The USD weakened across all major Forex pairs in the week's last trading session. As market participants digest Fed Chair Powell's hawkish comments (suggesting a bigger interest rate hike at the next FOMC Policy Meeting), many traders have started closing their trading positions to consolidate profits, causing the USD to fall to a more than-a-week low against the AUD.

The next Inflation Rate report on September 13th will have a high impact on the Fed's Interest rate decision; if inflation does not give in, we could see a larger hike, potentially at 100 basis points. On the other hand, if the inflation rate report shows a rate equal to or lower than 8.1%, the hike is expected to be between 50 and 75 bsp.

Australia will release high-impact economic indicators next week. On Monday, the Westpac Consumer Confidence Index is expected to come out at 80.5, a figure lower than the previous month. A higher figure than 80.5 will likely strengthen the AUD, while a lower number will weaken the Aussie against other currencies.

On Wednesday, AU will release the unemployment rate, a very solid economic indicator that gauges the strength of a country's labor market. The figure is expected to stay unchanged from the previous month at 3.4%, a good figure that shows a healthy economy in Australia.

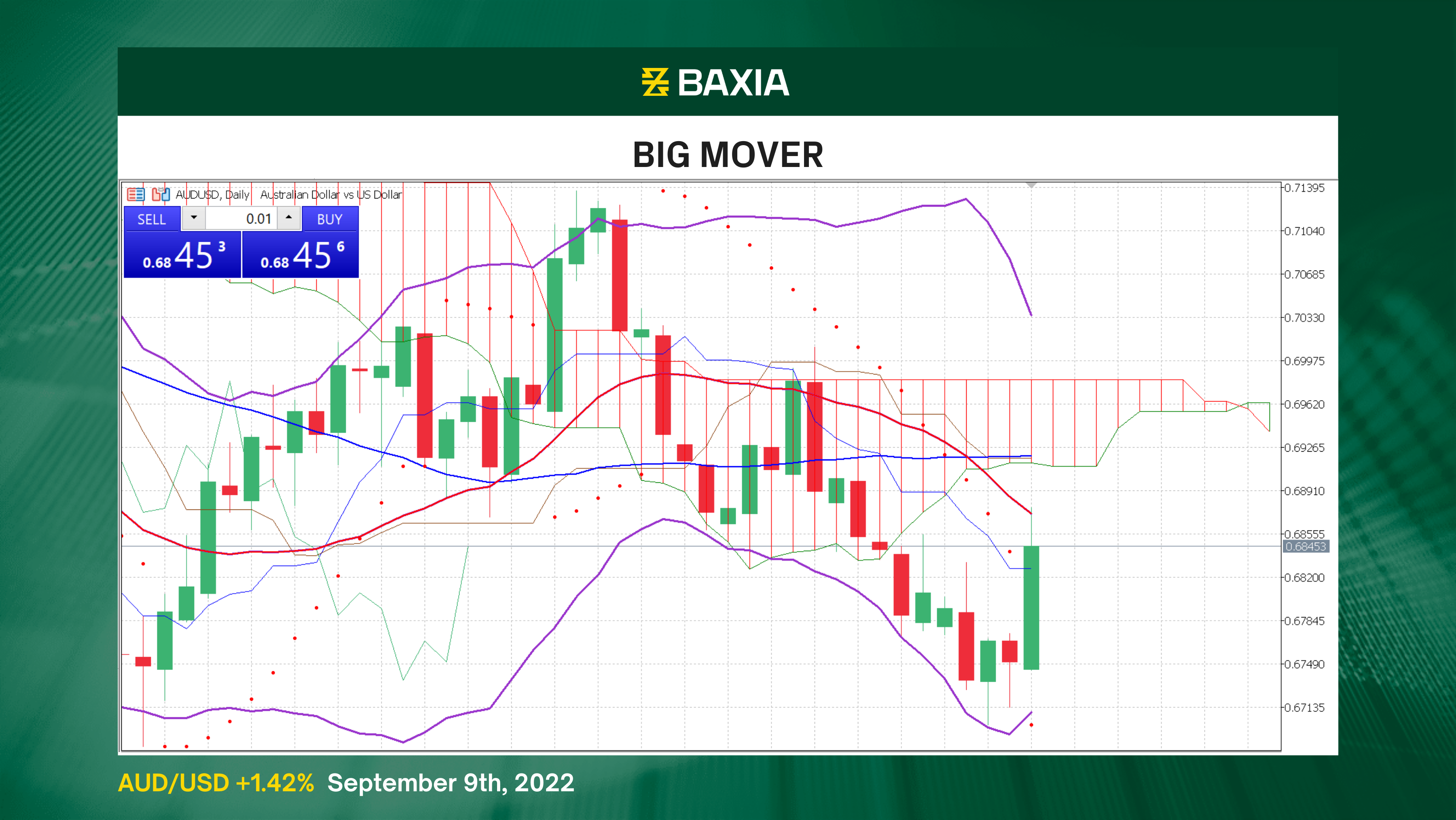

The general trend continues to be downwards as the price is below the short and long-term moving average; the trend lines crossed just four sessions ago; however, after today's rally, there is a chance of a trend reversal if the price breaks the 50% Fibonacci retracement at $0.69091.

The Bollinger bands are closing up, but they are still wide enough to expect high volatility in the upcoming trading sessions. The pair could enter a consolidation phase as the bands shrink.

The relative strength index climbed from 37% to 48% in today's session, allowing the pair to move in either direction as the RSI is very neutral. Our parabolic SAR indicator suggests that the price will continue to move upwards.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.