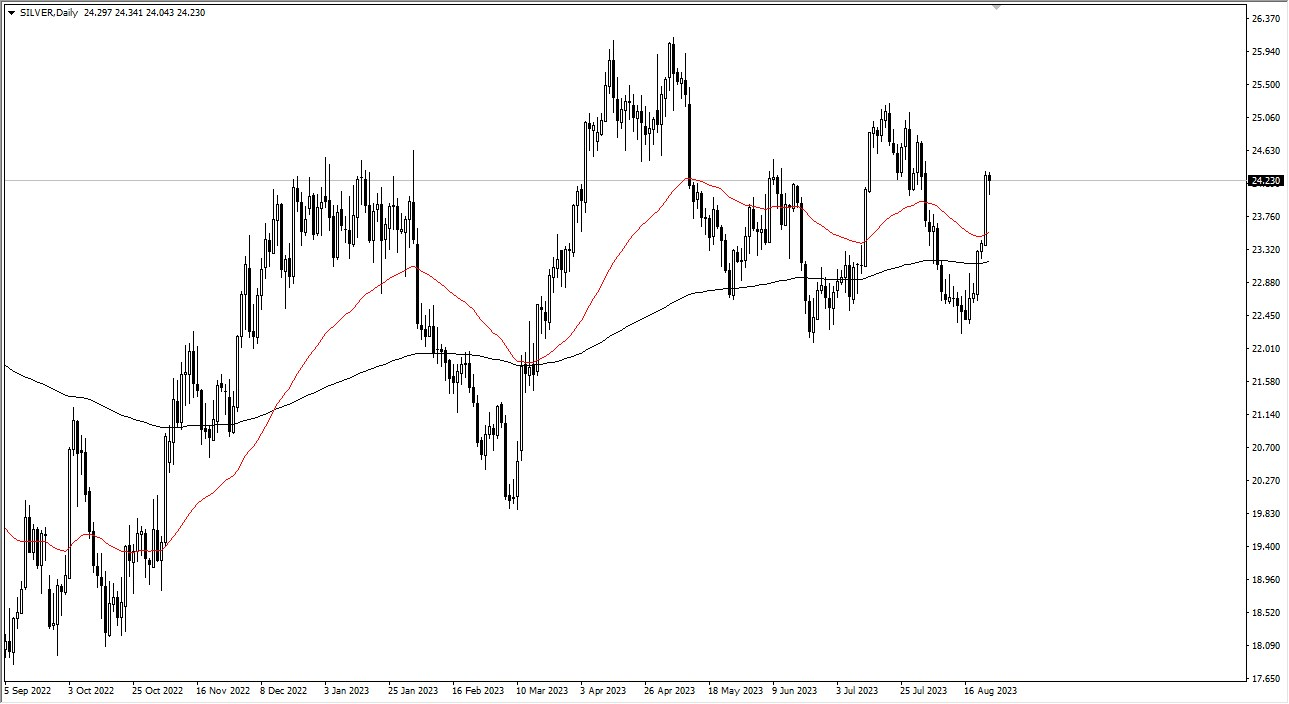

Silver experienced a slight retreat during Thursday's trading session, seemingly prompted by a modest round of profit-taking. This development appears reasonable, especially considering the impending Jackson Hole Symposium, scheduled to feature a series of speeches on Friday, which could significantly shape the near future. The potential influence of Jerome's tone cannot be underestimated, as an overly hawkish stance has the power to disrupt the market's equilibrium. This possibility is not unfounded, given our proximity to the upper bounds of the longer-term consolidation range, indicating that a pullback is within the realm of reason.

Looking ahead, it's worth considering the potential involvement of the 50-day EMA, which might offer a support level. This could offer the market a chance to catch its breath and recalibrate. A breach below the 50-Day EMA could open the door for a descent towards the significant 200-Day EMA – a key technical marker that commands considerable attention. Should this level be breached, a more substantial decline towards the $22 mark could unfold. Although such a scenario isn't necessarily expected, it's a factor that warrants consideration.

Moreover, the inverse correlation between the market and the US dollar shouldn't be ignored. This could also play a role in the unfolding dynamics. With Jerome Powell's speech on the horizon, it's logical to anticipate heightened volatility in the US dollar over the next day. Those already involved in trading might be inclined to secure profits. If you're not yet engaged in the silver market, delaying decisions until Monday could be a prudent strategy. The overall markets are poised to be exceptionally turbulent, demanding caution to navigate safely. It's important to note that silver tends to exhibit more pronounced volatility compared to other assets.

In conclusion, the recent retreat in silver's value comes as the Jackson Hole Symposium approaches, promising insights and potential market shifts. The sway of Jerome Powell's words and the technical indicators' nuances will play pivotal roles. While uncertainties abound, informed decisions and measured approaches can help traders navigate these treacherous waters.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit