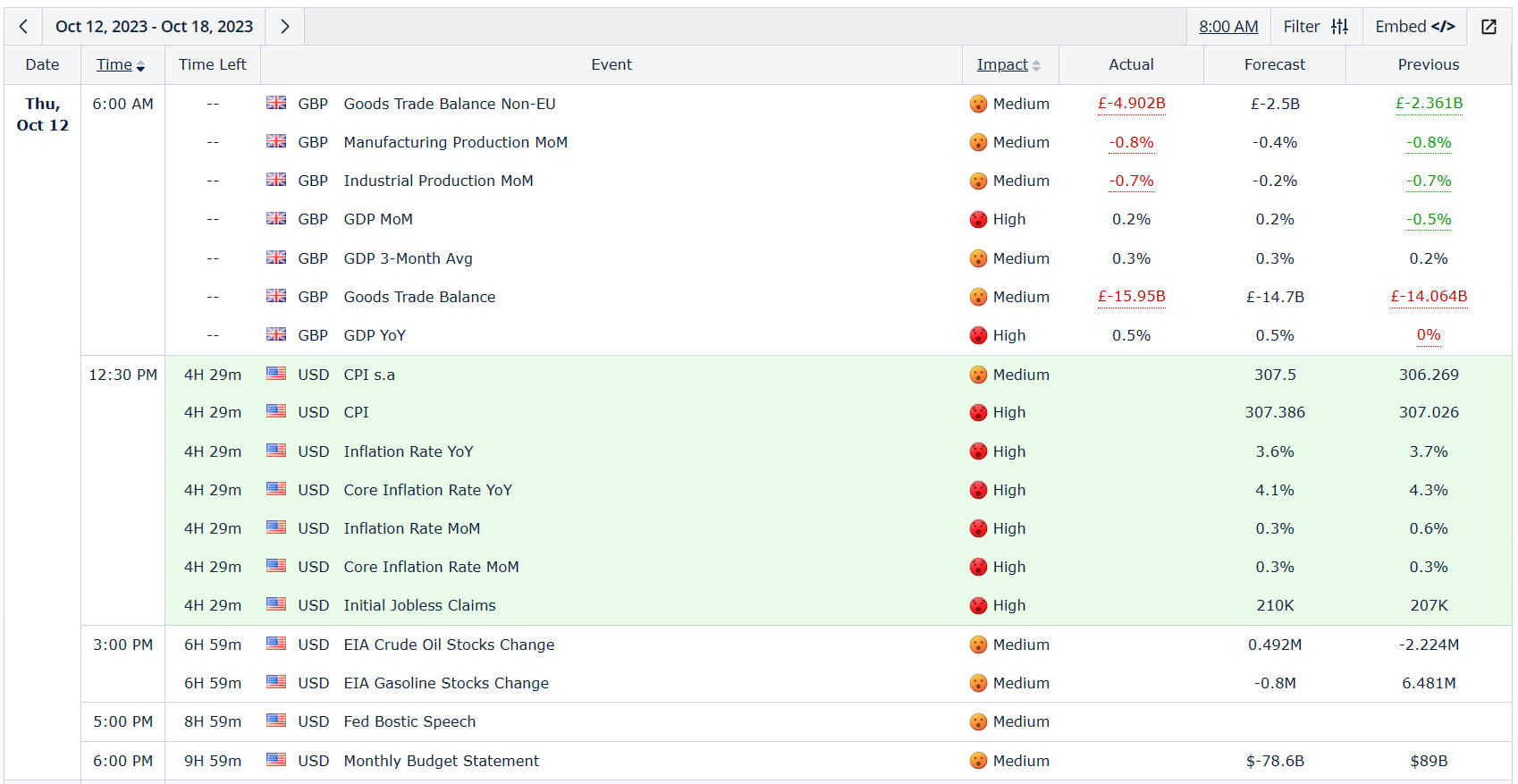

UK's Medium-to-high-impact news is inundating the GBPUSD trading sphere on Thursday, yielding a mixed bag of results with most figures falling below forecasts. This shift exerts pressure on the recent bullish sentiment, poised to pivot to a bearish mode during the upcoming New York session, promising increased volatility and clarity.

In Tuesday's reveal, minutes from the latest FOMC meeting hinted at a less hawkish tone among US policymakers. While they collectively agreed that interest rates should remain high for an extended period, they also acknowledged the need to balance against the risks of over-tightening, with an emphasis on achieving the 2% policy target for inflation.

Furthermore, Wednesday brought news of US producer price inflation surpassing expectations. The headline PPI surged from 2% to 2.2% in September, defying market projections of a decline to 1.6%. This uptick was fueled by elevated energy prices during the summer and the most robust increase in food prices seen in almost a year. The core PPI followed suit, ascending from 2.5% to 2.7%, far surpassing the anticipated drop to 2.3%.

