In recent sessions, XAUUSD has demonstrated remarkable strength, surging by over 5% within just 4 trading days. This impressive ascent occurred despite the backdrop of lower-than-anticipated US ISM non-manufacturing PMI figures. Despite the slightly disappointing economic data, the precious metal market remained resilient, showcasing the underlying bullish sentiment.

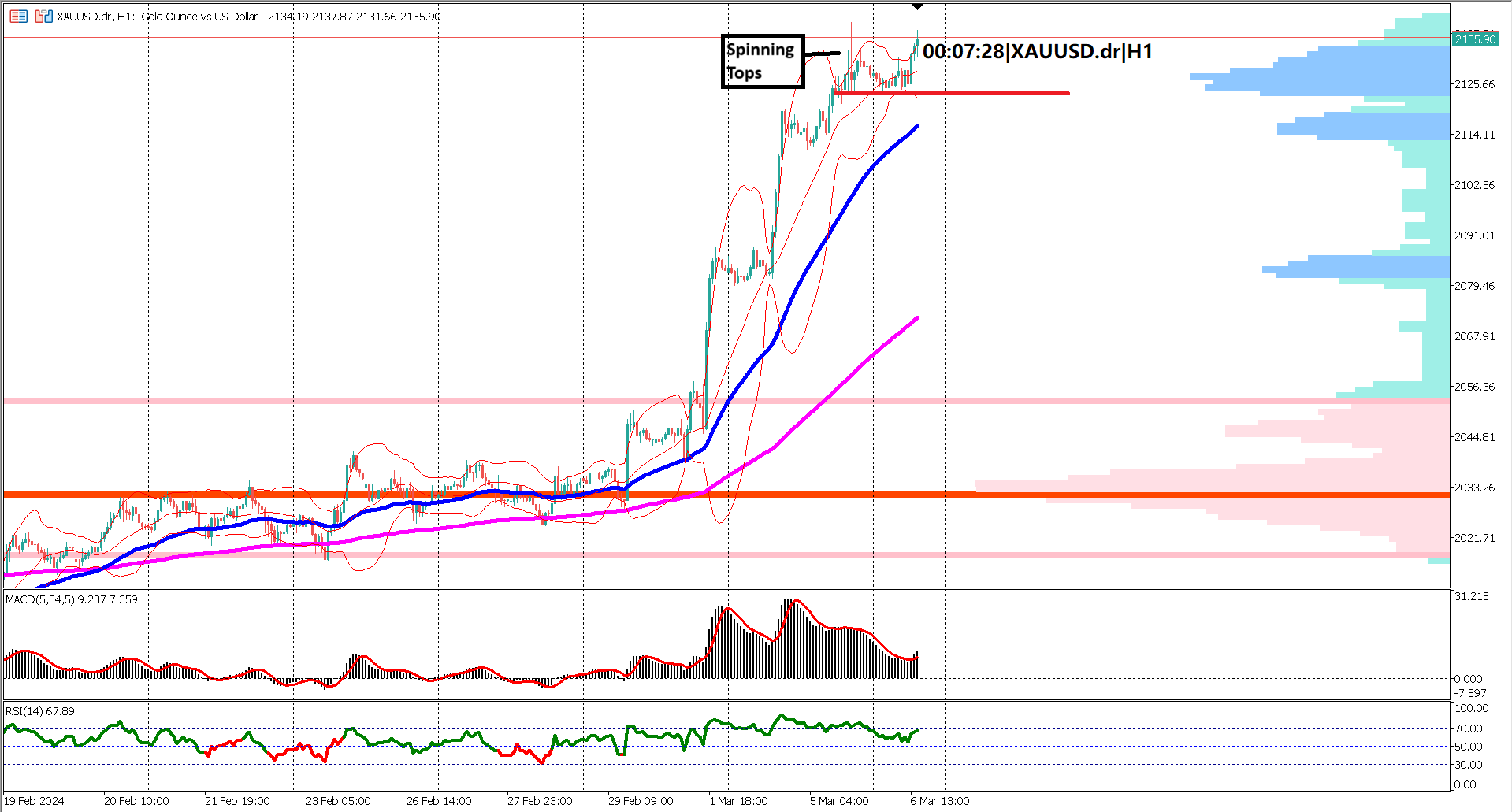

However, within this bullish surge, signs of caution have emerged. Notably, spinning top candlesticks with long upper wicks have appeared, signaling potential market indecision or a temporary pause in the uptrend. Traders are keenly observing a critical support level around $2122, representing the low of these candlesticks. A breach of this support level could prompt a retest of the EMA 50, acting as a crucial level of support and a gauge of the trend's resilience.

A deeper analysis of the moving averages reveals an encouraging picture for bulls. Both the EMA 50 and EMA 200 are aligned in an upward trajectory, indicating a strong and sustained bullish bias. Furthermore, the expanding separation between these moving averages suggests that the bullish momentum is not only intact but potentially strengthening.

Meanwhile, the Bollinger Bands, a popular volatility indicator, have also expanded significantly, highlighting increased market volatility. Despite this volatility, prices have remained consistently above the upper band, reinforcing the prevailing bullish sentiment.

Technical oscillators further support the bullish thesis. The MACD histogram and signal line continue to maintain positions comfortably above the baseline, reaffirming the strength of the bullish momentum. Similarly, the RSI indicator, oscillating between the 40% and 70% levels, suggests sustained buying pressure and an absence of overbought conditions.

In summary, while XAUUSD's recent surge underscores the resilience of the bullish trend, traders must remain vigilant amid signs of caution. Key support and resistance levels, alongside technical indicators, provide valuable insights for navigating potential market volatility and seizing opportunities within the ongoing uptrend.

Forecast 27.5B vs Previous 21.0B

Forecast 5.0% vs Previous 5.0%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.