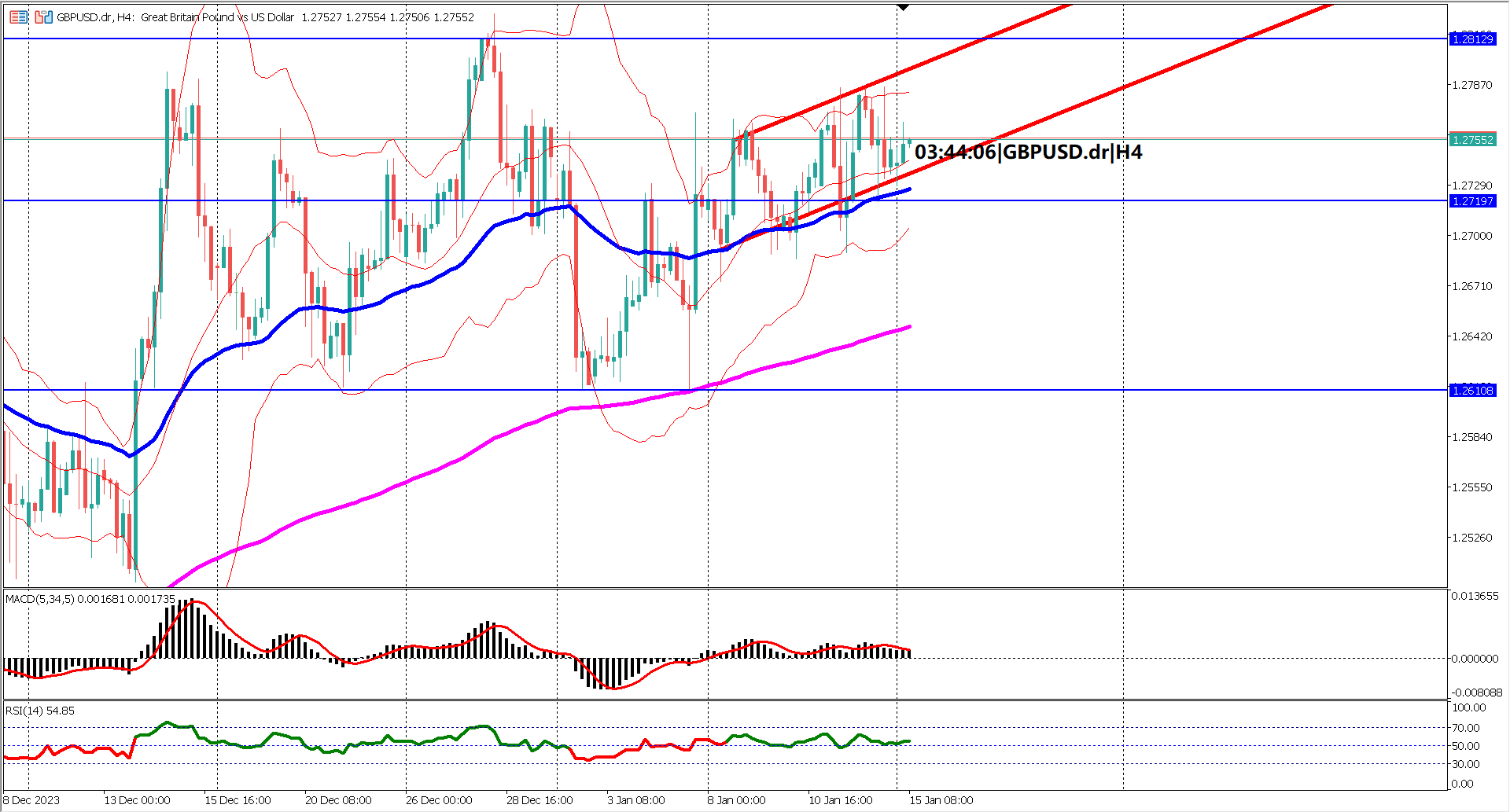

Despite the narrow, 40-50 pip rising channel on the 4-hour chart, GBPUSD maintains a surprisingly strong bullish momentum. The EMAs remain distinctly non-convergent, and prices have repeatedly closed above the upper Bollinger Band, showcasing the persistent buying pressure.

A weakening bullish trend would manifest in a few key ways. Look for the EMAs to start converging, with the EMA 50 closing in on the EMA 200. A break below the recent swing low of 1.26108 or two consecutive bearish candlesticks breaching the rising channel would be early bearish signals. Additionally, a sustained close below the lower Bollinger Band would confirm a fading bullish momentum.

Currently, the MACD and RSI offer further support for the bulls. Both histogram and signal line of the MACD remain above the zero line, while the RSI has climbed above 60%, indicating strong bullish momentum. However, a bearish divergence, where the RSI falls while prices rise, or a drop in the RSI below 40% and a MACD signal line crossing below zero would signal a potential trend reversal.

In conclusion, GBPUSD presents a tempting breakout opportunity for traders, but caution is warranted. Wednesday's CPI data looms large, acting as a potential catalyst for either a bullish surge or a bearish breakdown. Closely track the aforementioned technical indicators and the market reaction to the CPI data to identify the breakout direction and capitalize on the impending move.

Key Takeaways:

Forecast 11.2B vs Previous 11.1B

Forecast 0.8% vs Previous -0.5%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.