In the current trading landscape, XAUUSD has witnessed a substantial rally, with prices surging by over 200 pips since the recent session. This pronounced bullish movement can be attributed to the mixed outcomes observed in US economic data. Specifically, while Core PCE figures aligned with expectations, initial jobless claims exceeded forecasts, leading to a depreciation of the US dollar and consequent bullish momentum in XAUUSD.

Today's economic spotlight shines on the ISM manufacturing PMI, where economists anticipate an uptick in the data. Despite these optimistic projections, XAUUSD's bullish rally remains steadfast, indicating resilient market sentiment towards the precious metal.

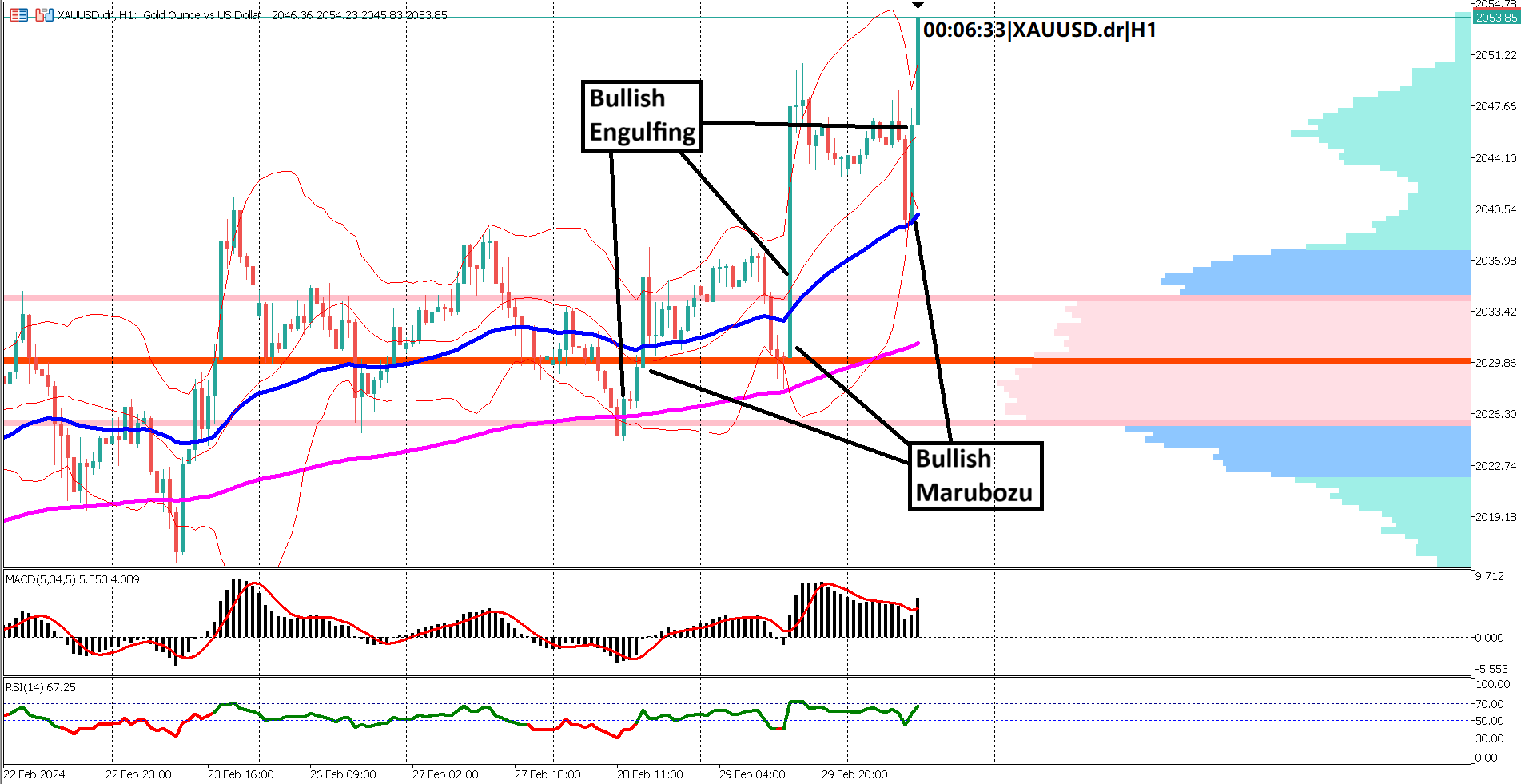

During the London trading session, XAUUSD soared to attain a new higher high, underlining the robustness of the bullish trend. Notably, both the EMA 50 and 200 exhibit widening patterns, with prices finding consistent support at the EMA 50 while achieving new highs. This trend reinforces the prevailing bullish sentiment in the market.

A closer examination of the volume profile indicator unveils that prices are currently trading above the value area, signaling a prevailing bullish sentiment among market participants. Furthermore, the presence of multiple bullish marubozu and engulfing candlestick patterns reinforces the dominance of bullish forces in the market.

Adding to the bullish narrative are the MACD and RSI oscillators, which affirm the upward momentum for XAUUSD. The MACD signal line and histogram maintain positions above the zero line, indicative of continued bullish momentum. Similarly, the RSI remains robust, consistently trading above the 40% and 60% levels.

In summary, the recent rally in XAUUSD underscores a strong and enduring bullish sentiment, bolstered by favorable technical indicators and market dynamics. Traders are advised to closely monitor these developments and economic releases for potential trading opportunities within the market.

1. XAUUSD has experienced a significant rally, surging by over 200 pips since the recent trading session.

2. Mixed outcomes in US economic data, with Core PCE meeting expectations but initial jobless claims surpassing forecasts, have contributed to the bullish momentum in XAUUSD.

3. Despite optimistic projections for the ISM manufacturing PMI, XAUUSD's bullish rally remains resilient, indicating sustained market confidence in the precious metal.

4. During the London trading session, XAUUSD reached a new higher high, supported by widening patterns in the EMA 50 and 200, reinforcing the prevailing bullish sentiment.

5. The presence of multiple bullish marubozu and engulfing candlestick patterns, along with bullish indications from the MACD and RSI oscillators, underscores the enduring strength of the bullish trend in XAUUSD.

Forecast 51.5vs Previous 50.7

Forecast 49.5 vs Previous 49.1

Forecast 53.5 vs Previous 52.9

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.