The silver market experienced a surge of approximately 3% on Friday, sparked by a disappointing Non-Farm Payrolls (NFP) report. The NFP data, which revealed an addition of 150,000 jobs versus an estimated 180,000, and a slightly higher unemployment rate of 3.9% compared to the expected 3.8%, contributed to the upward momentum of silver. This significant data release occurred following the Federal Open Market Committee (FOMC) meeting earlier in the week, where the Federal Reserve maintained its hawkish stance while expressing concerns about ongoing tightening, particularly in the form of elevated US yields and the potential shift in economic conditions as the year comes to a close.

The silver market experienced a surge of approximately 3% on Friday, sparked by a disappointing Non-Farm Payrolls (NFP) report. The NFP data, which revealed an addition of 150,000 jobs versus an estimated 180,000, and a slightly higher unemployment rate of 3.9% compared to the expected 3.8%, contributed to the upward momentum of silver. This significant data release occurred following the Federal Open Market Committee (FOMC) meeting earlier in the week, where the Federal Reserve maintained its hawkish stance while expressing concerns about ongoing tightening, particularly in the form of elevated US yields and the potential shift in economic conditions as the year comes to a close.

Earlier in the week, labor market data, including the ADP employment change and the Job Openings and Labor Turnover Survey (JOLTs) report, both fell short of expectations, with little change in job openings being observed. Federal Reserve Chairman Jerome Powell has been emphasizing a period of "below-trend" growth, referring to GDP growth slightly below 1.8% but above 0%, and has also alluded to a "softening" of labor market conditions, potentially leading to a modest increase in the current 3.8% unemployment rate.

This fundamental context sets the stage for potential further appreciation in silver prices, as well as in the broader precious metals sector and various forex pairs against the US dollar.

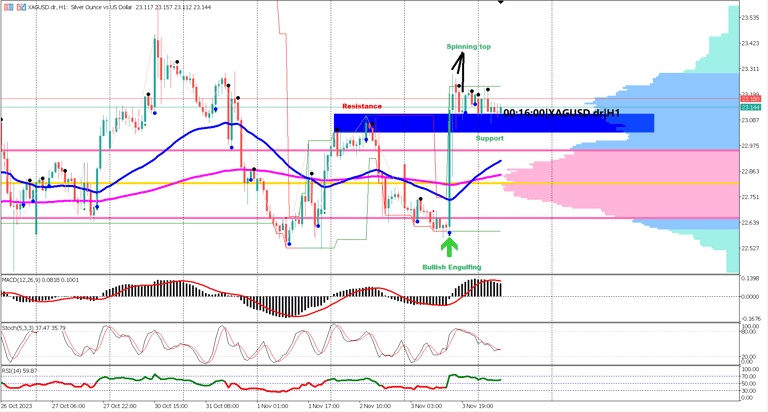

During Friday's NFP release, the silver market displayed notable price action developments. A large bullish candle engulfed a preceding spinning top candle, breaking through a key resistance level at 23.03-23.11. Subsequently, additional spinning top candlesticks emerged, indicating a temporary loss of bullish momentum. Friday's closing price, however, remained above the high of the earlier bullish engulfing candlestick.

As the market quickly distanced itself from the Exponential Moving Averages (EMAs) 50 and 200, leaving a noticeable gap between the candlesticks and the EMAs, a sideways trend became apparent. This pattern reflects the market's anticipation for the EMAs to catch up with the recent price movements. The occurrence of a golden cross at the close of Friday's trading session signified a potential end to the bearish trend and the emergence of bullish sentiment.

Turning our attention to the Relative Strength Index (RSI), it managed to surpass the overbought threshold at 70. However, this does not necessarily imply a bearish reversal, given the fundamental backdrop of the disappointing NFP and unemployment data. In this context, the overbought RSI suggests that short-term bullish sentiment is likely to persist.

The Moving Average Convergence Divergence (MACD) indicator supports the notion of a bullish correction, as indicated by the position of the histogram below the signal line.

In conclusion, the silver market currently exhibits a bullish trend. While a temporary sideways move is in progress, this presents an opportunity for buyers to consider entry points during pullbacks or shallow corrections in the ongoing bullish momentum.

Forecast 52.1 vs Previous 53.1

Forecast 52.1 vs Previous 53.1

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.