This week, the resilience of gold's appeal faces a significant challenge as investors eagerly await the release of the United States Consumer Price Index (CPI) data for March, scheduled for Wednesday. Projections indicate that both the headline and core CPI data are expected to reflect a 0.3% increase, surpassing the threshold required for inflation to return to the coveted 2% target.

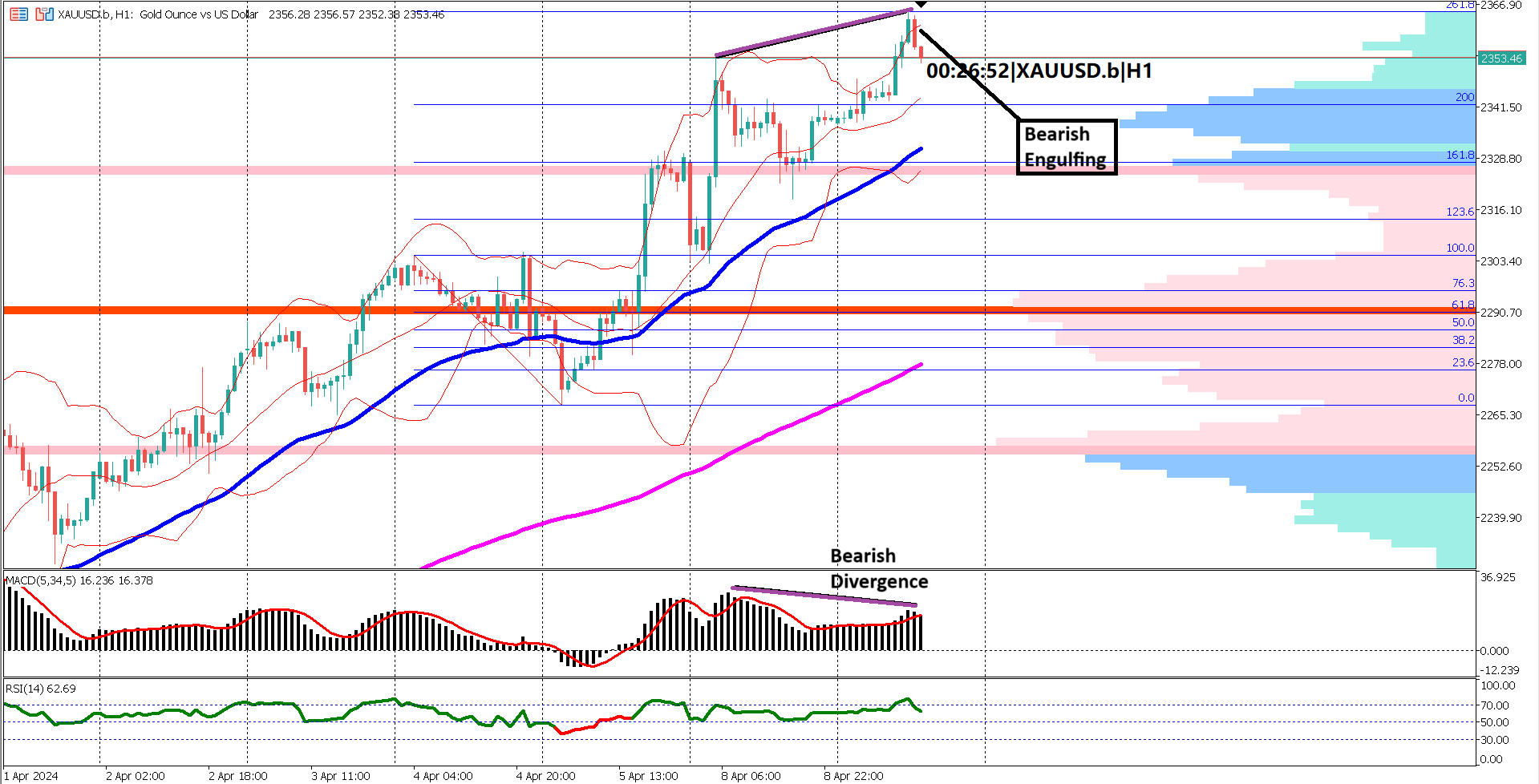

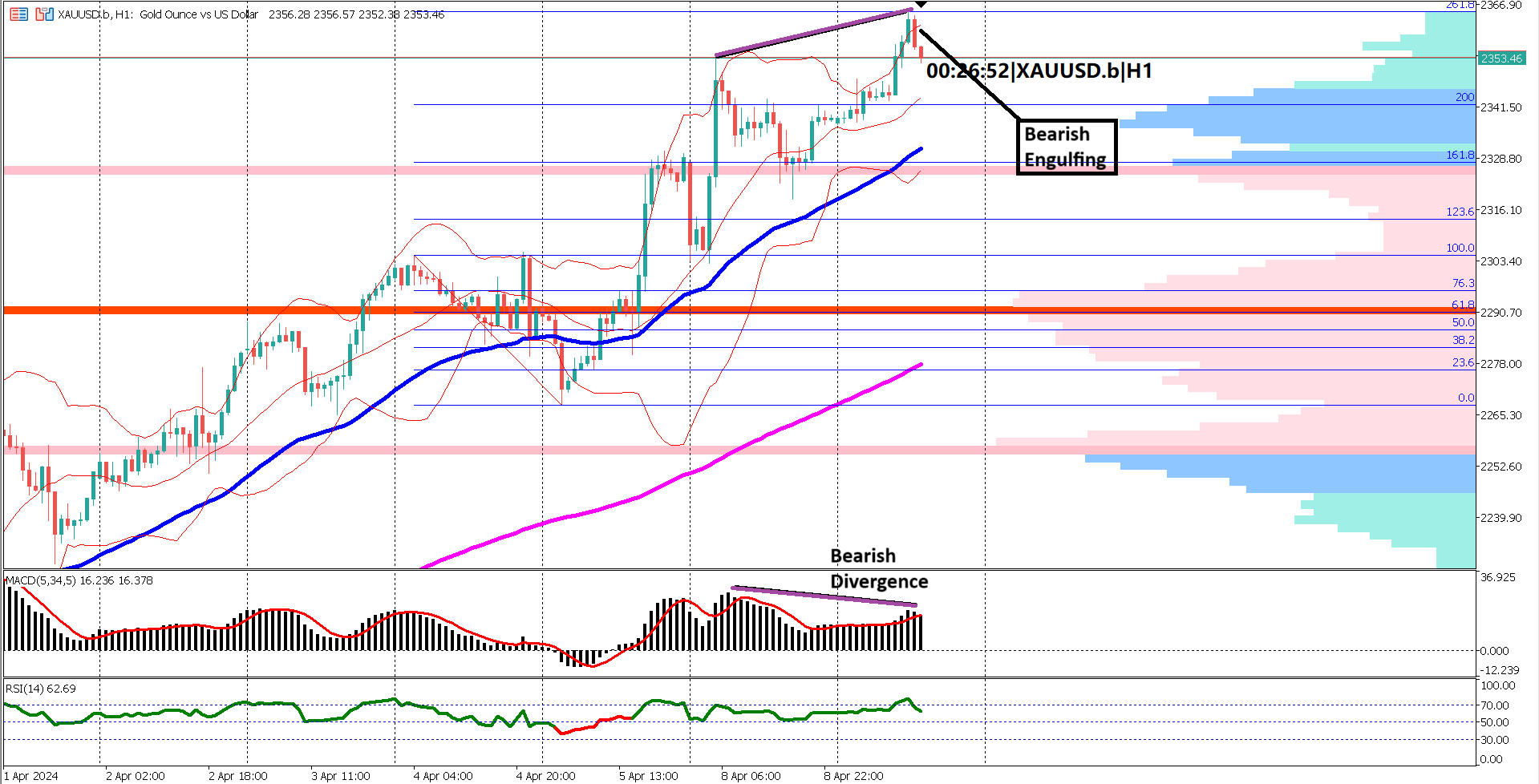

Amidst this anticipation, gold has surged to a notable milestone, reaching the 261.8% Fibonacci extension traced from the previous swing low observed just last week on April 4th. However, caution looms as a bearish divergence emerges on the MACD indicator. Despite gold prices hitting new higher highs, the MACD indicator signals a contrasting lower high, indicating a potential slowdown in bullish momentum. This divergence suggests a period of consolidation or a temporary pause rather than an outright bearish reversal.

Moreover, the Relative Strength Index (RSI) has recently breached the overbought territory, exceeding 80% before retracing below this level. This retreat suggests that gold may have encountered a resistance ceiling, potentially setting the stage for a retracement. In the event of a pullback, market participants will likely scrutinize the EMA 50 as a crucial support level.

An additional indicator supporting the bullish sentiment is the behavior of the Bollinger band, where the market has consistently respected the lower band. This adherence underscores the prevailing bullish sentiment surrounding gold, despite the emergence of potential signs of a slowdown in momentum.

As investors brace for the release of the US CPI data, gold's reaction to the outcome will be closely watched. A stronger-than-expected CPI reading could reignite concerns about inflationary pressures, potentially bolstering the case for further gains in gold. Conversely, a softer-than-expected report may provide temporary relief, but any significant deviation from expectations could lead to heightened volatility in the gold market.

EUR, German Trade Balance

Actual 21.4B vs Forecast 25.1B vs Previous 21.4B

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.