The USDJPY lost some ground after the Bank of Japan conducted a rate check, which often comes as preparation for currency intervention. Market participants are waiting to see if the Ministry of Finance in Japan will take action to strengthen the JPY as it reached a 24-year high.

Inflation in Japan remains low; the latest report showed 2.6%, a slight increase from a previous 2.4%, while the interest rate is at -0.1%. Japan will announce the inflation rate next Monday, Sept 19th. The BoJ will release the interest rate decision on Sept 21st. We could see BoJ take action in the monetary policy to boost the Yen.

The US released the Producer Price Index earlier in the sessions, and despite the better than the previous figure, the result came out as expected at -0.1% having little impact on the USD.

Japan will announce the Balance of Trade economic indicator later in the session. A deficit of - ¥ 2,398.2B is expected, a big jump from the previous month's figure of - ¥1,436.8B. The release of this high-impact indicator will affect the exchange rate of USDJPY. A higher number will be seen as positive for JPY.

The US will release a fair number of high-impact economic indicators during the following trading session. Retail Sales are expected to drop from a previous 10.3% to 9%. The expert consensus suggests that Initial Jobless Claims will come out at 226K, a 4K increase from the previous figure; however, we have been surprised by the US labor market in recent months, and the number could come out much better than expected, strengthening the USD once again.

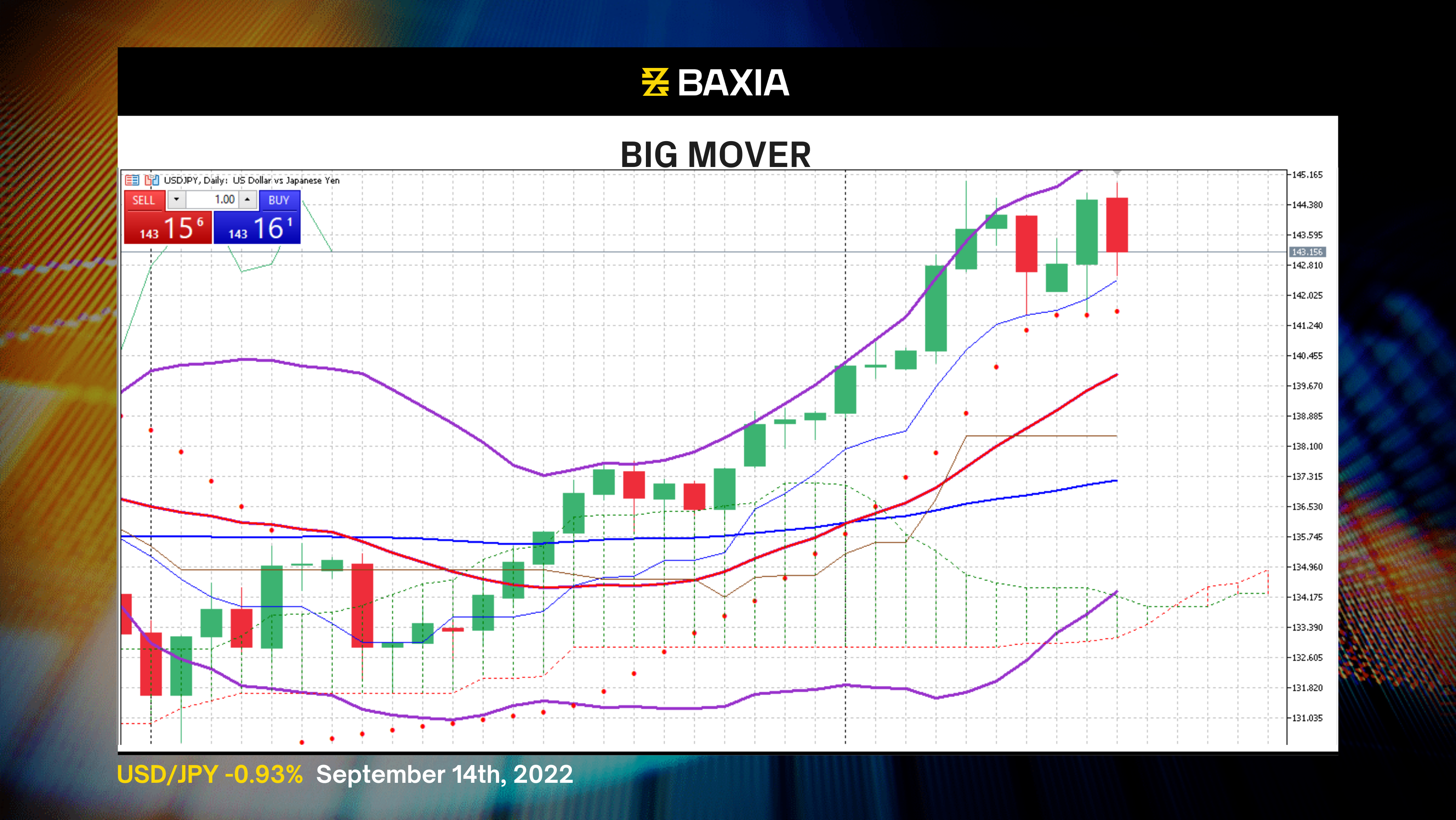

The Bollinger bands are wide and continue moving upwards, suggesting that we will have high volatility in the upcoming trading sessions and that the uptrend will likely continue in the short term.

The relative strength index is recovering from an overbought status and is currently at 65%; this will limit the uptrend in the short term. As the market sentiment changes, we could see a more significant retracement; however, this will help the USD gather strength to resume the rally.

The short and long-term moving averages are below the current price; the general trend continues to be upward, and the trend lines gap continues expanding, strengthening the long signals. Our parabolic SAR indicator suggests that the price will continue to increase in the upcoming sessions.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.