In the dynamic realm of the US30, today's anticipation looms large as the market awaits the release of crucial NFP and unemployment rate data. Economists forecast a shift in the NFP numbers, expecting a decrease from the previous 216K to 187K, coupled with a rise in the unemployment rate from 3.7% to 3.8%.

As the market treads cautiously in the lead-up to these pivotal economic indicators, US30 finds itself engaged in a sideward dance, its movements mirroring the collective breath-holding preceding significant news releases.

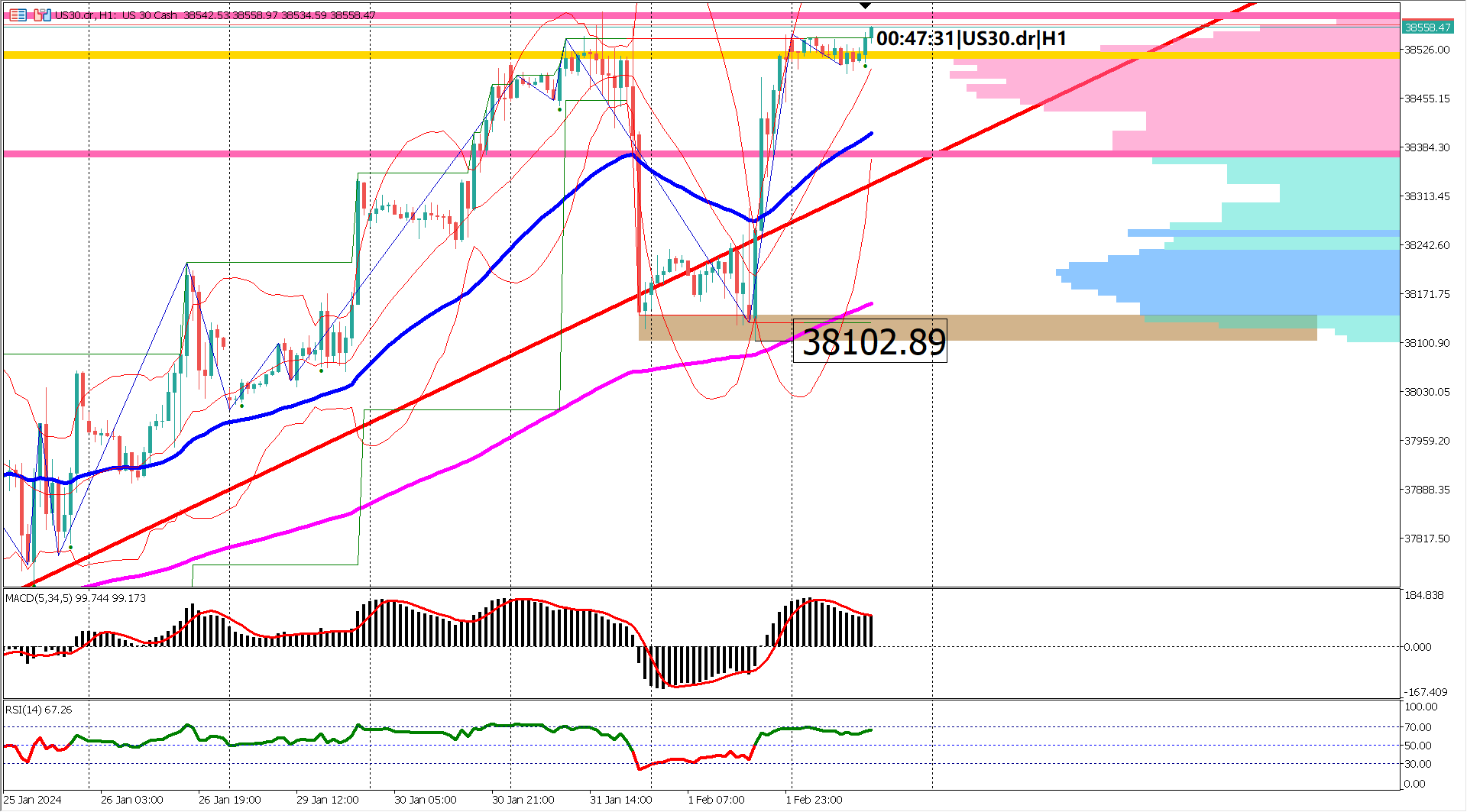

A key level of support at $38102.89 holds the spotlight, poised to dictate the market's narrative. A breach beneath this level may signal the emergence of a double-top reversal pattern, particularly if the economic releases fall short of forecasts. Conversely, meeting or exceeding expectations could pave the way for bullish advances.

The Bollinger Bands, offering insights into market volatility, reveal a scenario of reduced activity, with both upper and lower bands contracting. This suggests a narrow daily trading range, indicative of the current low volatility environment.

Amidst this anticipation, the EMA 50, having resumed its divergence post yesterday's rally, signals the potential resurgence of bullish momentum. However, a disappointing economic release today could see EMA 50 converge towards EMA 200, potentially heightening the risk of a bearish reversal and the formation of the double-top chart pattern.

Despite the cautious atmosphere, both MACD and RSI indicators align with a bullish bias. The MACD's signal line hovers steadfastly above the 0 line, while the RSI maintains its bullish stance by holding above the 40% level over the last 18 trading hours.

In summary, the overall trend for US30 remains robustly bullish. The nuanced outcome of today's economic releases could offer the market the directional impetus needed to sustain its upward trajectory. Traders, brace yourselves for the NFP waves and the potential shifts they may bring to the US30 seas.

NFP & Unemployment Rate Jitters: Traders brace for the impact of NFP and unemployment rate data, with economists forecasting a dip in NFP numbers (187K vs. 216K) and a rise in the unemployment rate (3.8% vs. 3.7%).

Sideways Dance: US30 engages in a cautious sideward movement, mirroring the market's collective anticipation as it awaits crucial economic indicators.

Critical Support at $38102.89: The market's fate hinges on the $38102.89 support level, potentially signaling a double-top reversal if breached, depending on the outcome of today's economic releases.

Low Volatility Environment: Bollinger Bands reflect reduced market volatility, contracting both upper and lower bands, indicating a narrow daily trading range.

Bullish Momentum Resurgence: EMA 50, after a rally, resumes divergence, signaling a potential resurgence of bullish momentum. However, a disappointing economic release may pose a risk of convergence towards EMA 200.

MACD and RSI Alignment: Both MACD and RSI indicators align with a bullish bias, providing a positive backdrop amidst the cautious atmosphere.

Overall Robust Bullish Trend: The overarching trend for US30 remains robustly bullish, with the nuanced outcome of today's economic releases poised to influence its continued upward trajectory.

Forecast 2.7% vs Previous 2.9%

Forecast 5.25% vs Previous 5.25%

Forecast 213K vs Previous 214K

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.