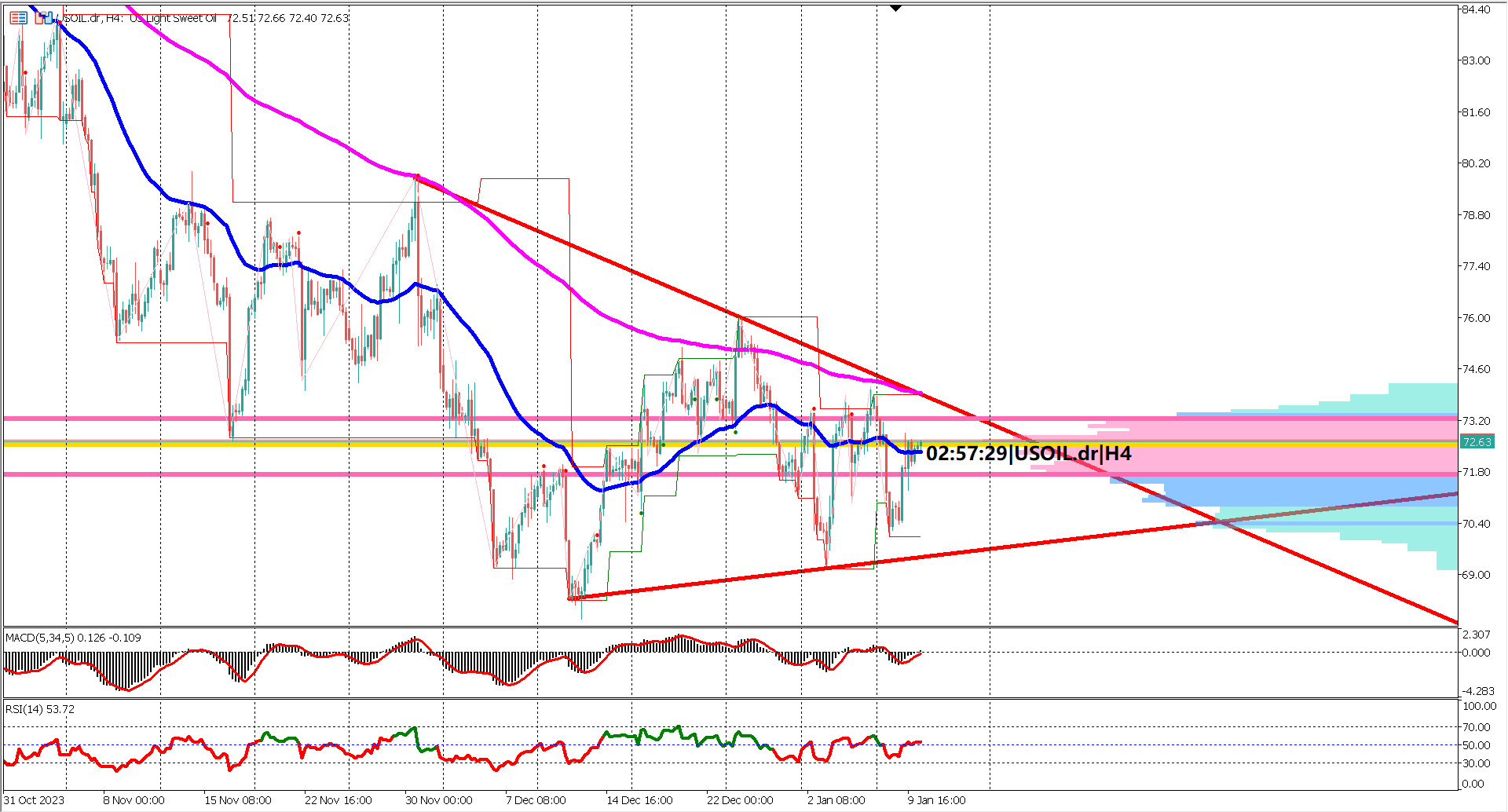

XTIUSD has recently been caught in a sideways movement, shaping a symmetrical triangle chart pattern over the past few weeks. Traders are closely observing this pattern, anticipating potential developments in the crude oil market.

Today's spotlight is on the US Crude Oil Inventories economic release, with economists predicting an increase in inventories compared to the previous week, projecting -0.675 million barrels versus the prior -5.503 million barrels. Should the result exceed expectations, it may trigger a scenario of more abundant oil supply, potentially leading to a decline in oil prices. Conversely, a lower-than-expected outcome could contribute to higher oil prices and potentially prompt a breakout above the symmetrical triangle chart pattern.

The symmetrical triangle's upper boundary aligns with the EMA 200, representing a key resistance level. A successful breach above this level would signify not only surpassing the EMA 200 but also a breakout from the symmetrical triangle pattern. Interestingly, the overall structure of this symmetrical triangle might suggest a weakening of the bearish trend, especially as the distance between the EMA 50 and EMA 200 converges, indicating a potential loss of bearish momentum.

Given the coiling nature of the market, typical technical indicators like oscillators may not provide reliable signals. Traders are advised to exercise caution and await a decisive breakout from the symmetrical triangle chart pattern. Confirmation signals can be sought through a breach of the recent swing low at $68.31 or the swing high at $76.00, offering a clearer picture of the prevailing trend. As the market dynamics unfold, a patient approach is recommended to navigate the potential shifts in the XTIUSD's price trajectory.

Forecast -0.675M vs Previous -5.503

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.