The pound sterling continues to rally against the USD; the pair reopened with a positive gap and made some progress during the trading session after the release of high-impact economic indicators from the UK.

The UK released Gross Domestic Product for July; the result came out at 0.2%, short of the expert consensus of 0.4%; despite showing a weaker economic activity, GBPUSD is up in the last two trading sessions. The UK also released Goods Trade of Balance; the result came out at -19.36B, a better than expected result by 3.03B.

More high-impact economic news will be announced tomorrow. The UK will release the Unemployment Rate, which gauges the strength of the labor market in the region. Analysts anticipate a 3.8%, which is unchanged from the previous figure.

The US will release the Inflation Rate tomorrow morning; experts anticipate that the inflation will drop to 8.1% from the previous 8.5%; the release of this economic indicator will affect the exchange rate of the USD against other currencies.

The USD fell to its lowest level in two weeks after investors starters closing the winning positions amid the hawkish remarks from Feds chair Powell last week.

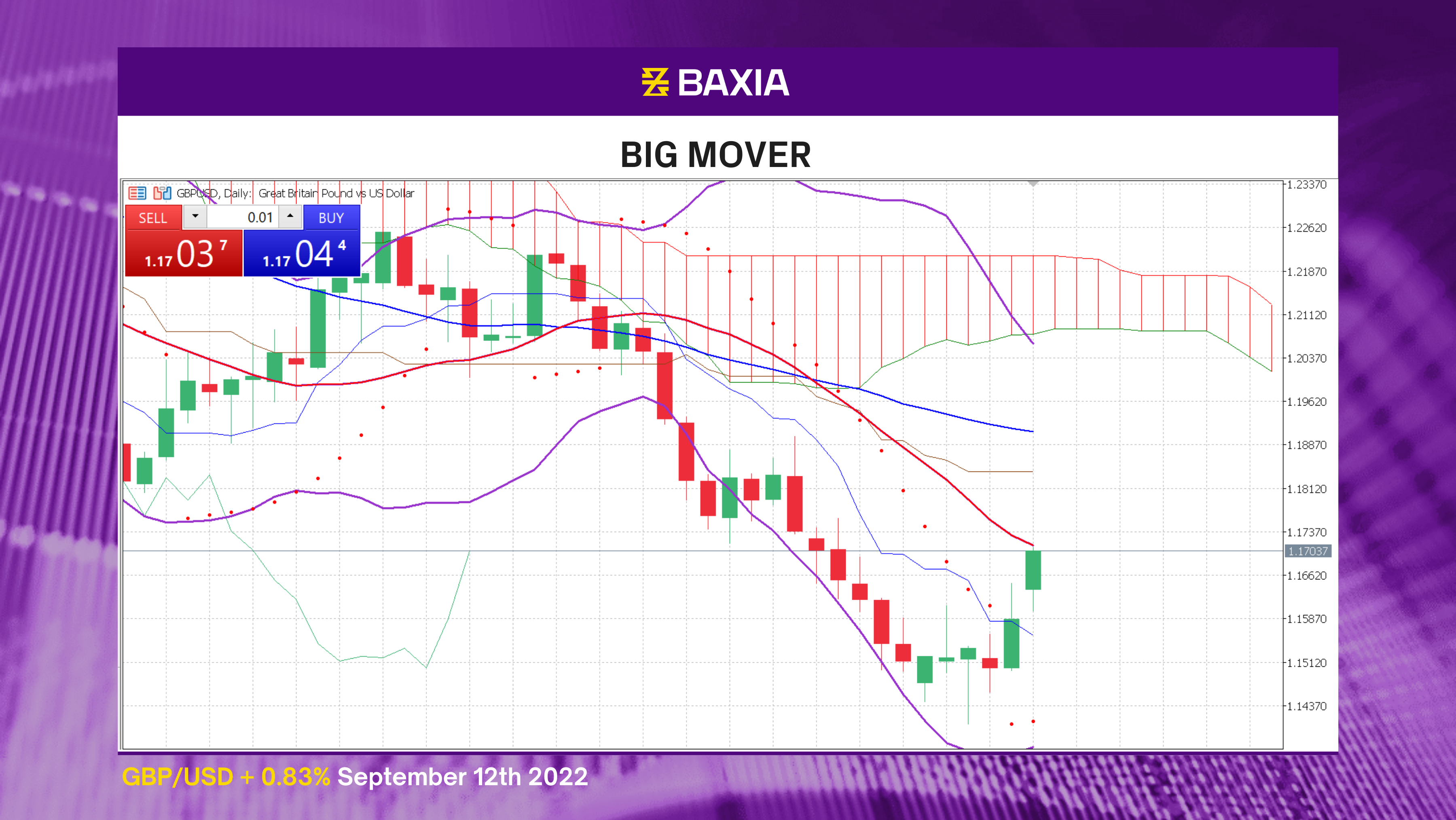

The Bollinger bands are starting to shrink, but they are still wide enough to expect high volatility in the upcoming sessions, the pair trades in between the bands, suggesting that the price is at a fair level.

The Relative strength index is at 46%; this will allow the pair to continue moving upwards in the short term before it is considered overbought. Our parabolic SAR indicator suggests a trend change in the short term.

The pair is still on a general uptrend as the price still trades below the short and long-term moving averages; however, this could change very soon as the pound continues making progress over the USD.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.