Amidst anticipation of the Bank of Canada's (BoC) interest rate decision, today's trading session is crucial for USDCAD traders. Economists predict a steady 5.0% interest rate. However, any deviation from this forecast could trigger significant movements in the CAD/USD exchange rate.

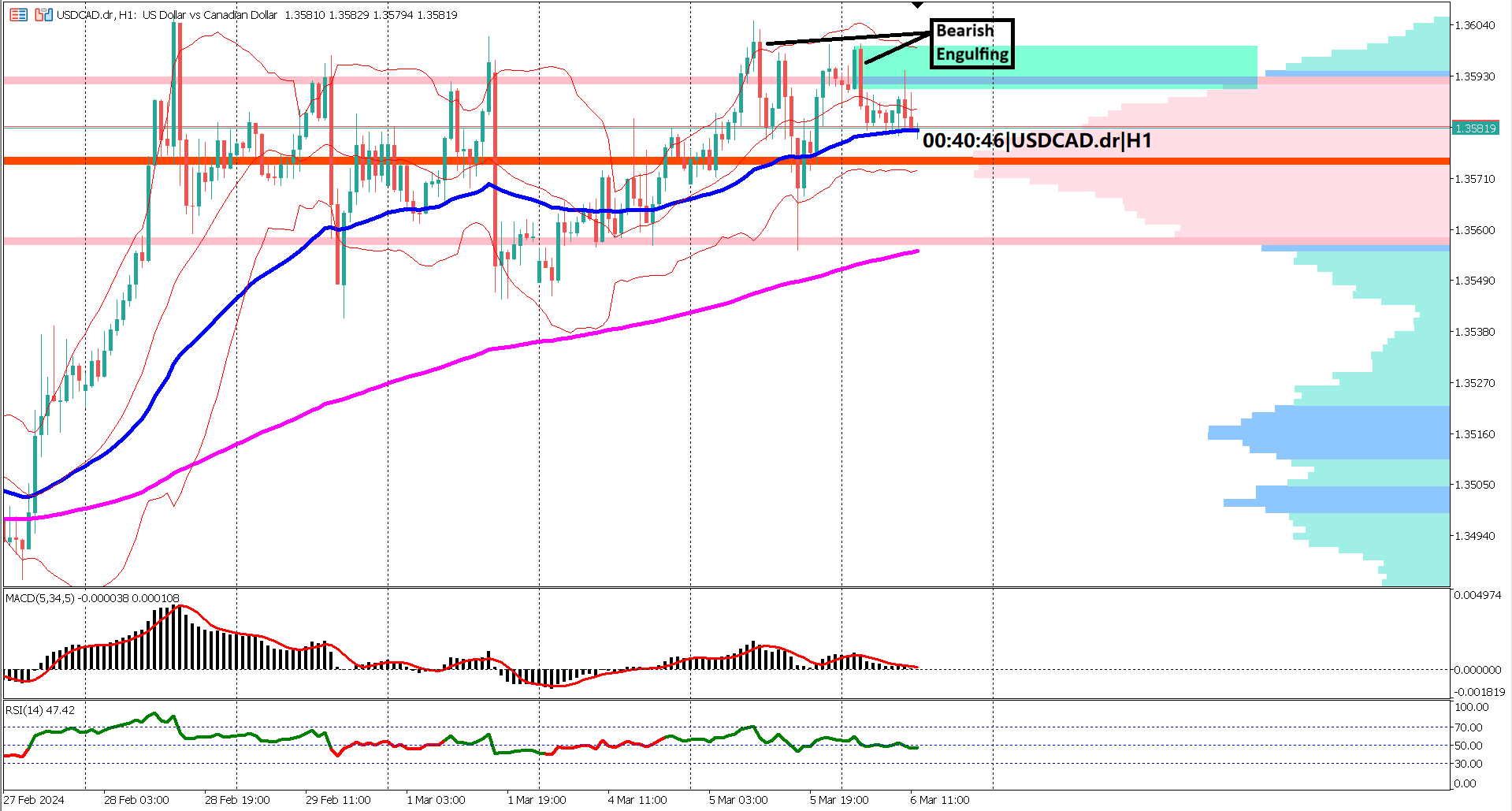

Examining the 1-hour timeframe chart reveals two consecutive bearish engulfing candlesticks, signaling a potential resistance level nearby. Moreover, market activity within the volume profile's value area suggests a pause in the previous bullish trend, with a key support level identified at 1.35565.

Analysis of the EMA 50 and 200 indicators reveals a flattening EMA 50, indicating its current role in supporting prices. However, a breach below the EMA 50 could signify a strengthening bearish momentum, potentially leading to a crossover with the EMA 200.

The Bollinger Bands, after a recent bullish rally spanning two trading days, are now contracting, signaling reduced volatility ahead of the BoC interest rate decision.

While both the MACD and RSI oscillators currently indicate a bullish market sentiment, they are approaching critical thresholds. The MACD's signal line nears crossing below the 0 line, while the RSI is inching closer to dropping below the 40% level. Although not indicative of an immediate bearish reversal, these developments suggest decreasing market volatility as the BoC announcement approaches.

1. BoC interest rate decision today could impact USD/CAD exchange rate.

2. Bearish engulfing candlesticks indicate potential resistance.

3. Market activity within the value area suggests a pause in the bullish trend.

4. Flattening EMA 50 may offer temporary price support, but a breach could signal increased bearish momentum.

5. Contraction of Bollinger Bands indicates reduced volatility ahead of the BoC decision, while MACD and RSI approach critical levels, signaling decreasing market activity.

Forecast 27.5B vs Previous 21.0B

Forecast 5.0% vs Previous 5.0%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.