Today, the US CPI data looms on the horizon, with the potential to influence both headline and core inflation. An inflation dataset surpassing expectations could scale back a portion of the recent dovishness surrounding the Fed and potentially reverse some of the recent gains observed in US Treasuries.

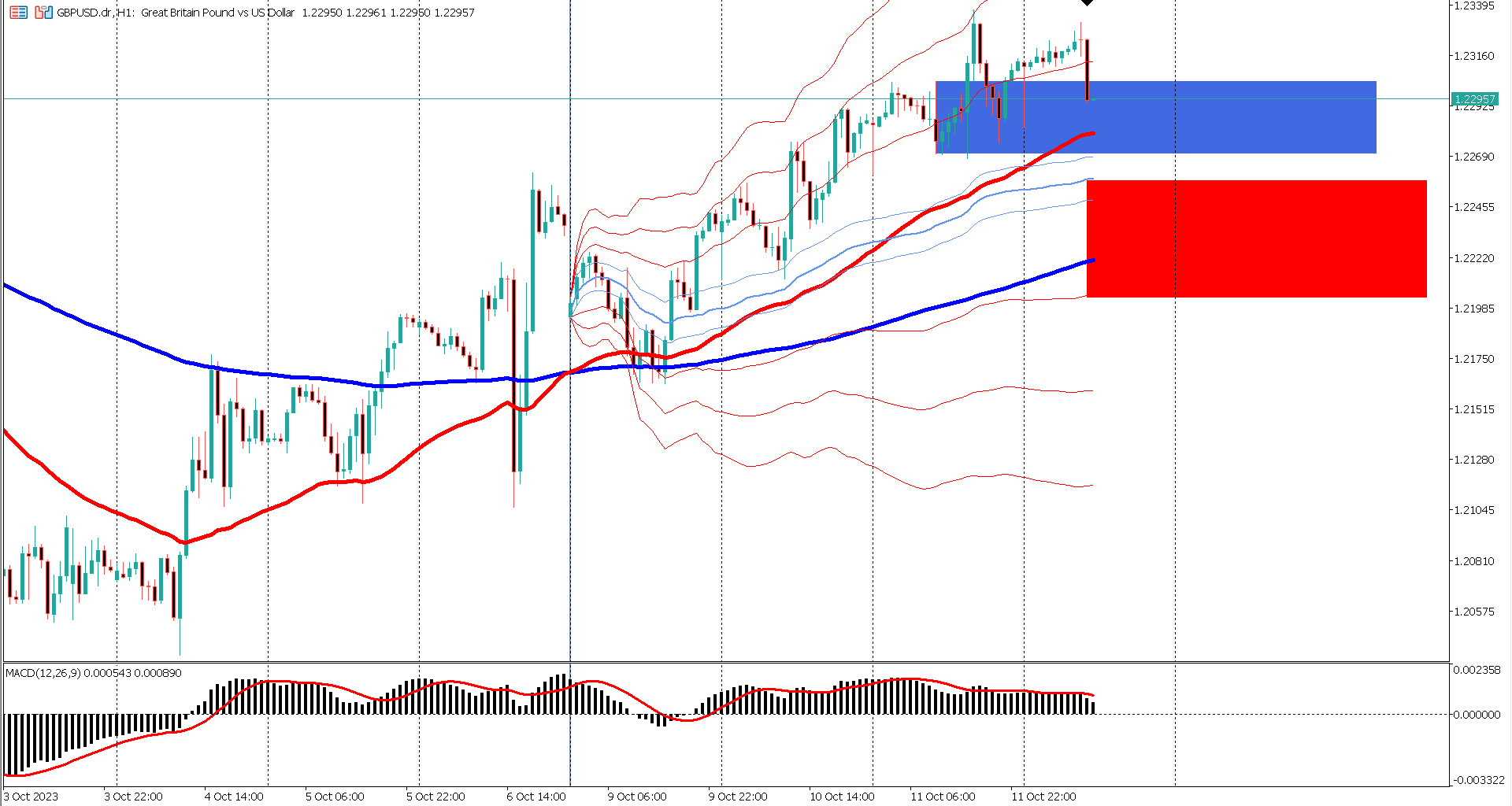

GBPUSD is currently showcasing strength following Wednesday's NFP release. The EMA 50 and EMA 200 golden cross lends support to this recent bullish momentum initiated since Monday's opening. Meanwhile, the MACD histogram and line have remained stable above the zero line. Additionally, the VWAP anchored from Monday's open is indicating bullish sentiment, with the price consistently above the VWAP midline and its first upper band.

In the short term, key support levels to monitor are situated within the 1.2303-1.2270 range, distinguished by a blue rectangle. For a medium-term perspective, keep an eye on the 1.2203-1.2257 zone, positioned between the Monday Anchored VWAP midline and its first lower band, distinguished by a red rectangle.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.