The US dollar regained some ground against the Yen earlier in the trading session after Japan announced the Inflation Rate for August; the results came out as experts expected at 2.6%, which remains unchanged from the previous figure.

The volume in the session was light today as there was a national holiday in Japan and London; we expect the following trading sessions to be more active with the release of high-impact economic indicators this week.

The US will announce an Interest Rate decision on Wednesday. After several comments from Fed Chair Powell, analysts expect the hike to be at 75 basis points. However, some experts argue that it could go up to a 100 bps hike after August Inflation showed that the Fed's efforts to restore price stability had not had the expected impact. A more aggressive stance could be expected.

The Bank of Japan will also release an Interest Rate decision on Wednesday later in the day; we will likely see high volatility for the USDJPY pair during the sessions as speculations arise. BoJ is expected to maintain its interest rate at -0.1% as Inflation in Japan is still very healthy.

The US will also announce the FOMC Economic Projections, which provide market participants with information about how the US Federal Reserve is expecting Inflation to develop after a Monetary Policy decision is made.

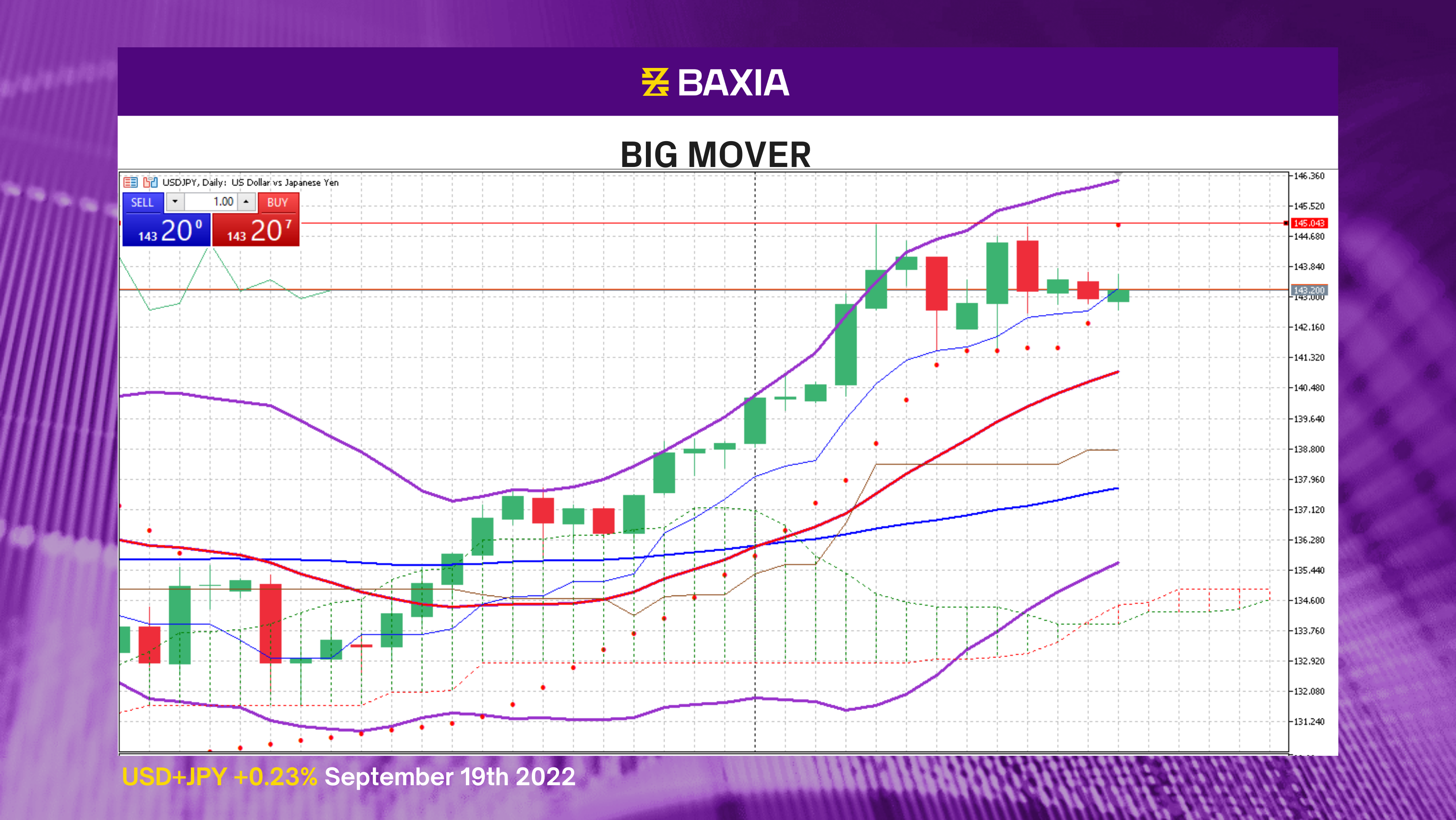

The Bollinger bands are wide and continue moving upwards, suggesting that there will be high volatility in the upcoming sessions and that the pair will likely continue the rally it started in mid-August.

The Bollinger bands are wide and continue moving upwards, suggesting that there will be high volatility in the upcoming sessions and that the pair will likely continue the rally it started in mid-August.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.