The Aussie took a big loss to the US Dollar after the release of high-impact economic indicators. The US inflation rate came out at 8.3%, a higher than expected figure by 0.2%. Consumer Price Index also came higher than expected at 296.17; the expert consensus was 295.53.

The USD is strengthening across all major Forex pairs and recovered nearly all the losses it suffered last week. A Higher Consumer Price Index shows that economic activity is still very high in the US, strengthening the USD. However, the US stock market is struggling as high inflation suggests that the Federal Reserve will continue to hike interest rates aggressively, threatening the US economic wellness in the short term. Fed Chair Jerome Powell has made it clear that the Federal Reserve will not yield until “compelling evidence” indicates inflation is slowing down.

Australia will release the Unemployment rate during the next trading session; the figure is expected to remain unchanged from the previous month at 3.4%. Simultaneously, the Reserve Bank of Australia will release a bulletin that will give market participants a better picture of where the RBA stands regarding monetary policy. The release of these economic indicators will heavily influence the AUDUSD exchange rate.

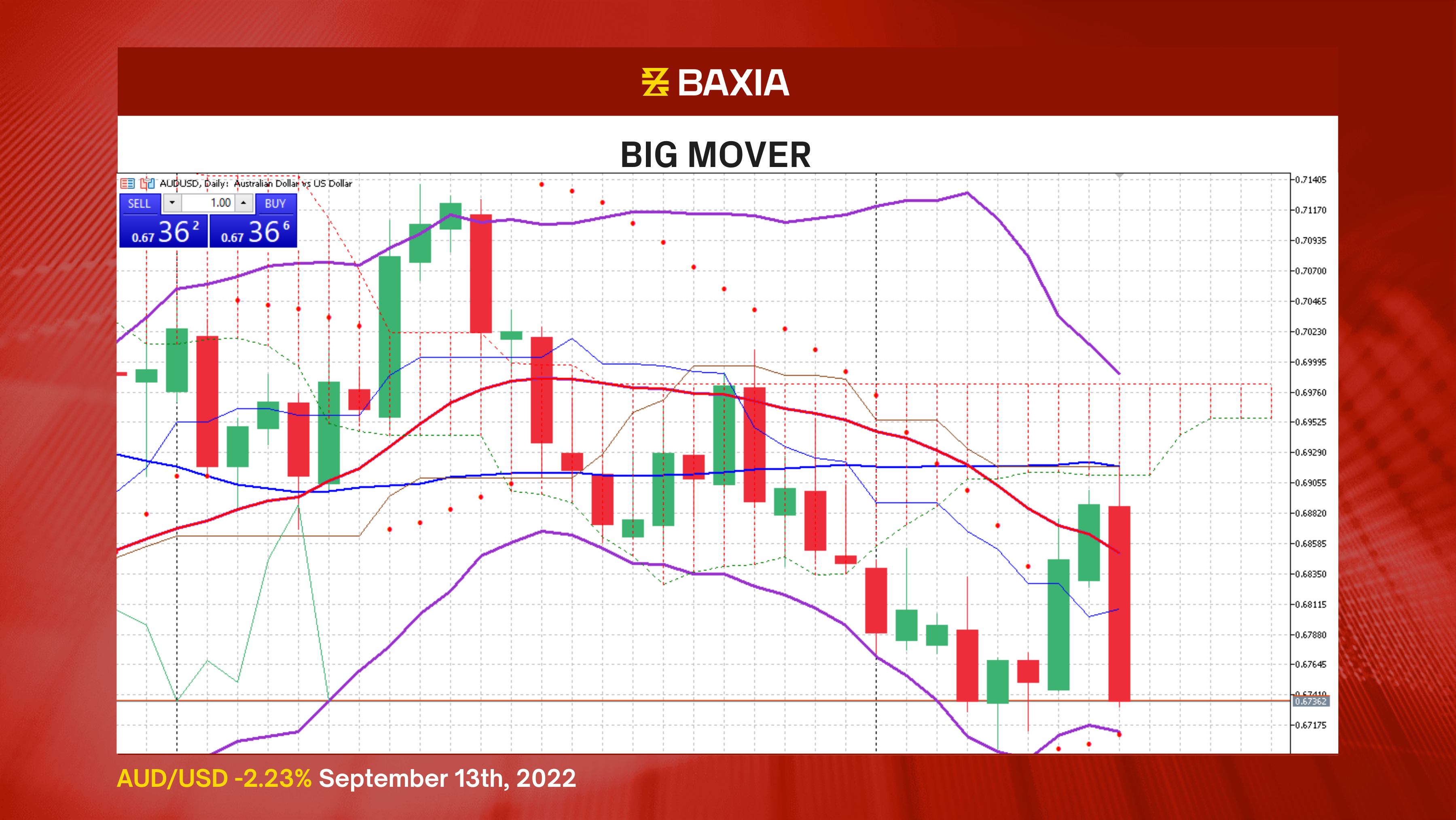

Despite the Aussie efforts to reverse the general trend continues to be downwards. The short and long-term moving averages continue trading above the current price, strengthening the short signals.

The Bollinger bands are closing and moving downwards, suggesting that the price will likely continue the downtrend; we will continue to see high volatility in the upcoming sessions as the bands are still wide. The pair could find support close to the lower band at $0.67116

The relative strength index is at 40%, which will limit the downtrend in the short term; once it gets closer to 30%, we could see a change in the market sentiment.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.