US crude oil (USOIL) has encountered bearish momentum in today's Asian trading session, influenced by both key economic data and technical indicators. With the UK's Consumer Price Index (CPI) surpassing forecasts and the Eurozone's CPI meeting expectations, market sentiment has been mixed. However, the most significant factor impacting USOIL appears to be the forecasted drop in US crude oil inventories, signaling decreased demand or increased supply.

Today's economic releases revealed that the UK's CPI rose to 3.2%, exceeding expectations and the previous figure. This strong inflation data can potentially strengthen the Pound Sterling, impacting the US dollar and thereby affecting oil prices. On the other hand, the Eurozone's CPI remained steady at 1.514M, in line with expectations, which could stabilize the euro against the dollar.

The most notable data point for oil markets is the forecasted US crude oil inventories at 1.600M, marking a substantial decline from the previous 5.841M. A drop in inventories typically suggests reduced supply or increased demand, which can be supportive of oil prices. However, the market appears to be focusing on the potential oversupply concerns, driving the bearish sentiment for USOIL.

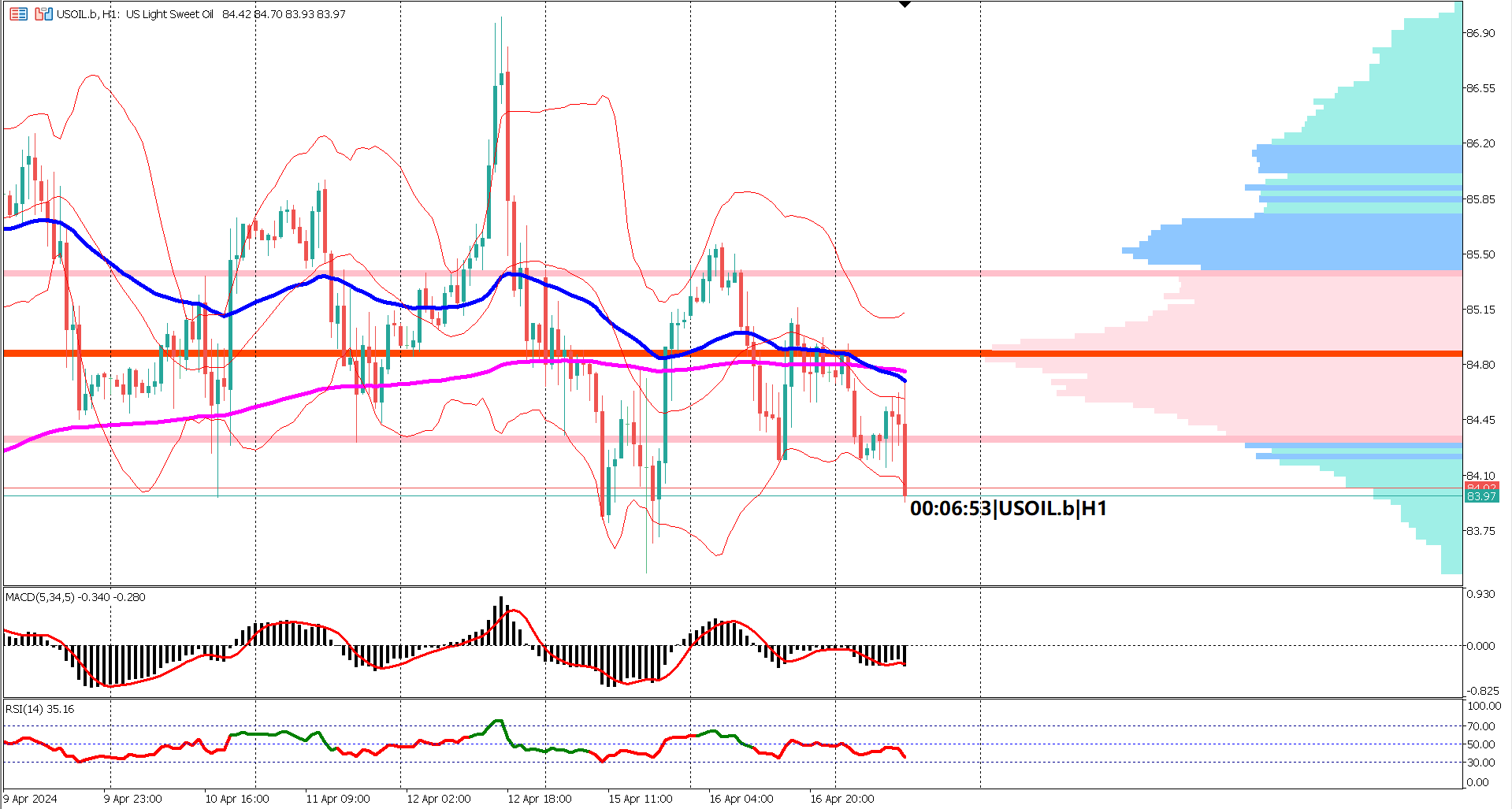

Adding to the bearish pressure, technical indicators for USOIL have turned increasingly negative. The price has broken below the value area range, signaling a potential continuation of the downtrend. A significant development is the formation of a death cross, where the EMA 50 crosses below the EMA 200, indicating a potential long-term bearish trend.

Oscillator indicators like MACD and RSI further support this bearish sentiment. Both indicators are reflecting negative momentum, aligning with the broader technical and fundamental bearish outlook for USOIL.

In conclusion, USOIL is facing considerable bearish pressure driven by a combination of key economic data and technical signals. Despite supportive inflation figures from the UK and stable Eurozone CPI, the focus remains on the forecasted drop in US crude oil inventories. Coupled with the death cross formation and negative oscillator readings, the short to medium-term sentiment for USOIL appears to be bearish. Traders and investors should closely monitor key support levels and market developments to navigate this challenging environment effectively.

Actual 3.2% vs Forecast 3.1% vs Previous 3.4%

Actual 2.4% vs Forecast 2.4% vs Previous 2.6%

Forecast 1.600M vs Previous 5.841M

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.