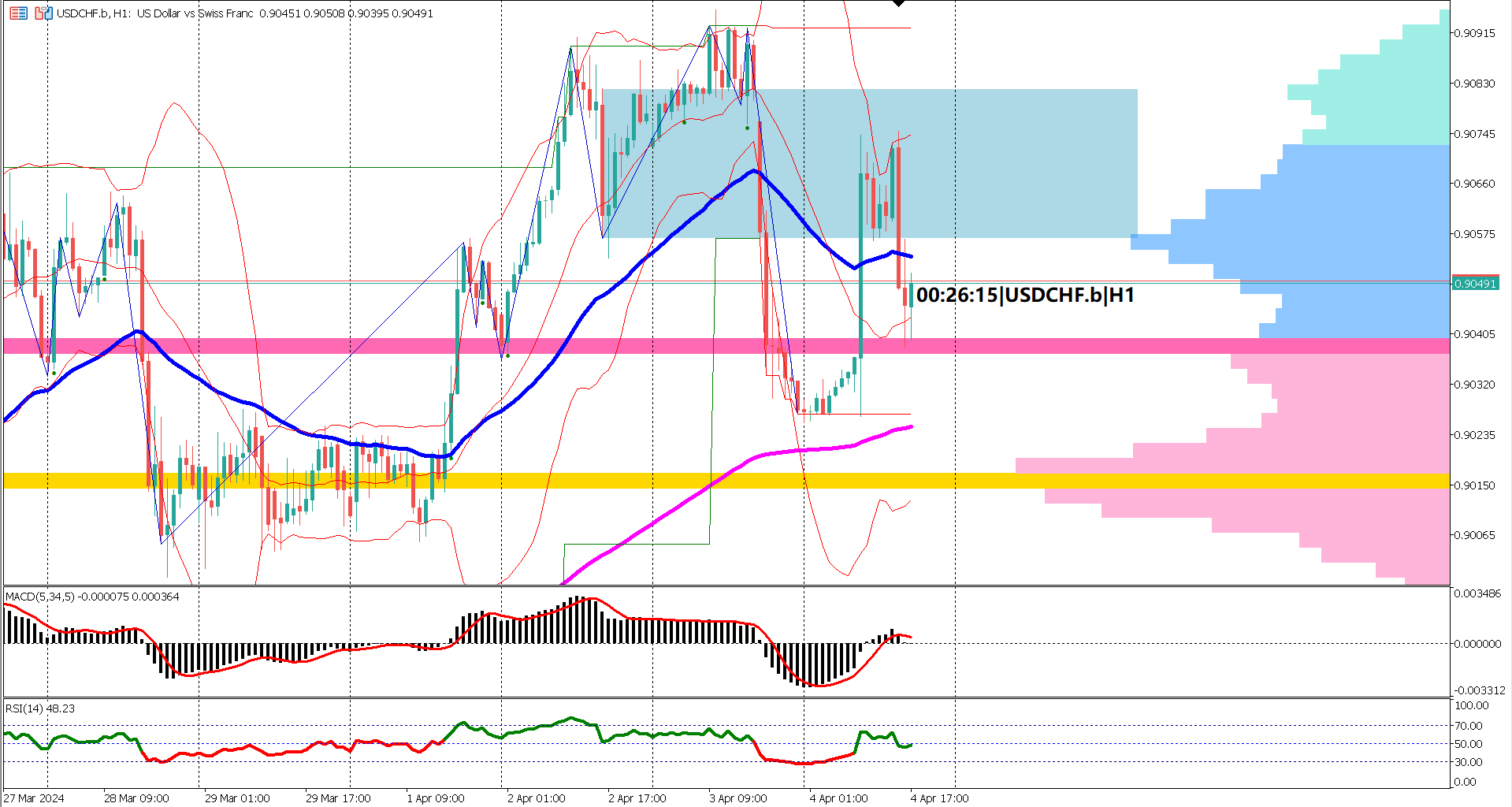

In the realm of forex trading, USDCHF has exhibited signs of weakness, with the pair breaching a crucial support level at 0.9056 following the release of adverse US data. The downtrend resulted in a substantial 70-pip drop in USDCHF, although it managed to maintain its position above the value area of the volume profile indicator, providing a semblance of stability. Following the decline, the market staged a recovery, reclaiming approximately 50 pips. However, for this rebound to signify a bullish reversal, it is imperative for the market not to close below yesterday's low at 0.9027.

Technical analysis reveals that both the Exponential Moving Averages (EMA) 50 and 200 are indicating weaker bullish momentum, primarily due to the EMA 50 nearing convergence with the EMA 200. Typically, a divergence between the two EMAs may signal a continuation of a bullish trend. Furthermore, oscillator indicators corroborate a bullish sentiment, with the Moving Average Convergence Divergence (MACD) signal line hovering above the zero level and the Relative Strength Index (RSI) steadfastly maintaining its position above 40%.

In the short term, the trend for USDCHF appears bullish, with the majority of technical indicators suggesting that bullish momentum remains intact. However, market participants remain vigilant, particularly regarding the potential for a bullish reversal. Traders are closely monitoring key support and resistance levels, including yesterday's low at 0.9027, to gauge the market's trajectory amidst evolving economic data and geopolitical developments.

In conclusion, USDCHF's recent movements underscore the delicate balance between bullish and bearish forces within the forex market. While the pair has experienced a temporary setback following the breach of a key support level, the resilience displayed above the value area and the subsequent rebound hint at the underlying bullish sentiment. Nevertheless, traders remain cautious, recognizing the importance of key technical levels and ongoing market dynamics in shaping the future direction of USDCHF.

Forecast 52.8 vs Previous 52.6

Forecast 0.70B vs Previous 0.50B

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.